Finally, we found the best Emerging Markets ETF to invest in!

For many years now, the famous BRICs have been touted as THE place to put your money for the best chance for long term capital growth.

We agree.

However, the returns of many of the indices and managed funds in Emerging Markets have not reflected the growth nor the opportunity that we see in those markets.

The main reason for this is that in most emerging markets, the largest companies tend to be state-owned enterprises (SOE) or heavily state invested. Take most of the main emerging markets and you will not have to dig far to see what I mean – Brazil / Petrobras, China / Sinopec, Russia / Gazprom to name but three household names.

The issue is that these state behemoths have a nasty weighting in each of the indices and so hold a disproportionate amount of your invested monies than other, smaller, privately held entities. Those public entities are almost without exception inefficient, bloated, and, yes, corrupt. Would you REALLY want to have your investments held in those companies if you are expecting large capital growth over the next 20 years?

No. Of course not.

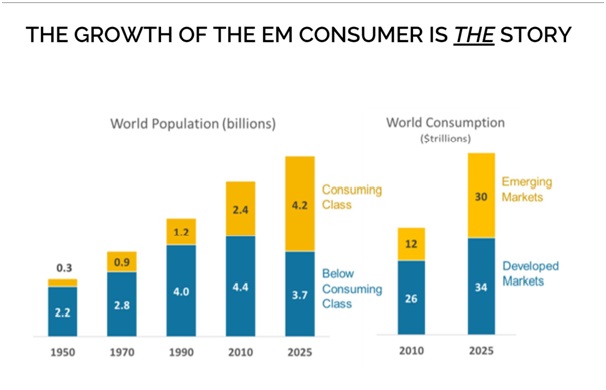

Now we find an actively managed ETF which holds NO SOEs but instead focuses on the huge growth themes that we have been aware of in emerging markets for years – namely the rise of the local young connected consumer.

Companies which target these themes through the interlocking catalysts of IT mobility, internet connectivity and consumerism include some well known names (even in developed markets) like Alibaba, Baidu and Mercado Libre.

In addition to those not being state owned, they are nimble, dynamic and in many cases have the benefit of being invested into by ‘Western’ investment managers which engender transparency and good governance.

A wonderful example is that of those nonagenarian gurus at Berkshire Hathaway investing into Brazilian fintech startup Stone.

We will revisit the themes and performance of this ETF over the months and years ahead but safe to say we are excited by its profile, its scope and its potential.

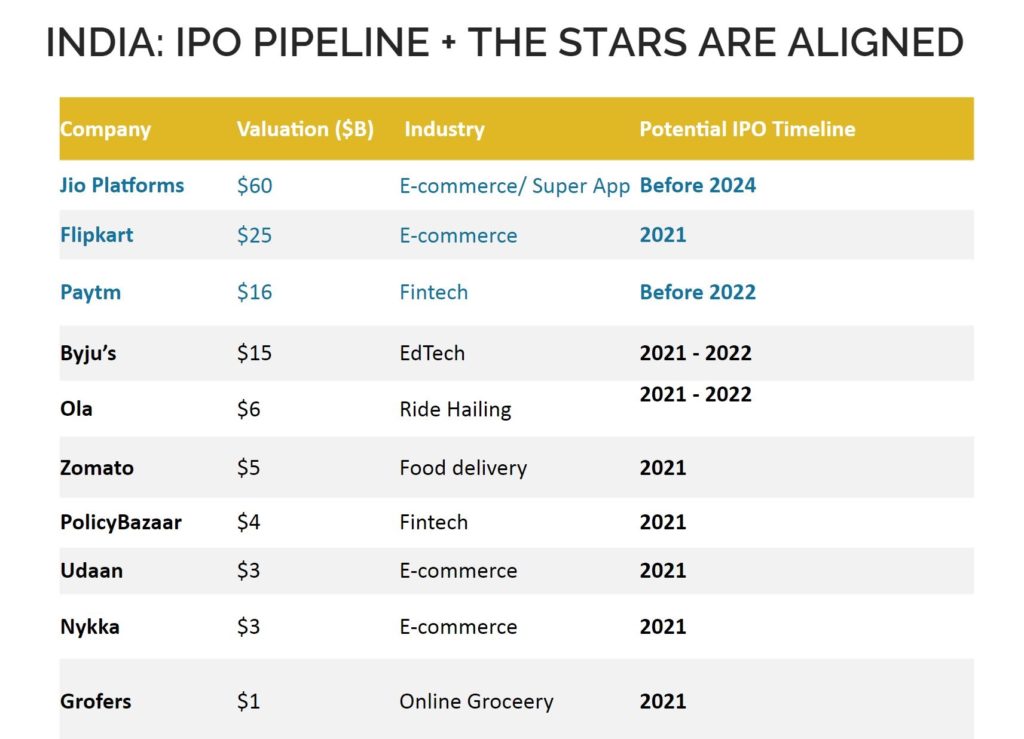

We leave you at this point with the following chart, which outlines one of the lesser appreciated dynamics of one particular emerging market – India.

In India, many of the leading consumer oriented companies are either family owned, or part of a much larger ‘old tech’ conglomerate or both!

However, these dynamics are slowly changing and if you look at the possible list of IPOs in the Indian retail, fintech and IT which are planned for the next few years, the opportunities are absolutely mouth-watering.

Remember also that India, allegedly, overtook China recently as the worlds most populous country and GEN Z’ers, who are pushing the boundaries of tech are more numerous in India than in China and the United States combined!

Now, if anyone asks where to put your money for the next twenty years, you will now a very good choice.