Tag: Tech

- 31.08.2020

- Categories: Investment ideas

- Tags: Health Care, NASDAQ, SPX, Tech

- 10.08.2020

- Categories: Investment ideas, Personal finance

- Tags: AAII, ARKK, bonds, EMQQ, MELI, russia, Tech

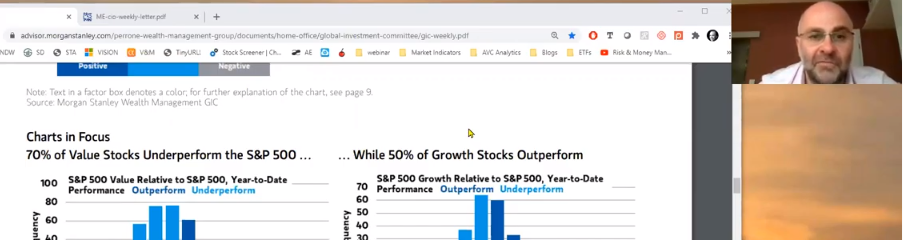

Again looking at the hot tech sector, the potential value to growth rotation, Russia as a value and dividend play, and some contrarian bullish indictaors for stocks while bonds are simply stretched very far. Mercado Libre (MELI) stock reports next week and BAML is out with a nice target price for the bulls.

- 19.07.2020

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

- Tags: dividend, FAANG, Health Care, Seasonality, SPX, Tech

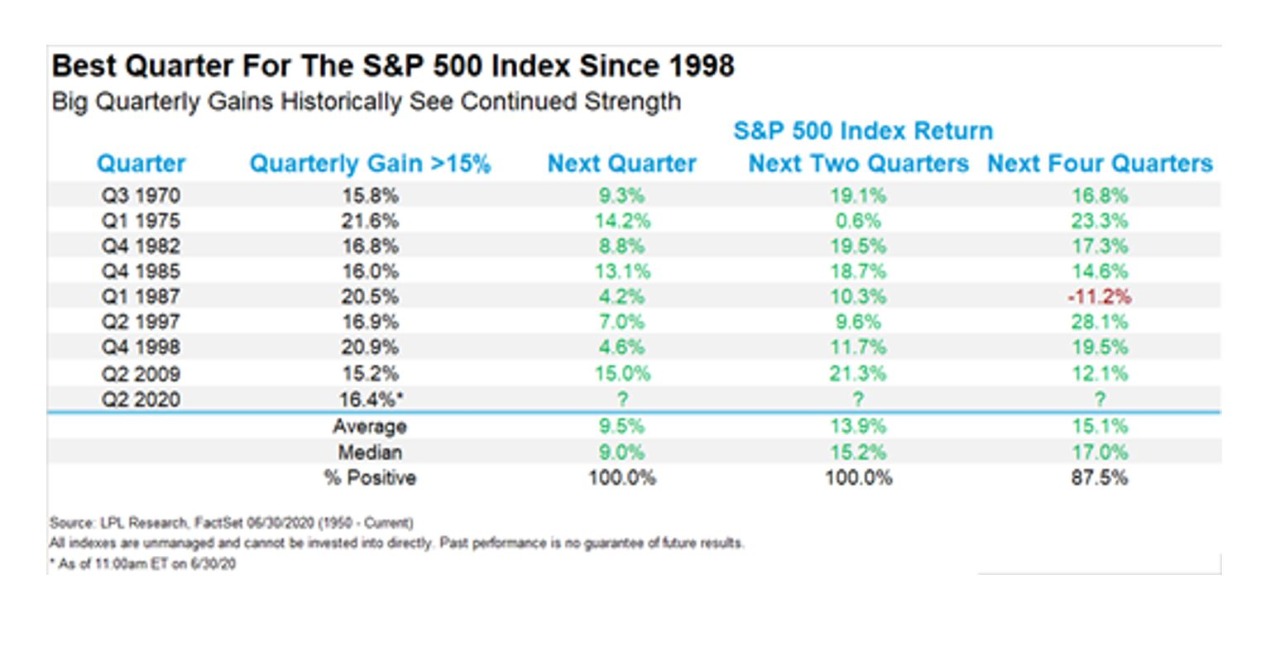

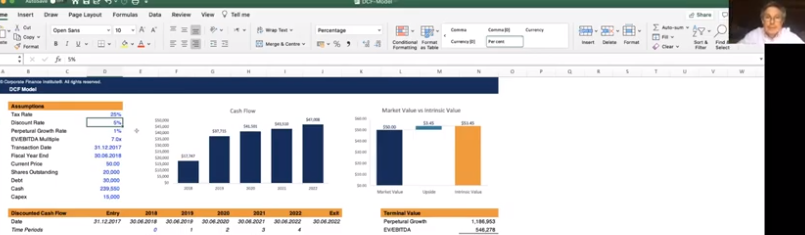

Are markets overbought? The narrow bull market in FAANG and some other technology stocks has led to concern among analysts that stocks are out of sync with the economy. We explore how interest rate assumptions affect analyst pricing in discounted cash flow models and lead to inflated asset prices. A discussion of the opposite case …

- 4.07.2020

- 18.05.2020

- Categories: Investment ideas, Personal finance, Личные финансы

- Tags: Gold, interest rates, Rubles, russia, Tech

Having one’s cake and not eating it. When I came to Russia, my first summer was hot and sunny and I took to cycling, exploring the city’s cycle paths, one of my favourites being the one that runs along Bolshaya Nikitskaya up to the Garden Ring. For those unfamiliar, the Garden Ring is a ring …

COVID Emergency Funds, the Price of Gold, and the Stock Market Read More »

- 6.04.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: AGG, BND, DJIA, GLD, IBB, Seasonal Strategy, SPX, Tech, XLP, XLU

- 30.03.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

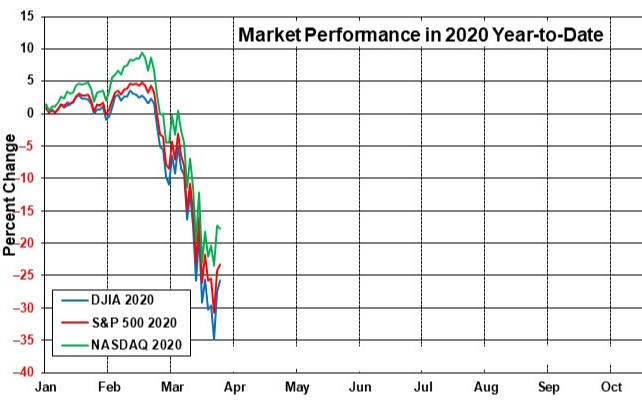

- Tags: April, CoronaVirus, DJIA, NASDAQ, Russell 2000, SPX, Tech

- 7.03.2020

- 1.01.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: 2020, SPX, Tech