Category: Investment ideas

- 27.06.2020

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: bonds, COVID, divdiends, MLPs, russia, taxes, Valuations

AVC partners review Veronika’s participation in the Russian Portfolio Investment Conference where she discussed our Dividend Investment Research (DIR), and the new 13 to 15% income tax for Russian non-residents, down from 30%. We reviewed the influence of recent central bank actions stocks and bond pricing. Credit quality is likely to become more of …

Friday Investment Talk: Russian Taxes, Market Valuation, MLPs and Credit Quality Read More »

- 19.06.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: DJIA, NASDAQ, SPX

July historically is the best performing month of the third quarter. This strength inevitability stirs talk of a “summer rally”, but we must beware of the hype, as summer has historically been the weakest rally of all seasons. Are US election years any different?

To access this post, you must purchase Subscription Plan – AVC Pro.

- 17.06.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: dividend, ETFs, MLPs

Here we update our Dividend Investment Research (DIR) that we initiated last month.

In our momentum appraoch, we run monthly screens that show the top performing stocks from each of 6 Dividend ETF categories.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 13.06.2020

- Categories: Analytics, Investment ideas

- Tags: bonds, GDX, GDXJ, GLD, HYG, JNK, QQQ, Seasonality

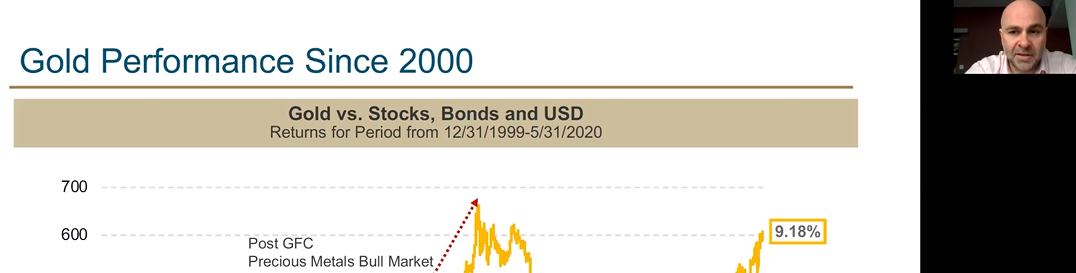

AVC partners discuss corporate bonds from some surprising names now considered "Fallen Angels". Gold, inflation and the undervalued gold miners are discussed in relation to the current overbought market. Thursday's huge sell off is a set up for a last run of strength before real seasonal weakness sets in.

- 11.06.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: MACD, NASDAQ, NDX, Seasonal Strategy

NASDAQ Seasonality has changed to a more negative stance after today's negative performance. Caution is warranted in tech stocks. Bonds can be added as summer months can provide weakness to stocks.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 6.06.2020

