TLT (US Treasuries ETF) and DVY (iShares Select Dividend) and VNQ (Vanguard Real Estate)

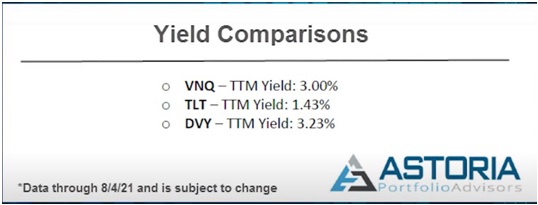

For those clients seeking income, we have a choice between US Government Bonds, Dividend paying stocks and Real Estate.

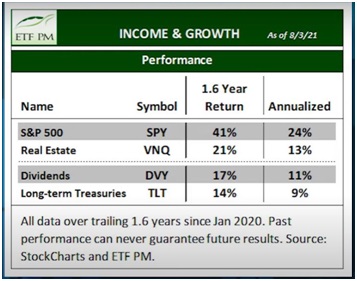

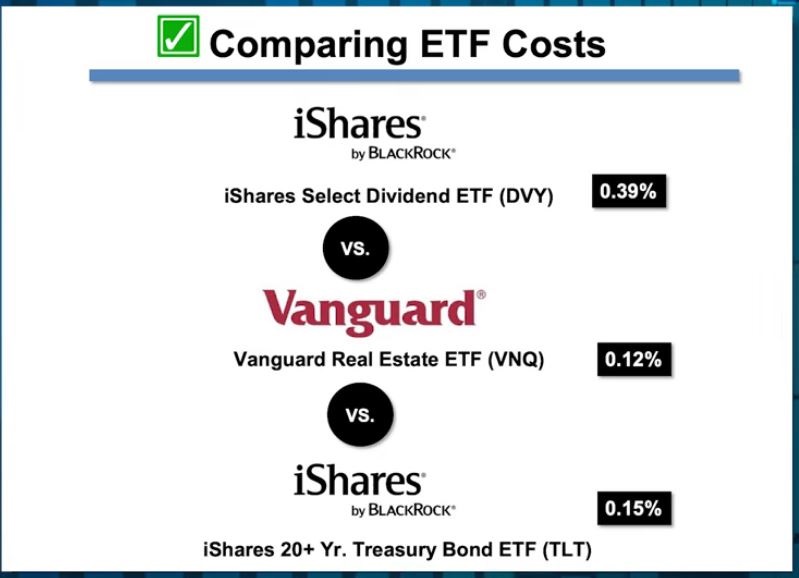

Let’s look at each via a number of criteria, the first of those being Costs. Then we will look at Exposure Strategy then, Performance and Yield

On a simple rating using TERs, then it is obvious that VNQ is the cheapest, as one might expect with Vanguard.

Having said that, there is really not that much to split the three ETF’s all are ridiculously cheap.

One might also so that on a value adjusted basis, it is worthwhile paying the extra 3 bps and go for the Treasury Bills Index tracker.

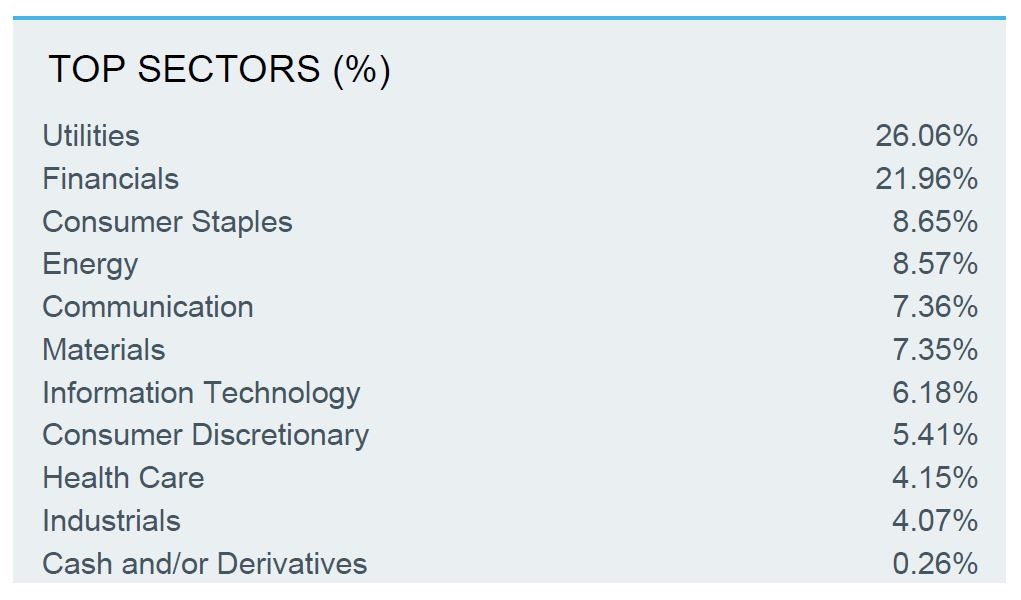

When it comes to exposure strategy, the VNQ is a very specific index and although it has outperformed over the last few years, it is perhaps the weakest of the three when it comes to exposure, as it is of course restricted to real estate assets, primarily REITS.

