AVC have focused on the two leading Biotech ETFs over the last few years, but it has been a tough year. We follow XBI and IBB. XBI is SPDR S&P Biotech, and IBB is iShares Biotechnology.

While 2021 marked an extraordinary year for genomics breakthroughs, and has been exceptional for some vaccine companies due to Covid, most of the rest of the sector has struggled.

Nevertheless, innovation in oncology therapeutics could be even more groundbreaking in 2022.

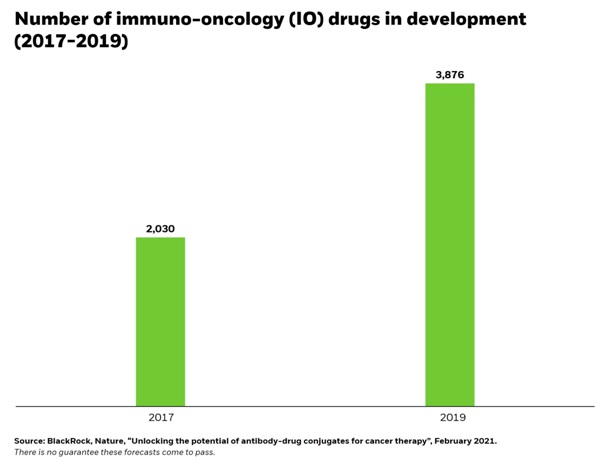

One of the main areas where research is being concentrated is in what is a called antibody-drug conjugates (ADCs), designed to more precisely target tumours and release toxins that deliver 10,000 times the potency of standard chemotherapy, all while limiting impact to healthy tissue.

Currently, nine different ADCs are approved as cancer treatments with dozens more in pre-clinical and clinical development.

Another area is bispecific antibodies (BSMAbs), have immense potential. These antibodies not only attack cancer cells but also have the ability to guide natural disease-fighting cells in our bodies closer to the disease itself, like a commander deploying troops to the front. There are more than 300 bispecific antibodies in development and the global market is predicted to reach $10 billion by 2026, according to Blackrock.

Lets go back and look at how our preferred Index Trackers performed in 2021 and the outlook for the next few years.

As said, it is a mixed bag, XBI is down more than 17% year to date, whilst IBB is almost break even at +1.42%. These are amazing results considering there is a more than 30% overlap on holdings.

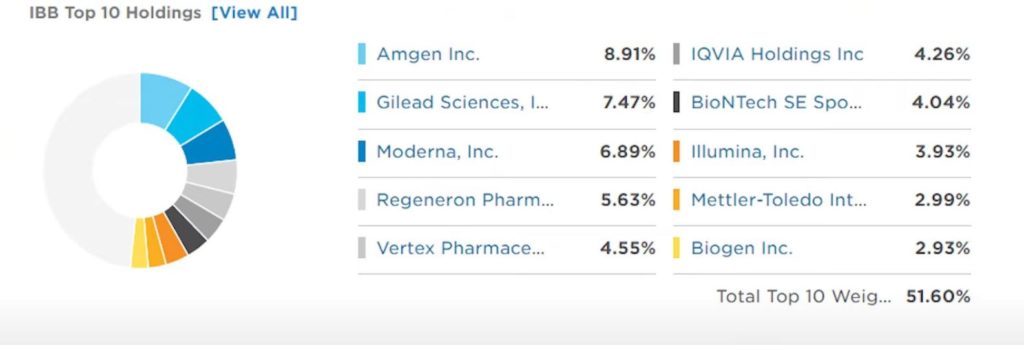

The key here is how these holdings are weighted. IBB has a market weighting system, where the bigger the company, the bigger the holding in the ETF, this results in the top 10 holdings making up more than 50% of the ETF.

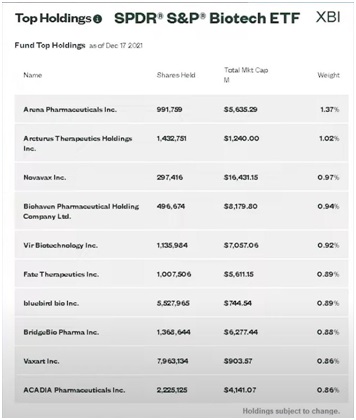

XBI has an equal weighting system, which makes more of an emphasis on the smaller members of the index.

