It is well known that a variety of factors move equity markets, both in the US and in the non-US (International) space. One of the more frequently discussed factors are commodities, and no commodity is featured more prevalently in major financial news outlets than Crude Oil. Given the recent rally in Crude Oil Continuous (CL/) over the course of 2019 (up 26.47% year-to-date through 7/9), we felt it pertinent to examine various regional and country ETFs that would be most affected by further movement. We took each of the regionial/country representatives and ran their correlations to CL/. Below you can see the top five and bottom five correlations, as well as some interesting observations to note. Note that if a country had multiple representative ETfs, only the fund with the highest correlation was used.

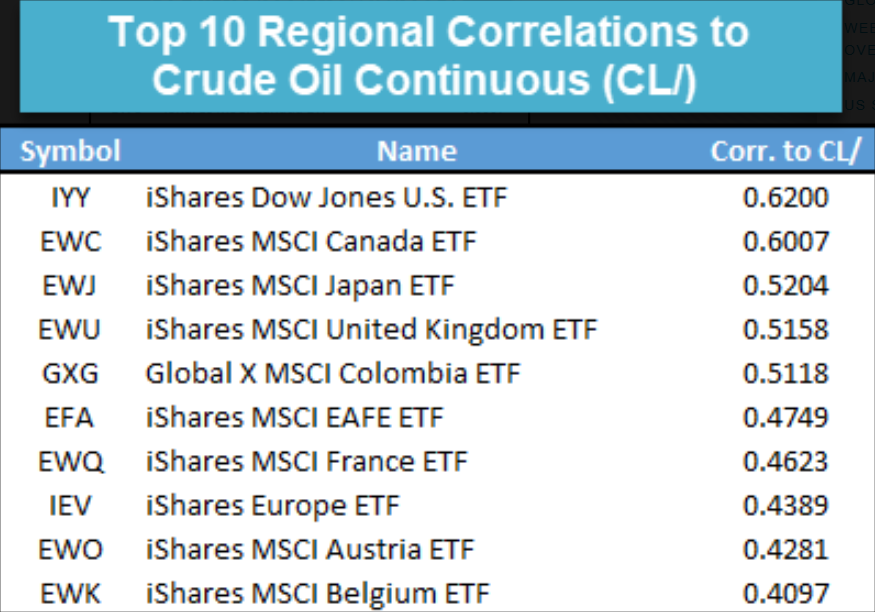

- The country with the highest correlation was the United States (IYY). In fact, developed countries dominated the top of the correlations, with each of the top ten regions falling into this classification.

- The countries with the lowest correlations were unsurprisingly areas from emerging markets, with the Philippines (EPHE) coming in last. This was one of 4 areas, including India (EPI), Brazil (EWZ), and Indonesia (IDX), that actually had negative correlations to Crude Oil.

- It is interesting to note that the correlations did not necessarily align with regions that are typically thought of to be more affected by Oil, such as the Middle East (GULF) and Russia (RSX).