Treasuries are similarly narrow in their index objective but it is understood that many peoples’ portfolio foundation should have a decent chunk of TLT in it.

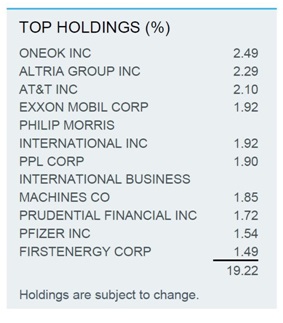

Clearly here, the fact that the Select Dividend Index has top ten holdings from the industries of Technology, Tobacco, Pharmaceuticals, Natural Resources/Energy, and Financials means the exposure of this index is much broader than the other two.

With dividend income stocks there is a well-understood risk premium and so an element of “you know what you get” which one might argue is missing from the REITS index tracker.

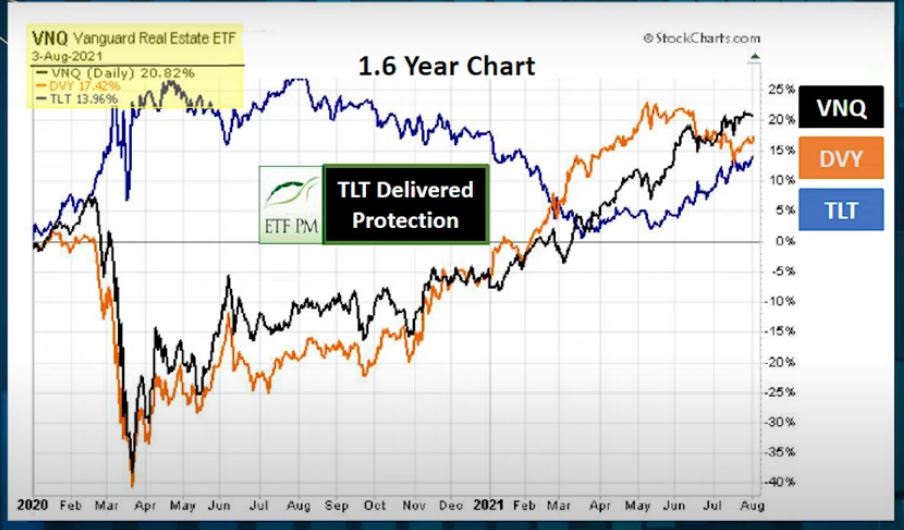

On the other hand, even though TLT is pretty limited in terms of exposure there is excellent historic crash protection, which should be considered by all investors but maybe now more than in recent memory.

In this comparison essay, we must not get fixated by returns. Whilst they are important, we equally should be concerned by enhanced diversification and protection.

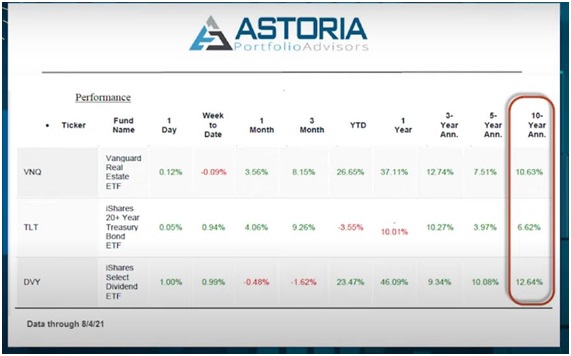

As mentioned, over the last couple of years, the VNQ has been the top performer admittedly not by much. In fact over the last 10 years, DVY has just edged the performance between the three indices.

TLT is certainly best for downside protection, which is a critical factor in these defensive allocation portfolios.

One of the fund allocators interviewed for this essay uses a risk adjusted return metric, the Sharpe Ratio – which calculates the unit of growth for each unit of volatility. He maintains that DVY has a well documented historical Sharpe ratio and as such allows for a long term buy and hold strategy to be implemented.

Whilst the Sharpe ratio is lower for TLT, simply because TLT doesn’t return as much as stocks, it is the best ‘buffer’ for capital loss.

Another fund allocator, interestingly, takes a slightly different viewpoint. He suggests that it is better to avoid these, what he calls, HYBRID index trackers (meaning stocks AND income).

He contends that it is better to focus on buying TLT AND a vanilla S&P tracker and use the latter for capital growth but be content with income and downside protection from the former. He use the last 4 main crises – GFC, European Debt crises 2012, Q1 2016, and COVID as showing that TLT offers priceless protection that the other 2 indices do not offer.