Category: Investment ideas

- 3.09.2019

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: MSFT

- 31.07.2019

- 27.07.2019

Our article back on on January 16th highlighted Brazil stocks (EWZ) as a place to search for growth companies. We felt that Brazil’s economy should perform well in 2019 after better economic results and decreased regulation. We liked MercadoLibre (MELI) when the stock was trading in a range between $250 and $350 dollars. We then repeated our comments about MELI again in …

- 20.07.2019

- Categories: Investing basics, Investment ideas, Personal finance

- Tags: International, Investing, NASDAQ, Stocks

Recently Bloomberg commented on a newly released study by Hendrik Bessembinder regarding how many global stocks that actually perform well. Variations of this study have been done by a number of different academics and practitioners – all with fairly similar conclusions – many stocks are duds. Two years ago, an Arizona State University professor made waves …

- 17.07.2019

- Categories: Analytics, Investment ideas

- Tags: AMZN, BMO Capital, FB, MSFT, NFLX, WMT

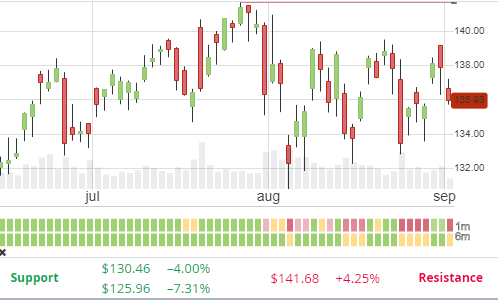

Microsoft (MSFT) reports earinsg on Thursday. In FAANG and related stocks, MSFT continues to be a standout. NFLX has competition and content reduction, AMZN has seen competition from WMT and also cloud spending slowdown, GOOG faces political backlash along with slowing compartive results, FB faces similar issues currently, along with lower usage rates. We’ve seen a high amount of call buying recently, heavily bullish-biased flow as shares …

- 13.07.2019

- 12.07.2019

- 11.07.2019

- 11.07.2019

- 10.07.2019