Category: Analytics

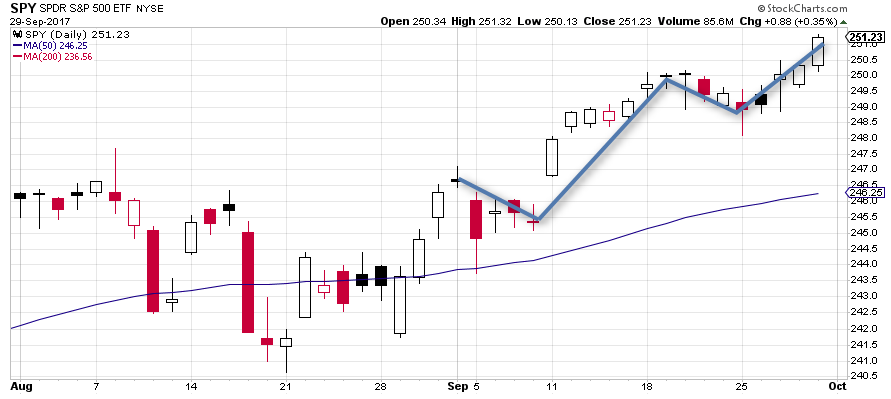

In October, large and medium sized companies outperformed smaller companies, after underperforming them in September. A strong performance from technology companies led the outperformance. SPY and MDY remain extended far above their medium and long term moving averages. The US market will likely have to either pullback in November or at least pause for a …

- 18.10.2017

- Categories: Analytics

- Tags: market trends

The funds can bet on rising or falling prices, and have a low correlation with stocks or bonds Taken as a group, managed futures mutual funds have been wretched over the past five years. But the category has some strong performers, and if you’re looking for an unloved area due for a turn, managed futures …

Managed futures funds have fared poorly, but could shine in a market downturn Read More »

The third quarter ended with the 50th new high for the S&P 500 of the year as the bull market in US stocks continues. The S&P 500 increased by more than 4% during the quarter – its eighth straight quarter of gains. Real volatility has shrunken to record lows also, as CBOE Volatility Index (VIX) …

- 7.08.2015

- Categories: Analytics

- Tags: bonds, germany, market review, market trends, usa

Overview Stocks around the world rebounded last week, with the U.S. taking the lead. Investors should be aware, however, that the good times may not last for long. Although last week featured more evidence that U.S. companies are able to beat diminished earnings expectations, several other developments argue for caution. Notably, estimates for growth have …

- 8.07.2015

- Categories: Analytics, Investing basics, Investment ideas

It is not a secret. As the S&P 500 and other US stock market indexes have seen big gains in the last five years, active managers have struggled to outperform. Bloomberg reported (using Morningstar data) earlier this year that just 20 percent of actively managed funds investing in U.S. stocks beat their main benchmarks in …

- 23.06.2015

- Categories: Analytics, Investment ideas

- Tags: market review, market trends, usa

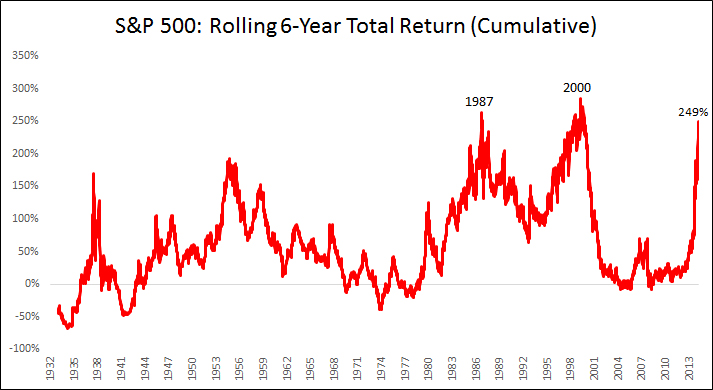

As the US bull market goes into its seventh year, we admire how far we have come. From the dark clutches of fear in March 2009, the S&P 500 has had one of the greatest six year bull market runs in history, more than tripling. Only 1981-1987 and 1994-2000 saw larger gains over a similar …

Review of markets over May Do you hear the markets sing, singing the song of nervous investors? One didn’t need to listen carefully to hear that volatility was the main melody in May. While April’s tune was characterised by fairly sound gains in most asset classes, May began with a European bond market correction, which …

- 18.05.2015

- Categories: Analytics

- Tags: bonds, emerging markets, eur, market review, market trends, oil, usa, usd

Global stocks rose modestly amid a strong rally in the energy sector. Rising oil prices, surging M&A activity and central bank stimulus measures helped to support world stock prices despite a slowdown in U.S. economic growth during the first quarter. Emerging markets rallied as market observers pushed back the timing of an increase in interest …

In stocks, volatility is back. The Standard & Poor’s 500 Index, which never went more than three days without a gain in 2014, has twice fallen five straight times since January. Daily equity moves exceeding 1 percent have jumped 50 percent from last year and shares tumbled 3 percent or more over four different stretches …

Back To Normal In Stocks Feels Like Trauma As U.S. Bull Run Ages Read More »

- 7.03.2015

- Categories: Analytics

- Tags: market review, market trends, oil

The main US indexes each hit new highs last week and multiple times in February. The broad market will most likely grind higher for another week or two. However, if one or more of the indices break back down below the recent breakout level, this will most likely trigger a 2% to 5% pull back. …