We examine differences in AI-related funds and highlight some names you might not consider to be AI-related.

Even though artificial intelligence (AI) continues to make headlines, not all AI-related investments have seen the same price action over the last few months. The fresh headlines from the weekend discussed Sam Altman being ousted as the CEO by the board of Open AI, the company behind ChatGPT, only to potentially be rehired at the request of Open AI employees before ultimately being hired by Microsoft (who owns 49% of Open AI) as the head of their new internal AI division (source: wsj.com). Seem confusing? You are not alone. Luckily for us, all of the differing opinions on these headlines are filtered down into the price action of the publicly traded companies involved. Microsoft (MSFT) shares rose by over 2% during Monday’s trading as investors rewarded the company for their actions over the weekend.

The AI craze has taken the market by storm this year, with a few companies taking most of the headlines. Another major player in the AI space has been NVIDIA Corporation (NVDA), which is set to report earnings after the market close on Tuesday (11/21). Given the excitement around AI this week, we felt it would be prudent to review some differences between major ETF representatives and highlight technically sound names within the space.

Our ETF focus looks to take a broader approach than simply examining funds that have a small number of holdings with overweight positions in US mega-cap companies. When we last examined the AI space almost exactly six months ago, we used five AI & robotics funds that each had more than $100 million in AUM, for today’s purposes, we will take the three largest funds from that list, which include the Global X Robotics & Artificial Intelligence ETF (BOTZ), iShares Robotics and Artificial Intelligence Multisector ETF (IRBO), and the First Trust Nasdaq Artificial Intelligence & Robotics ETF (ROBT). While these three funds seem like they should all maintain a similar approach according to their names, we can see through our Fund Compare tool that the top ten holdings for each show little overlap. BOTZ, the largest of the three funds with over $2 billion in assets, has a 14% overweight toward NVDA as the largest stock in its portfolio (as of 10/31). Meanwhile, IRBO and ROBT each do not have a single stock that makes up more than 3% of their portfolios.

The technical pictures of each fund show major differences as well. IRBO is the only one of the three that shows a favorable fund score at a recent posting of 3.45. This iShares representative also shows the largest overweight toward technology, which has likely been attributed to its higher fund score.

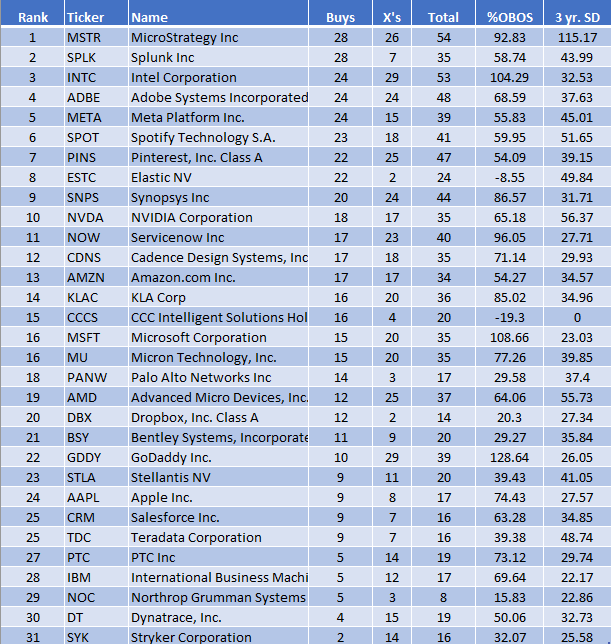

Taking a deeper dive into the underlying constituents of these funds by screening for stocks with strong technical pictures, we used NDW’s Security Screener. Combining the US-listed holdings of each fund leaves us with 116 stocks. From there, we filtered for names with higher liquidity, favorable technical attribute scores (4 or 5), and those demonstrating favorable absolute strength through a buy signal and positive trend. This simple screen narrowed our list down to 31 stocks ranked by technical buy signals below.

Many of the names included in the list are large technology stocks that have moved into extended territory on the recent rally. This list is not meant to include only actionable stocks – some of these names are worth monitoring for potential pullbacks or normalization in their trading bands. However, we have highlighted two stocks below that are trading in an actionable range based on the recent market action, Pinterest (PINS) and Spotify (SPOT). These stocks are not usually the first names one thinks of when AI is mentioned, but they have each tangentially benefitted from AI over the past few months.

Pinterest, Inc.

Pinterest is a software company that operates a pinboard-style photo-sharing website where users can manage theme-based image collections. According to the last two earnings calls, the company has instituted AI-powered guided browsing to better match merchants with customers (source: FactSet). Shares of PINS advanced last week to mark a new multi-year high at $32 after returning to a buy signal earlier this month. The stock has been trading in a large consolidation range for about a year and saw the recent breakout occur after passing a test of its bullish support line last month. PINS has a 5 TA rating and sits in the top quintile of the internet sector RS matrix, highlighting its strength among its peers. The weight of the technical evidence is favorable and continues to improve. Initial support can be seen at $24, which is also the current location of the bullish support line. Further support can be seen at $21 from May.

Spotify, Inc.

Spotify is one of the preeminent digital music services, garnering most of its revenue through its premium and ad-supported segments. While they do not have many visible AI enhancements, their management team discussed on recent earnings calls how the company uses AI to create audio ads (source: FactSet). The recent price action gave three consecutive buy signals before reaching $180 Monday, just one box shy of its 52-week high last seen in July. This 5 for 5’er has maintained a positive trend since January and has been on an RS buy signal against the market since May. It also sits in the 3rd position out of the 27 names included in the media sector matrix. The weight of the technical evidence is positive here and continues to improve. Initial support is seen at $168 with further support seen at $156 and $148, which is the current location of the bullish support line.