Tag: SPX

- 20.09.2021

- Categories: Investment ideas, News

- Tags: ARCH, ETFs, Natural Gas, SPX

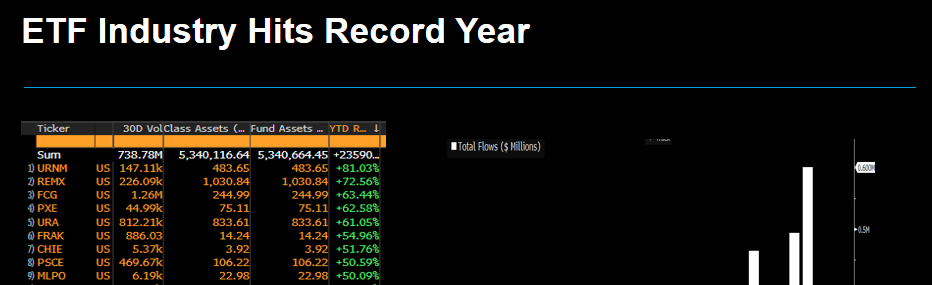

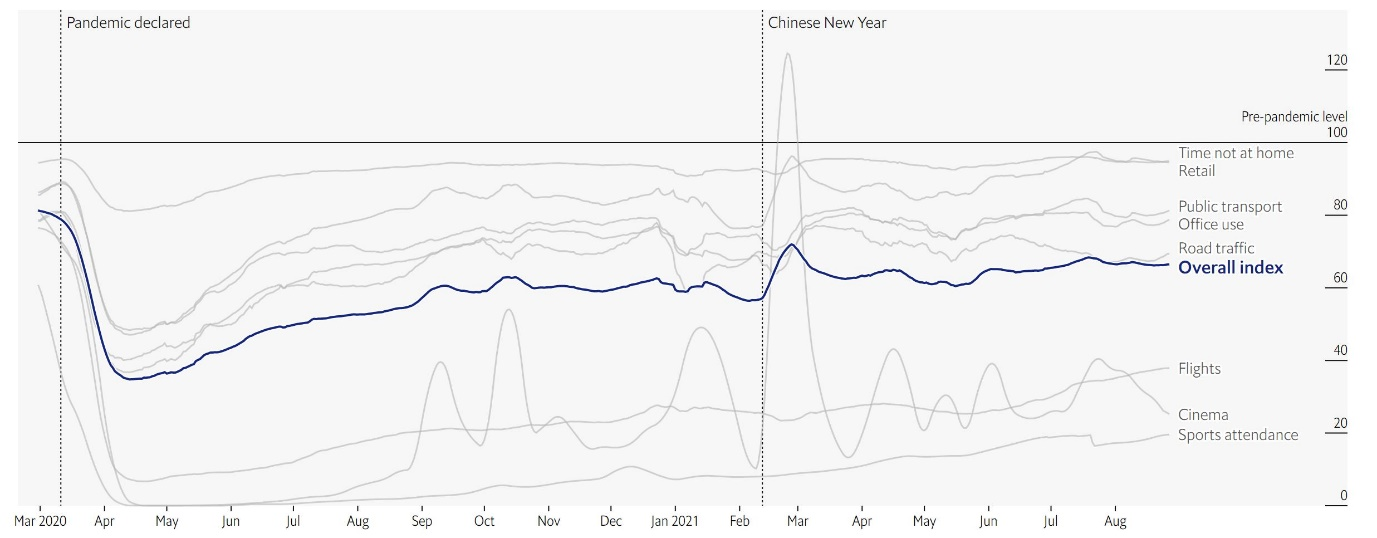

After visiting the Money Show annual conference in Las Vegas, we review Bloomberg’s ‘Hot ETFs’ list – ETFs likely to grab investors attention through the rest of 2021. Then we turn to Europe to look how natural gas prices have soared this year, putting pressure on European households headed into the winter months. Back in …

Friday Investment Talk: ETFs, Natural Gas, US Markets Read More »

- 6.09.2021

- Categories: Investment ideas, News, Personal finance

- Tags: DJIA, inflation, NFLX, PPLI, QQQ, SPX

As the US and many other countries discuss raising individual income taxes, private placement life insurance comes again into focus. Its always been a mechanism to legally hide investments from taxes, but now it is receiving a renewed interest from even less wealthy individuals. A bullish fund manager feels a return to normalcy will send …

Friday Investment Talk: PPLI, US Recovery & Jobs Data Read More »

- 25.08.2021

- Categories: AVC Pro Subscription, Personal finance

- Tags: DJIA, NASDAQ, Russell 2000, Seasonality, SPX

- 6.08.2021

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AAPL, DJIA, GOOG, IBB, IYW, MSFT, NASDAQ, NVDA, SPX, xbi

- 30.07.2021

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: COVID, DJIA, NASDAQ, Seasonality, SPX

- 25.07.2021

- Categories: Analytics, AVC Pro Subscription

- Tags: DJIA, Russell 1000, Russell 2000, Seasonality, SPX

- 18.07.2021

- 10.07.2021

- Categories: Analytics, Investment ideas, News

- Tags: COVID, SPX

- 23.06.2021

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: DJIA, NASDAQ, Seasonality, SPX

- 20.06.2021

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: $CI, SPX, XLV