Technically, all major indexes sit around their 200dMA – which means nothing really, other than everyone is watching it. Therefore, this level becomes a psychologically important level. A retracement from these levels is basically a self-fulfilling prophecy as everyone expects a fall of some sorts from here.

Investors Business Daily counts only 2 distribution days on this uptrend since early Jan. We need 5-7 before a large pullback is really in the cards. However, these next few distribut9oin days can come quicker than usual because markets are not trading at new highs. Bear market rallies end by going straight down, not with the usual rounding tops.

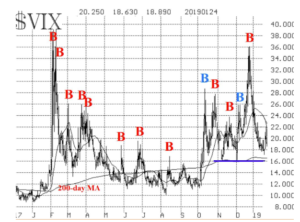

Volatility is bullish for SPX, with short-term vol instruments trading at discounts to long-term ones. Again, this is good for now, but the original buy signal on this was early Jan, and it works best for 21 trading days usually. After that, it loses significance.

Breadth has been excellent – very bullish – but to the point where some consolidation and re-balancing in the daily up/down volume is necessary.

Seasonality speaking, February is not great, espceically for tech stocks, but mid month is strongest. After options expiration week, markets could see additional selling.

News, which can act as a catalyst for movement in any direction, has been supportive of stock prices: a newly reformed ‘dovish’ Powell is the big ‘put’ under the market. Also, Trumps negotiators have been putting a positive spin on the China trade talks (except for just now!), World GDP growth and PMI numbers – although falling drastically – are viewed with ‘glass half full’ mentality of late. I am really watching China’s production numbers closely if they continue to come down, then expectations for Q3/Q4 will need to be reduced (see below).

Earnings, which is most important, have been deemed as ‘better than it could have been’ – especially on short covering for overly harassed stocks (including AAPL and its suppliers). Two things are disconcerting; 1) lowering guidance for Q1 and possibly Q2 – which seems priced in if things don’t fall off the cliff, while 2) support has come from the idea that earnings will start growing in Q3 and Q4 again strongly after this soft patch. As markets tend to price in 6-9 months in advance, any deterioration in revenue forecasts for 2019 would send the market into a tizzy again.

Fundamentally, I am noticing some trends in that stock buy backs are supporting the market also. Several companies offering lackluster performance and earnings forecasts announced huge stock buybacks (like SWKS an AAPL supplier, for instance) and have seen shares skyrocket. Meanwhile, with any hint of raising more money with a secondary offering the effects are devastating (like RMBL, for instance, and TSLA needs to be watched here as well). Although the effects of buy backs and offerings on stock price is nothing out of the ordinary really, I see an issue with companies like TWTR showing good results and guidance that beats expectations, but talk of increased costs from spending on R&D killing the stock – or maybe it was the dismay with no talk of being bought out. In bullish markets, this does not happen. The market is not sympathetic to the long term strategy here it seems. NFLX, AMZN, and maybe even FB and other high flyers are burning cash like mad, so I wonder if there a slowdown emerges how the market will react.

In any case, markets are bullish, and we are in a bullish period for a while longer. I would not be chasing returns here though with new money. This year is not going to be a run away, straight up year for stocks, it should be pretty choppy with news and earnings shocks. Europe and UK need settling – or just culmination of some sort. Emerging markets look interesting though, especially parts of Asia – Korea and Thailand – and Middle East – Egypt and Saudi Arabia – and even good, old mother Russia, with the sanction push full extended and P/Es in the mid single digits. If Saudis and Russia come to a deal on oil, this could be a big boost to their economies. It just doesn’t look like that is imminent right now.