Tag: SPX

- 14.08.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: DJIA, SPX

- 19.07.2020

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

- Tags: dividend, FAANG, Health Care, Seasonality, SPX, Tech

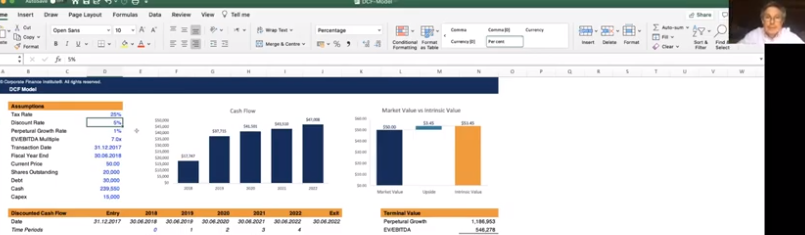

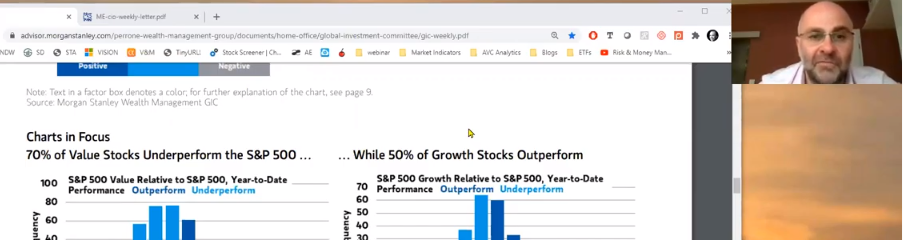

Are markets overbought? The narrow bull market in FAANG and some other technology stocks has led to concern among analysts that stocks are out of sync with the economy. We explore how interest rate assumptions affect analyst pricing in discounted cash flow models and lead to inflated asset prices. A discussion of the opposite case …

- 4.07.2020

- 3.07.2020

- 28.06.2020

- Categories: Analytics, AVC Pro Subscription, News, Personal finance

- Tags: Elections, NASDAQ, s&p500, SPX

- 22.06.2020

- Categories: Analytics, News, Personal finance

- Tags: COVI-19, ESG, ETFs, NDX, SPX, Unemployment

This Friday we follow up on our ESG webinar from Wednesday. ESG ETFs have witnessed explosive growth in terms of AUM and number of listings. ESG outperfomance vis-a-vis SPX and even the NDX is evident lately. Certain institutional investors have pushed this stretched trend recently. Many market indicators (both fundamental and technical) are very overbought. …

Friday Investment Talk: ESG, Corporate Debt, and Fundamental Weakness Read More »

- 19.06.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: DJIA, NASDAQ, SPX

- 31.05.2020

- Categories: Analytics, Investment ideas, Personal finance

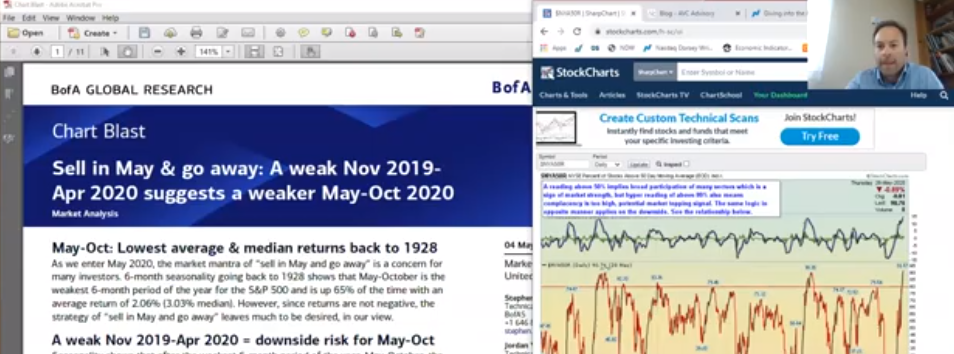

- Tags: FTSE100, Seasonality, Sectors, SPX, TLT, XLI

- 29.05.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: SPX

- 29.05.2020