Treasury yields increased sharply last Wednesday, January 6th, with the US Treasury 10-year Yield Index (TNX) gaining more than nine basis points and crossing the 1% threshold for the first time since March 2020. TNX has continued to rise since then reaching 1.175%. The move resulted in a breakout that returned the index to a positive trend for the first time since 2018.

The Democratic Party’s sweep of the two Senate runoff elections in Georgia seems to be the primary cause of the yield spike. The Senate will be split 50-50, giving Democrats effective control as the Vice President will break any ties. The shift in control of the Senate is viewed by many as increasing the likelihood of further COVID-19 relief spending, especially in the form of higher direct payments to individuals, for which several Democratic Senators have advocated, and other additional spending by the incoming administration.

There are two potential, non-mutually exclusive effects of the expected spending increase that could be pushing yields higher. First, investors believe that increased spending will stimulate the economy and result in higher economic growth and thus expect that, the Fed’s monetary policy will tighten sooner than it otherwise would, resulting in higher Treasury yields. Meanwhile, the increased spending could also drive higher inflation which reduces the real return bondholders earn unless yields also increase.

As yields rise during periods of economic growth, robust equity markets play out. However, rising rates are not themselves a tailwind for equities.

The basic model of fundamental equity valuation projects the future earnings of a company and then discounts those earnings back to arrive at the present value of the stock. Construction of a discount rate often starts with a risk-free rate of return and then adds a risk premium, with US Treasury yields typically used as a proxy for the risk-free rate. Thus, all else being equal, higher bond yields would result in higher discount rates and thus lower equity valuations. We discussed the effects of low rates on equity prices back in July 2020 during a Friday Investment Talk.

Keep in mind that to some extent higher rates act as a disincentive to companies from borrowing for capital projects or stock buybacks while reducing consumer spending. Therefore higher rates could be a drag on the economy and thus on equity markets. However, even with the recent increase, yields remain very low from a historical perspective, well below where they were even just a year ago.

Higher yields, especially higher real yields (i.e., yields less inflation), are a headwind for many commodities, like gold and silver, as the higher income investors can earn from holding bonds makes these assets less attractive. We have seen this play out over the last week as gold (GLD) reversed down, fell to a sell signal, and has continued to decline. We discussed this in last week’s Friday Investment Talk.

Rising rates are the main enemy of most segments of the fixed income market as there is an inverse relationship between rates and bond prices. Given that yields remain near historic lows – the 10-year yields would need to rise about another 75 basis points to get back to where they were at the end of 2019 – it is conceivable that we would see a sustained period of rising rates.

Investment Options

High Yield/Short Duration

The simplest way to protect a fixed income portfolio from a rise in interest rates is to shorten its duration. Duration measures how sensitive the price of a security is to changes in interest rates. The higher the duration, the higher the interest rate sensitivity. Therefore, the value of long duration securities tends to deteriorate quickly in rising rate environments.

A primary factor that determines duration is maturity; all else equal, a security with a longer maturity will have a higher duration. However, in a normal rate environment – one with an upward sloping yield curve – choosing a shorter maturity will mean lowering yield.

One way to offset a loss of yield from reducing duration is increasing exposure to high yield bonds. Luckily, high yield bonds, in and of themselves, can also be an effective way to reduce interest rate risk. High yield bonds usually have relatively high coupons and a bond with a high coupon will have a lower duration than an otherwise equivalent bond with a lower coupon. Of course, adding high yield bonds to a portfolio means increasing your credit risk. Nothing is free in the world of investing!

For a variety of reasons, high yield bonds are typically issued with shorter maturities relative to other types of bonds. This characteristic, combined with their higher coupons, means there is an ample supply of bonds that are both high-yield and short duration.

Floating Rate Securities

As the name implies, floating rate securities do not have a fixed coupon rate (or dividend, in the case of floating-rate preferreds). Instead, the rate is typically set at a predetermined spread to a reference rate (e.g. LIBOR + 200 basis points) and resets at a fixed interval.

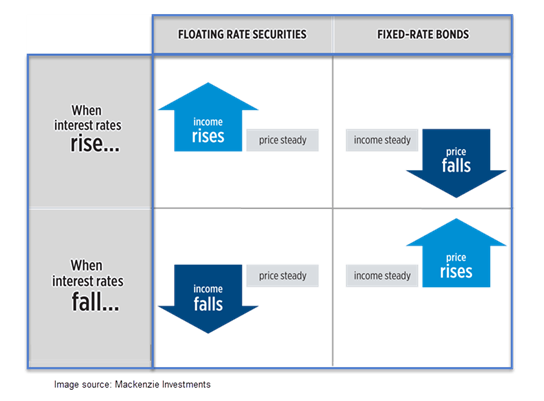

Because the next coupon reset is never too far off, the price of a floating rate security will not move significantly due to changes in interest rates and when there are small changes, the price should return to par value at the next reset date. This is obviously advantageous in a rising-rate environment, as ‘floaters’ will not experience significant price decline like fixed-rate securities. However, the flip side is that floaters will not experience price appreciation in a falling rate environment and their coupon rates will decline. Put simply, in a rising rate environment, all else equal, a floating rate security will outperform a fixed rate. And in a falling rate environment, the reverse is true.

One other disadvantage of floating rate securities is that, because the buyer (lender) is taking on less interest rate risk, floaters will almost always have a lower yield than an otherwise equal fixed-rate security.

