Tag: interest rates

- 30.09.2022

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription, Personal finance

- Tags: DJIA, GDP, inflation, interest rates, QQQ, S&P 500, Seasonality

- 29.03.2022

- Categories: Analytics, Investing basics, Investment ideas

- Tags: bonds, interest rates, RPV, Stocks

Bonds are now worst performers than stocks since the beginning of the year. Such pessimism in bond prices has not been seen for decades. Meanwhile, interest rate hikes are usually bullish for equities during the first few months of increases. Value stocks broke out to new highs this week as market internals turn more bullish. …

Friday Investment Talk: Bonds Weakness and Equity Strength Read More »

- 11.03.2022

- Categories: Analytics, Investment ideas, News

- Tags: inflation, interest rates, Investment Strategy, SPX

Bond Yields are nearing 2% in US and Italy. This has killed the long term Austrian bond we love to look at. Investing in energy, precious metals and defense contractors has paid off since the start of the year. Our strategies show strong outperformance compared to the $SPX. Recession is predicted by the S&P 500 …

Friday Investment Talk: Bond Yields, AVC Investment Strategy, Recession Read More »

- 26.02.2022

- Categories: AVC Pro Subscription, News, Personal finance

- Tags: inflation, interest rates, Seasonality, Ukraine

- 11.12.2021

- Categories: Investing basics, Investment ideas, News

- Tags: CPI, interest rates, IWM, RSX, XLRE, XOP, XRT

High debt levels and inflation create difficulties for investors in 2022. ‘Financial Repression’ could become a household phrase. Inflationary pressures will put certain sectors in the spotlight. We watch oil and gas exploration and production, consumer staples and real estate as places for outperformance. A quick look the Russian ETF (RSX) reveals its need to …

Friday Investment Talk: Macroeconomics, Financial Repression in 2022 Read More »

- 3.10.2021

- Categories: Investment ideas, News, Personal finance

- Tags: china, inflation, interest rates, Retirement

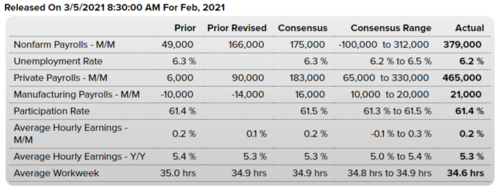

- 6.03.2021

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: inflation, interest rates, Stocks

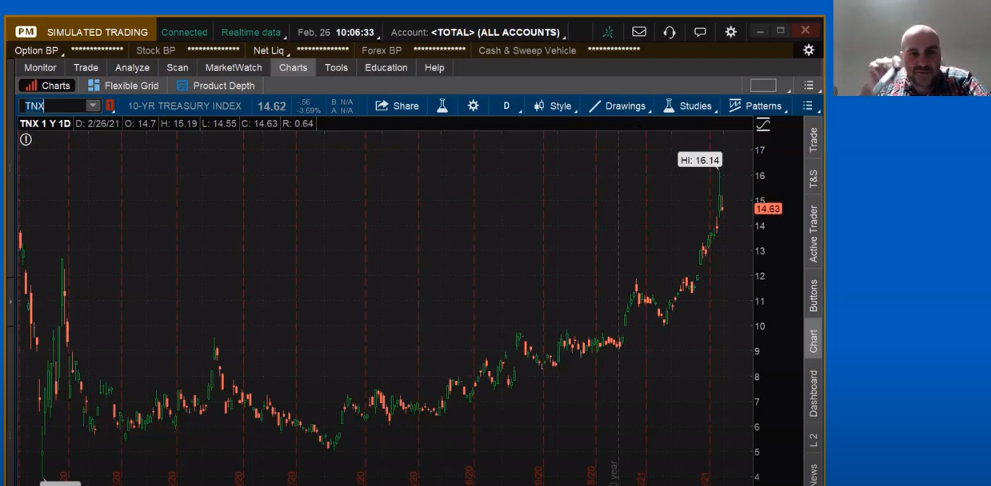

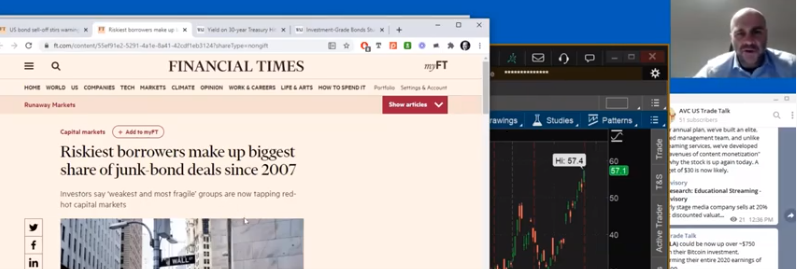

- 1.03.2021

- Categories: Investment ideas, News, Personal finance

- Tags: $DKNG, inflation, interest rates, TLT, TNX, TSLA

- 21.02.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: Biotech, bonds, inflation, interest rates, Medtech, Semiconductors, TBT, TLT

- 13.01.2021

- Categories: Analytics, Investing basics, Investment ideas, News, Personal finance

- Tags: interest rates, TLT, TNX