Tag: inflation

- 30.09.2022

- Categories: Analytics, AVC Pro Subscription, AVC UL Subscription, Personal finance

- Tags: DJIA, GDP, inflation, interest rates, QQQ, S&P 500, Seasonality

- 11.03.2022

- Categories: Analytics, Investment ideas, News

- Tags: inflation, interest rates, Investment Strategy, SPX

Bond Yields are nearing 2% in US and Italy. This has killed the long term Austrian bond we love to look at. Investing in energy, precious metals and defense contractors has paid off since the start of the year. Our strategies show strong outperformance compared to the $SPX. Recession is predicted by the S&P 500 …

Friday Investment Talk: Bond Yields, AVC Investment Strategy, Recession Read More »

- 11.03.2022

- Categories: AVC Pro Subscription, News, Personal finance

- Tags: Fed, inflation, s&p500, Seasonality, volatility

- 26.02.2022

- Categories: AVC Pro Subscription, News, Personal finance

- Tags: inflation, interest rates, Seasonality, Ukraine

- 8.01.2022

- Categories: Investment ideas, News, Personal finance

- Tags: bonds, BRK/B, inflation, PCAR, Stocks, TEX

Inflation has pushed interest rates higher and wrecked havoc in bond markets. Investors turn away from SAAS towards ‘reopening stocks’ in the Industrial sector. This rotation has crimped the markets so far this year and could spell trouble for most of 2022.

- 12.12.2021

- Categories: News, Personal finance

- Tags: Commodities, COVID, DJIA, inflation, NASDAQ, Russell 2000, SPX, TLT

- 3.10.2021

- Categories: Investment ideas, News, Personal finance

- Tags: china, inflation, interest rates, Retirement

- 10.09.2021

- Categories: Analytics, Investment ideas, News

- Tags: china, Commodities, inflation, iron, nickel, palladium, PMI

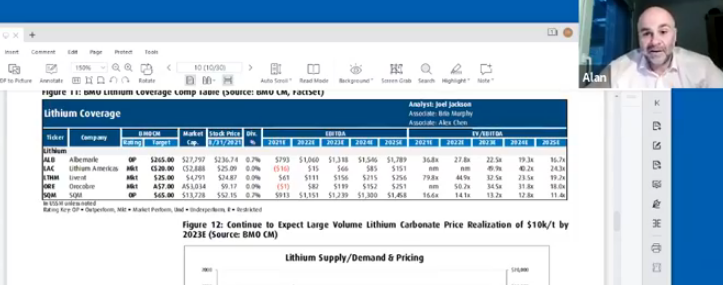

Lithium prices are set to rise over the next decade. We have previously discussed Albemarle (ALB) and Sociedad Química y Minera (SQM) as main beneficiaries of this trend. We review these again during this week’s Live Facebook chat. Other metals, like iron ore and palladium look to have peaked recently after strong runs. Chinese PMI …

Friday Investment Talk: Lithium, Iron Ore, Palladium, Inflation Read More »

- 6.09.2021

- Categories: Investment ideas, News, Personal finance

- Tags: DJIA, inflation, NFLX, PPLI, QQQ, SPX

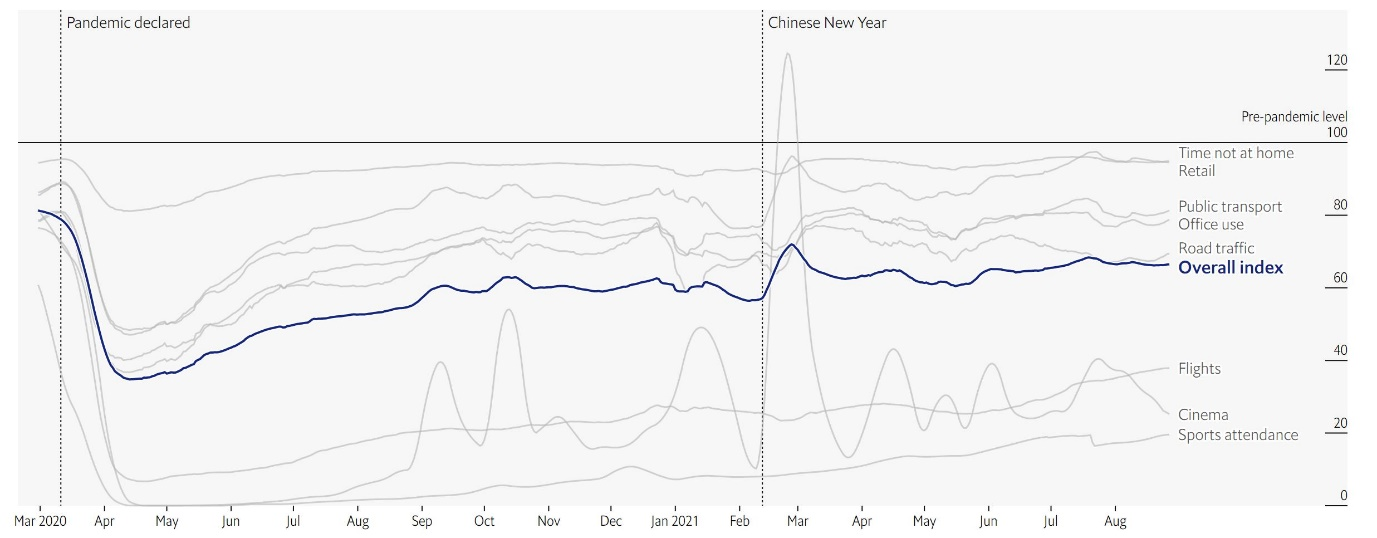

As the US and many other countries discuss raising individual income taxes, private placement life insurance comes again into focus. Its always been a mechanism to legally hide investments from taxes, but now it is receiving a renewed interest from even less wealthy individuals. A bullish fund manager feels a return to normalcy will send …

Friday Investment Talk: PPLI, US Recovery & Jobs Data Read More »

- 23.08.2021

- Categories: Investment ideas, News, Personal finance

- Tags: china, dividend, emerging markets, inflation

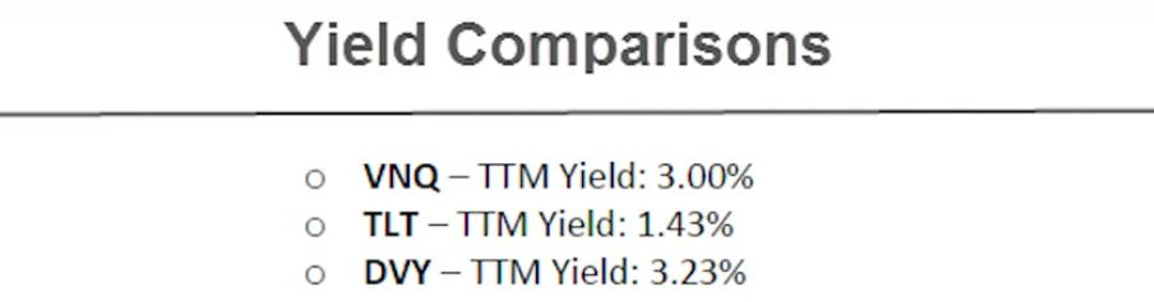

Chinese stocks have been pounded lately as Xi puts pressure on companies to provide funding for socially beneficial projects. Arm twisting seems at play, as wealthy businessmen kowtow to politicians. Emerging markets face inflation as natural disasters, COVID and supply chain issues fuel shortages. Dividend ETFs always generate attention. We compare $DVY to owning the …

Friday Investment Talk: China, EM Inflation, Dividends Read More »