Interest Rate Hedged ETFs

Just as the name implies, rate-hedged ETFs hold portfolios of bonds along with instruments designed to hedge against price declines in the event that rates increase. While hedging is a good way to mitigate risk, it almost always comes with an additional cost. In this case, it comes in the form of increased fees and expenses and/or reduced yields.

Most rate hedged ETFs mitigate their rate exposure by shorting U.S. Treasuries futures contracts. The managers of these ETFs seek to weight their portfolio of short positions in such a way that the duration of those positions matches the overall duration of the long positions. However, differences in the individual weighting of short positions, e.g. between 2-, 5-, and 10-year treasuries futures, can impact the effectiveness of the hedge depending on how the yield curve shifts during a rate increase.

Rate hedged ETFs can be an effective way to manage interest rate risk without reducing the overall fixed income allocation of a portfolio. However, ETFs that appear to be similar can have important differences when you take a closer look at the details. This is especially true of fixed income ETFs and even more pertinent in the case of hedged ETFs, which also come with differences in hedging technique/effectiveness. So, you’ll want to make sure you’re familiar with all the ins and outs of a particular ETF before investing. Below we’ve recapped the major advantages and disadvantages of rate hedged ETFs.

Advantages of Rate Hedged ETFs

- Typically composed of conventional fixed income instruments, i.e. corporate and government debt.

- Provide protection against increasing interest rates.

- Can be used to take a position on the future direction of rate spreads.

Disadvantages of Rate Hedged ETFs

- Typically have higher fees.

- Usually have lower yields.

- These funds typically underperform their unhedged counterparts if rates decline.

- Hedging tactics vary from fund to fund and therefore some may be more effective than others.

Target Maturity ETFs

One way to avoid interest rate risk is simply to hold your fixed income securities to maturity. If we assume there is no default, when a security matures you receive its par value. However, constructing a well-diversified portfolio of individual bonds that you can hold to maturity is a complicated task that requires a significant amount of capital available to invest. While traditional ETFs and mutual funds offer easy access to diversified bond portfolios because they are perpetual in nature they cannot be held to maturity. Luckily, investors now have access to target maturity ETFs which can address both of these issues.

Unlike traditional fixed income ETFs, target maturity ETFs hold individual bonds that each mature or are expected to be called in the same year. As the underlying bonds mature, the cash or cash equivalent holdings of the fund increase and upon the fund reaching maturity the proceeds are distributed to shareholders. Because these funds have a target maturity, they can be used to create a held-to-maturity portfolio to protect against capital losses due to rising interest rates.

Target maturity ETFs can also be used to create laddered portfolios. A laddered portfolio is one with allocations spread across several different maturities, e.g. 20% each to 1- to 5-year maturity bonds. A laddered portfolio provides liquidity and can help minimize interest rate risk.

Even though the underlying bonds in a target maturity ETF are expected to be held until maturity, they are exchange-traded and therefore the market value and price of the fund will still be affected by interest rate movement. Therefore it is important to understand that ultimately, as the bonds near maturity, the price of the fund should move toward the par value of its holdings and the fund will receive par value for its bonds (excepting any potential defaults), which will, in turn, be distributed to the funds’ investors.

Convertible Bonds

Convertible bonds are hybrid securities with features of both debt and equity. They give the bondholder the right, but not the obligation, to exchange the bond for a pre-determined number of shares of the issuer’s common stock.

In a situation where the underlying equity value of a convertible bond is higher than its conversion price (i.e. price at which the bond can be converted to common stock) the bond will generally trade much like equity, i.e., the price of the convertible bond rises and falls with the stock price. Meanwhile, the value of the straight (option-free) bond acts as a floor to the value of the convertible bond, thereby making it less risky than a straight equity investment.

Convertible bonds typically have a yield advantage over common shares. In general, an investor earns more income from holding the convertible bond than they would receive in dividends from holding the common stock, which is one reason why a bond may not be immediately converted if the value of the underlying equity rises above the conversion price.

As with other fixed income securities, constructing a portfolio of convertible bonds can be a challenging task requiring significant analysis and capital. However, there are several ETFs and mutual funds that can streamline the process of incorporating these securities into your portfolio. The SPDR Barclays Capital Convertible Bond ETF (CWB) is an obvious choice and has been on a tear since the COVID crash – nearly doubling in price.

A Momentum Model

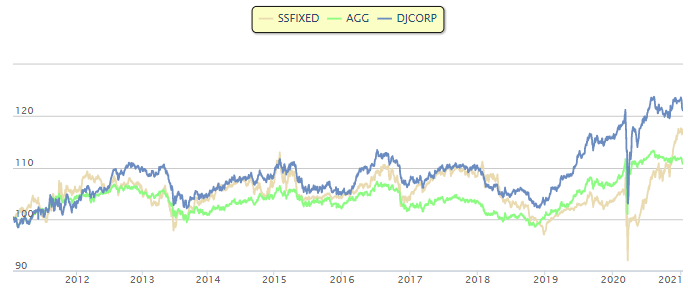

Using all the asset ideas outlined above, we can put together a managed portfolio model using State Street Fixed Income Funds to generate above benchmark returns using a momentum overlay. Selecting from an inventory of over 20 ETFs covering virtually every area of the fixed income market from convertible bonds to emerging market bonds to long-term Treasuries, the model utilizes a relative strength matrix to evaluate the inventory, identify areas of strength, and avoid areas of weakness in the market.