Tag: bonds

- 13.06.2020

- Categories: Analytics, Investment ideas

- Tags: bonds, GDX, GDXJ, GLD, HYG, JNK, QQQ, Seasonality

- 1.10.2019

- 15.01.2019

- Categories: Analytics, News, Personal finance

- Tags: bonds, market trends, usa

Today, Citigroup reported earnings in line with analysts expectations, but warned of weakness in its fixed income business. This resonates with our own concerns for the US debt market. Both government bonds and corporate bond yields have been under pressure for months as we have seen an inversion of the yield curve in some U.S. …

Walls needed, walls built As the old adage goes, “markets climb a wall of worry”, so in good fashion BAML tapped into its inner Trump in its weekly market review to make certain sure that investors have a wall! While the US Federal Reserve tries to atleast stabilize its debt to GDP ratio – something …

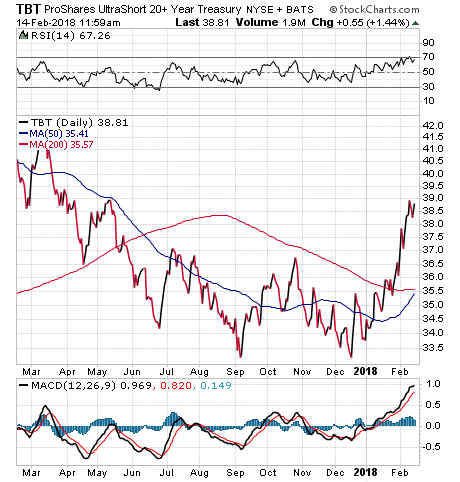

With the US Fed widely expected to raise interest rates several times in 2018, we get many questions about how to take a position that could benefit from the rate hikes using low cost ETFs. The ProShares UltraShort 20+ Year Treasury (TBT) stands out as a good idea. As bond prices and interest rates are …

- 7.08.2015

- Categories: Analytics

- Tags: bonds, germany, market review, market trends, usa

Overview Stocks around the world rebounded last week, with the U.S. taking the lead. Investors should be aware, however, that the good times may not last for long. Although last week featured more evidence that U.S. companies are able to beat diminished earnings expectations, several other developments argue for caution. Notably, estimates for growth have …

- 18.05.2015

- Categories: Analytics

- Tags: bonds, emerging markets, eur, market review, market trends, oil, usa, usd

Global stocks rose modestly amid a strong rally in the energy sector. Rising oil prices, surging M&A activity and central bank stimulus measures helped to support world stock prices despite a slowdown in U.S. economic growth during the first quarter. Emerging markets rallied as market observers pushed back the timing of an increase in interest …

Last week the US market showed some signs of cracking its bullish momentum. The SP500 and NASDAQ fell out of their positive bullish consolidations (pennant patterns everyone is talking about) and broke back down into the August and October trading range. More bullishly, meanwhile, the DJ30 was actually holding above that trading range and continuing …