An excellent example of this is Moderna. Moderna has a holding percentage of almost 7% in IBB but less than 1% of the ETF in XBI. Considering two of the highest returners in the Sector in the last year was Moderna, up 164% (along with BionTech at 250%), this has clearly benefitted the market weighted type approach.

However if we look further back at performance, we can see that in actual fact the leading index is XBI but a decent margin.

Over 15 years, the XBI outperformed their competition by more than 147%.

It is critical to understand the reason for the outperformance as it is vital to our suggestion as to which ETF will outperform going forward.

The primary factor is the weighting system.

One of the main reasons investors allocate to Biotech is to take advantage of the M&A activity inherent in the sector.

If the Index is market weighted, then the emphasis is on the larger participants in the sector, which are less likely to be subject of a speculative acquisition. One cannot second guess the M&A market, once a deal is announced, its too late to get in for that bounce. Some of these corps could pop 60%+ in a day so you really need to have exposure pre-announcement. That’s where these sector ETFs really come in to their own.

This year has not been a great year for M&A all told. The biggest beneficiaries have been the vaccine producers, but these ETF’s are not the best ways to play the vaccine manufacturers story.

Having said that, if we want to look at research opportunities looking for a COVID pill or for more satisfactory solutions to ANY future Corona Virus, then this is an interesting sector to have exposure to.

In fact, according to one Bloomberg analyst, the huge potential upside in Biotech could be fuelled by “Baby boomers who have all the money and want to live forever”!

XBI is definitely the pick here, as there is more diversity and more risk due to the Equal Weigh structure. There are more companies in the XBI who have the potential to be the next big thing, more experimentation in those companies and hence more opportunity for the next big discovery.

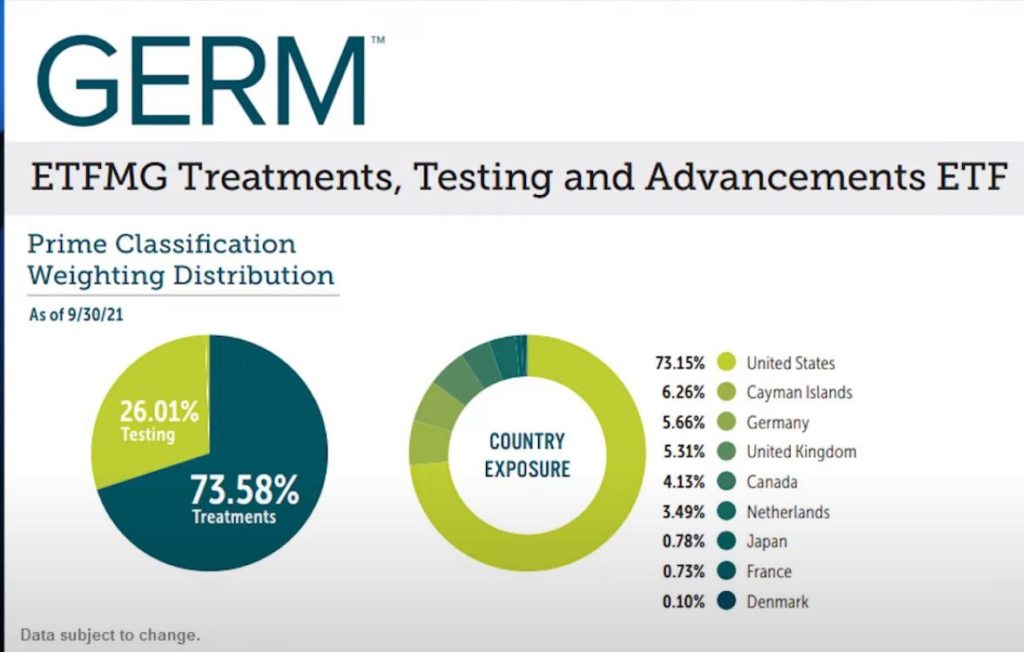

However, lets add a third dimension to the mix, GERM.

GERM is a relatively new ETF which focuses more on research and companies looking into infectious diseases solutions. This is the place if you think Covid19 is just the start of the ‘plague’ on homo sapiens. Its certainly worth considering if you are looking at this space.

And it has outperformed BOTH IBB and XBI in 2021!