Category: Investment ideas

- 19.09.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: Investing, Stocks

Several trade ideas are presented in this paper. These are shorter term trading ideas for swing traders.

- 18.09.2020

- Categories: Analytics, AVC Pro Subscription, Investing basics, Investment ideas, News

- Tags: CTLT, ETSY, SPX, TER

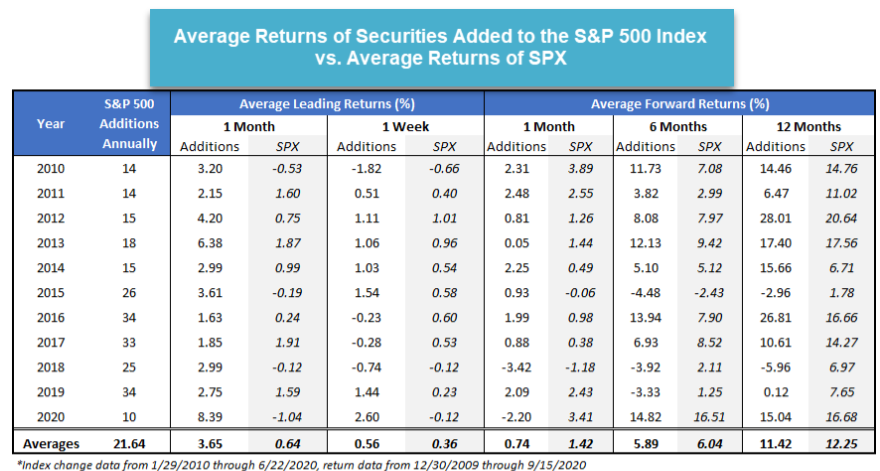

We examine whether there is a performance advantage for stocks being added to the S&P 500.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 18.09.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: DJIA, Elections, NASDAQ, Russell 1000, Russell 2000, S&P 500, Seasonal Strategy, Seasonality, SPX

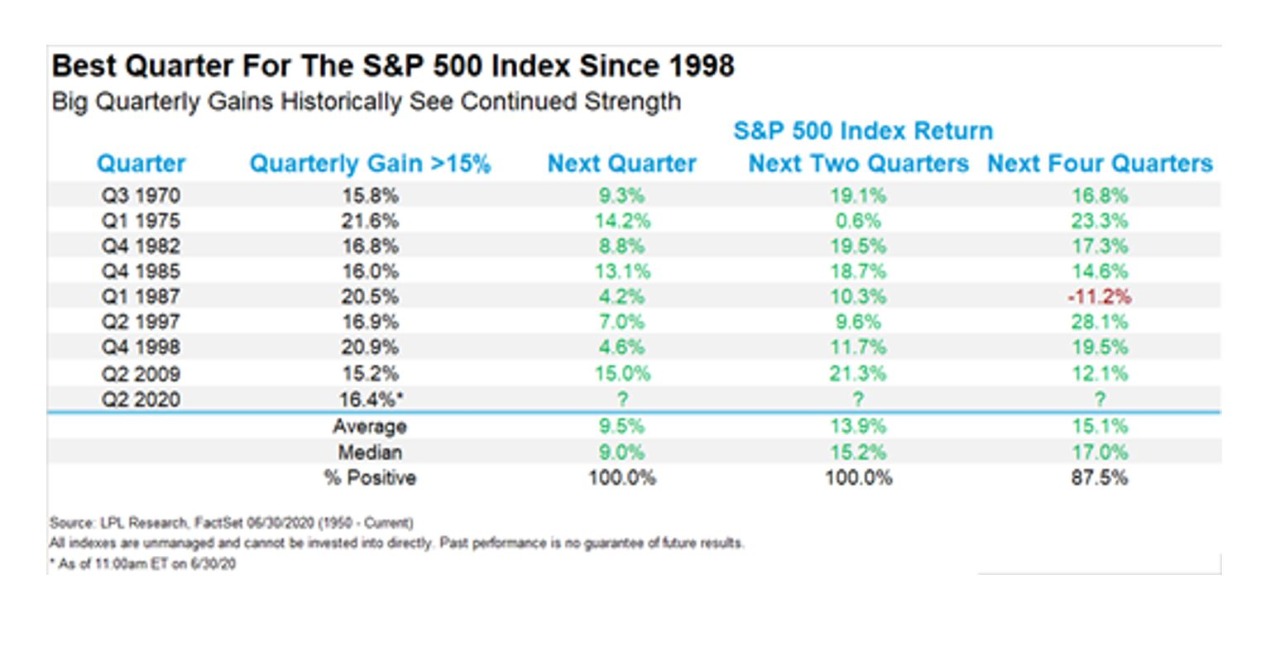

October can invoke fear into investors as it is usually a weak month. However, October often marks the lows for the year. Stay diligent!