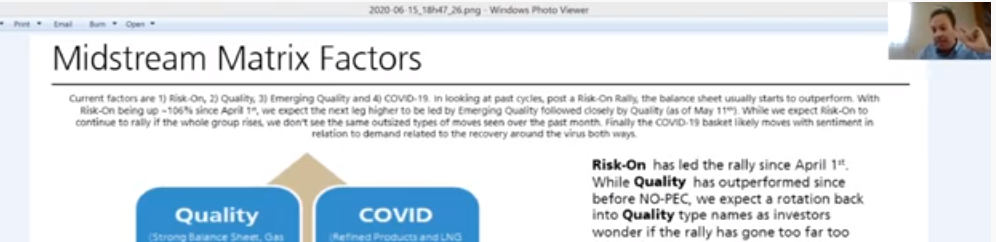

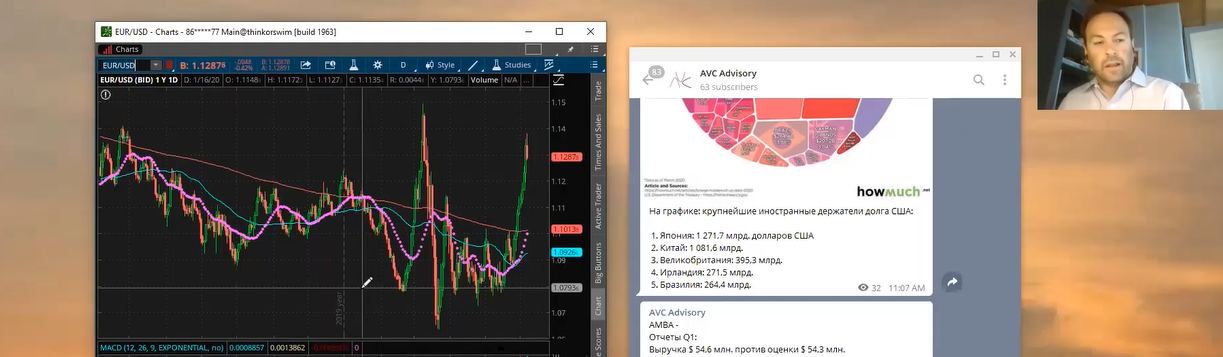

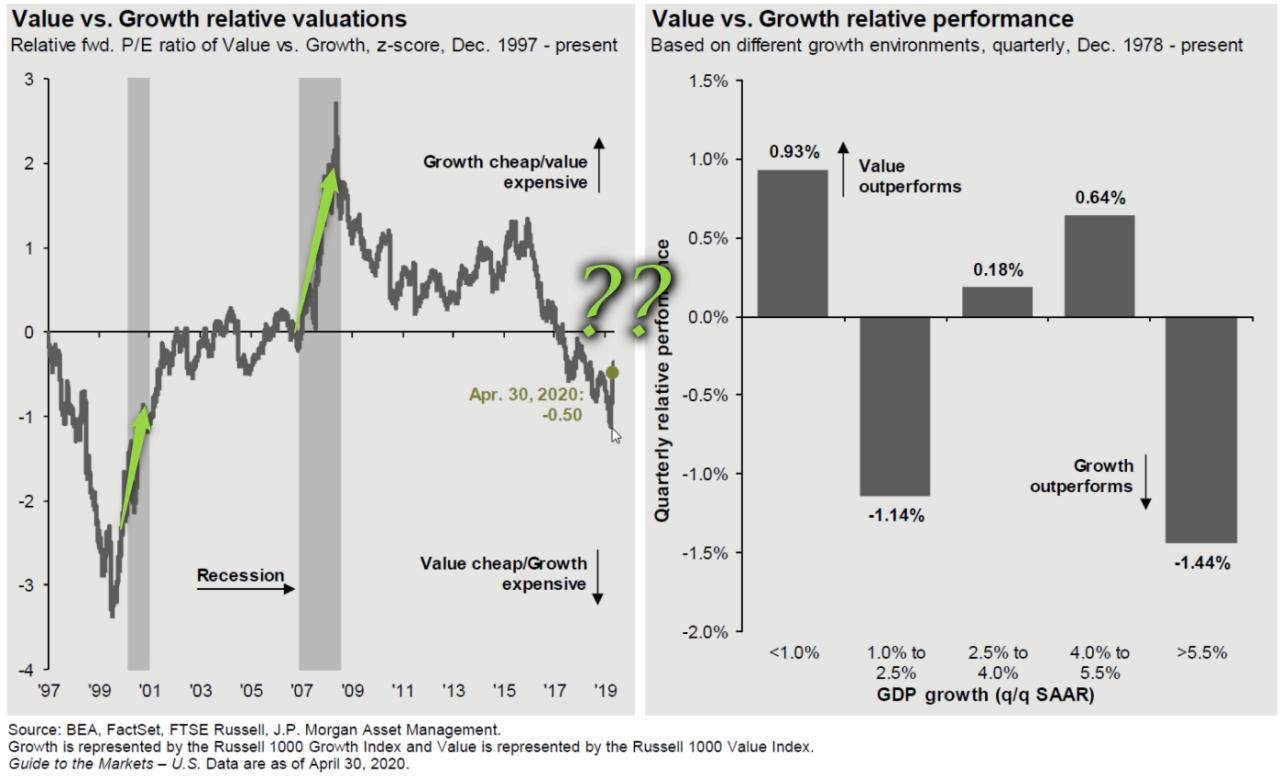

Markets are still bullish, although even more overbought than last week. Today's unexpected employment report provides fuel for higher prices. MLPs are leading momentum in all high dividend paying ETFs. Defense and Transportation (Airlines) showed strength this week. Value plays have rebounded sharply, while software companies look vulnerable with high valuations. Defaults are rising. Investors have piled money into cash equivalents. We look at the EUR/USD and Palladium also.

- 31.05.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: FTSE100, Seasonality, Sectors, SPX, TLT, XLI

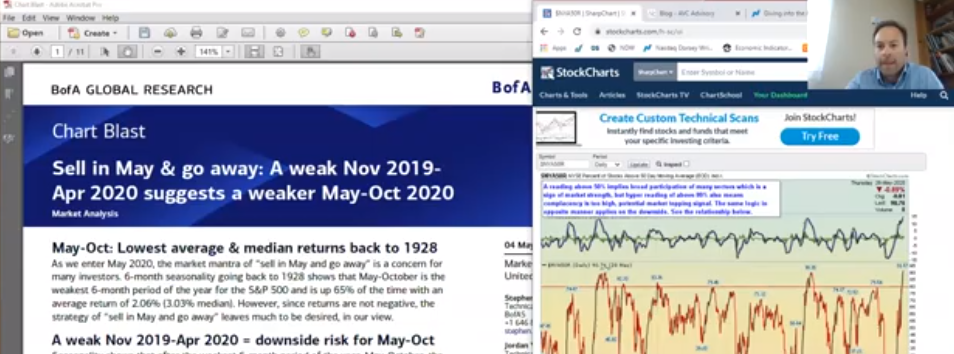

Stocks are still bullish from a technical point of view - the Put/Call ratio is overbought, but not yet negative.

All time highs for percentage of stocks above their 50-day moving averages (95%).

Seasonality is generally weak in summer months, but summers are better in election years than other months in election years, and better than in summer months in non-election years. Research from Bank of America,

Cylicals could take the lead in the summer, as social media and tech companies under polical pressure.

- 29.05.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: SPX

Since broad domestic equity indices posted a bottom on March 23rd, they have not looked back. In fact, the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average have each rebounded with price returns in excess of 30%.

As a result of this upward movement a number of indicators have turned positive. What does this mean longer term for equity markets?

To access this post, you must purchase Subscription Plan – AVC Pro.

- 26.05.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

We see overvalued prices in certain Tech companies, particluarly specific software companies. At the same time, PMIs may have hit near term lows. Can the classic cyclical sectors take the lead from here?

To access this post, you must purchase Subscription Plan – AVC Pro.

- 24.05.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: EWJ, EWY, FXI, GLD, SPX, TLT

We have a just launched the first session of our new weekly "Friday Investment Talk" series. This week Alan, Mike, and I discuss the continuation of the bull market's posture. Mike speaks of how client's 'fear of missing out' leads to overly concentrated portfolios. Alan highlights how the recent Chinese sell off could be a buying opportunity, as other Asian markets look strong.