Next week starts the Jewish holidays and the relevant market adage, “Sell on Rosh Hashanah and buy on Yom Kippur” comes into play. The evening of Saturday, September 19, marked the beginning of the Jewish New Year of Rosh Hashanah, which occurs on the first and second days of the Hebrew month of Tishri. In keeping with the market adage, it marks the beginning of a period of time where many of the Jewish faith are traditionally less interested in capital markets than they are the celebration of the “High Holy Days.” This could reduce demand from the markets and thus lend to the greater potential for lower prices and better entry points when such demand returns to the marketplace. Yom Kippur marks the end of this period, which this year falls on Monday, September 28, marking what is considered as the holiest day of the year for the Jewish faith.

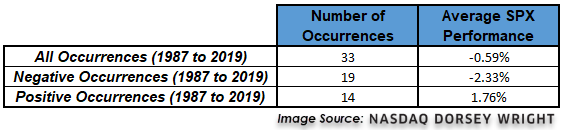

In looking at historical returns for the S&P 500 during the High Holy Days from 1987, the SPX was down roughly 58% of the time during this period, or on 19 of the 33 occurrences. The table below summarizes the performance of the S&P 500 Index during this time period from 1987 to 2019. On average, the SPX is down -0.59%, while the Index is down -2.33% on average during negative occurrences and up 1.76% on average during positive occurrences. While the sample size is relatively small, this data shows that the market has a slight bias toward negative returns during the High Holy Days, and that we see the average loss being larger than the average gain on an absolute basis.

Many of the sources we follow have specific trade recommendations for this period. For instance, McMillan’s Options Strategist writes a specific trade called the “Week after September Expiration Seasonal Trade” specifically calling to short the market on September 18th. “The system is simple: short the market on the close today and cover on the close next Friday.” McMillan notes, “The results have been good. The last 30 years’ results … have been profits on this system in 24 of the 30 years. “

September’s trading calendar highlighted this period with bearish markings also, which we noted in our Friday Investment Talk video.

No specific trade recommendation is given as many investors still cannot easily short the market in an effective manner. However, just noting the weakness and the need for caution in the weak September period is worthwhile for those investors still with large exposure to US markets.