To access this post, you must purchase Subscription Plan – AVC Pro.

- 13.09.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: DOW, SPX, XLB

- 6.09.2020

- Categories: Analytics, Investment ideas, News

- Tags: Abenomics, Japan, NDX, Property, Real Estate, SPX, Tech

- 2.09.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: NASDAQ, Russell 1000, Russell 2000, Tech

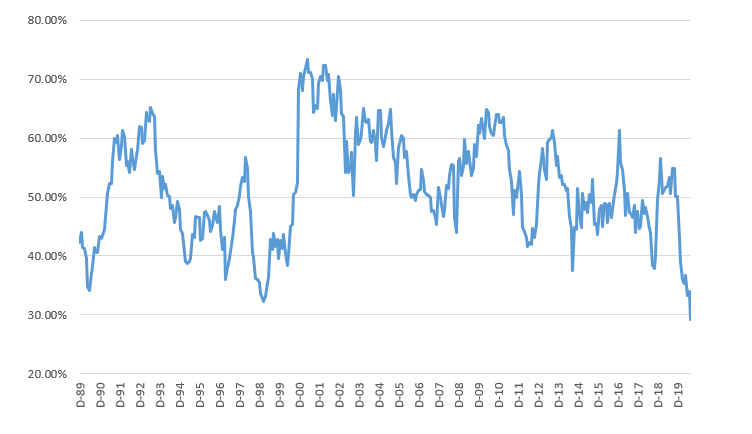

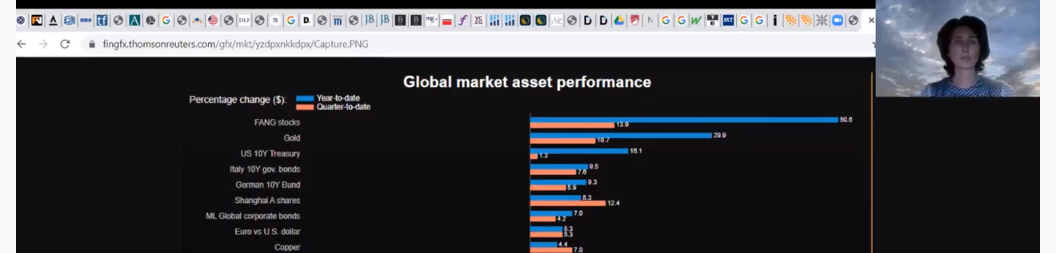

US stock markets continue to see an extreme concentration of interest in a small number of stocks. Does this signal an imminent sell off or will market participation broaden?

To access this post, you must purchase Subscription Plan – AVC Pro.

- 31.08.2020

- Categories: Investment ideas

- Tags: Health Care, NASDAQ, SPX, Tech

- 23.08.2020

- Categories: Analytics, Investment ideas, News

- Tags: emerging markets, GLD, IWM, Rubles, SPX, TUR, Turkey

- 15.08.2020

- Categories: Analytics, Investment ideas

Reviewing this week’s sell off in gold and US government bonds, we notice new investor attention on small cap stocks with IWM outperforming the tech laden NASDAQ and S&P 500 indexes. Mercado Libre (MELI) traded down after it posted excellent Q2 results – a case of ‘buy the rumor, sell the news’ and using strength …

Friday Investment Talk: Gold, MELI, Growth to Value Rotation Read More »

- 10.08.2020

- Categories: Investment ideas, Personal finance

- Tags: AAII, ARKK, bonds, EMQQ, MELI, russia, Tech

Again looking at the hot tech sector, the potential value to growth rotation, Russia as a value and dividend play, and some contrarian bullish indictaors for stocks while bonds are simply stretched very far. Mercado Libre (MELI) stock reports next week and BAML is out with a nice target price for the bulls.