In October, large and medium sized companies outperformed smaller companies, after underperforming them in September. A strong performance from technology companies led the outperformance. SPY and MDY remain extended far above their medium and long term moving averages. The US market will likely have to either pullback in November or at least pause for a few weeks as the last two months have created an extreme overbought situation is US equities.

Smaller US companies traded flat for most of the month. There was not real selloff, but it gives warning for what may be in store for November for the larger companies. IWM may also come to test its 50-day moving average in November.

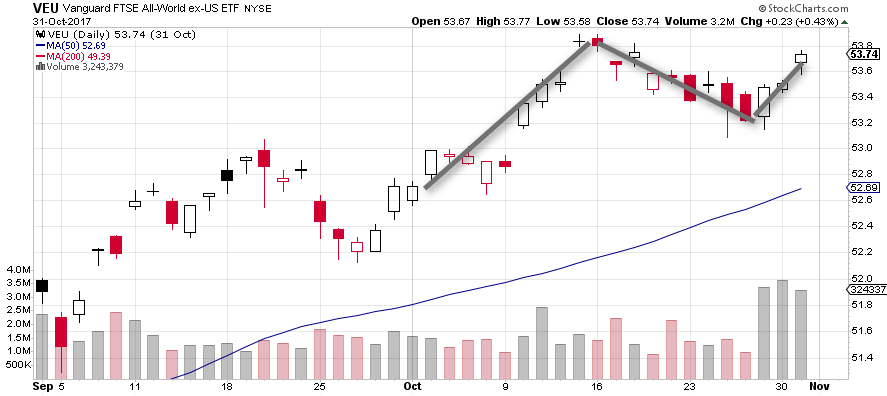

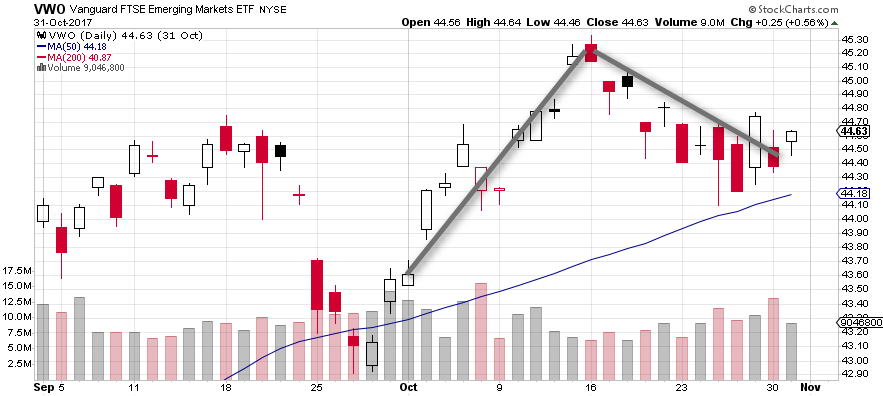

For the first half of October, non-US companies and emerging markets traded bullishly, but then sold off in the second half of the month. While VEU (non-US developed markets) were able to recoup some of those losses on the last trading days, VWO (emerging markets) were not. VWO ended the month trading just above its 50-day moving average, which should act as some support going forward into November.

As we mentioned in our September market review, the world real estate ETF – RWO – started the month below its 50-day moving average, but during the first two weeks was able to rise sharply. However, the worldwide sell off in non-US markets dragged down REITS with them to where RWO ended the month resting on its long term, 200-day moving average. This has to hold in November for RWO to remain even slightly bullish.

Commodity producers moved in tandem with non-US markets in October with strength in the beginning and weakness in the end of the month. HAP remains positively bullish above its 50-day moving average.

USCI, an ETF that tracks commodity prices, ended October on a very strong note after testing and bouncing off its 50-day moving average three times. With commodity prices showing resilience, commodity producers and energy companies should perform well in November.

US bonds remained weak in October. Bonds tracked by the ETF AGG remained below their 50-day moving average for most of the month. The slope of that average is now flattening and possibly turning negative.

US inflation indexed bonds saw similar action to other US bonds. The medium term moving average is acting as strong resistance for the ETF TIPS.

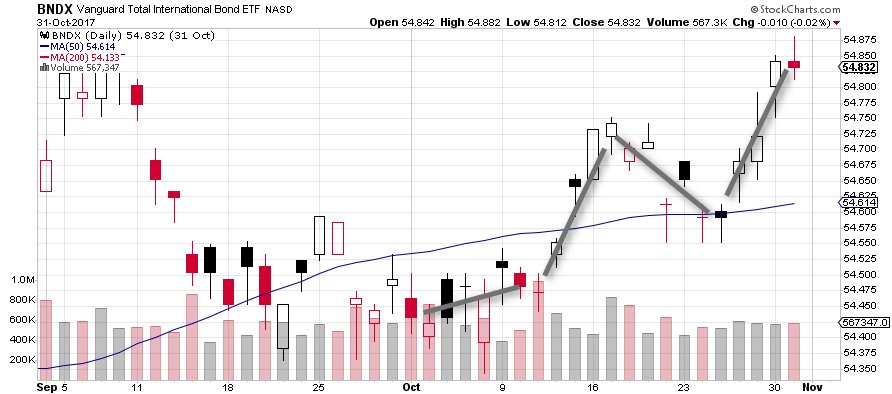

Non-US bonds outperformed their US counterparts in October. As non-US equities suffered in the second half of the month. BNDX bounced firmly off its 50-day moving average to the same levels of its September highs by month end.

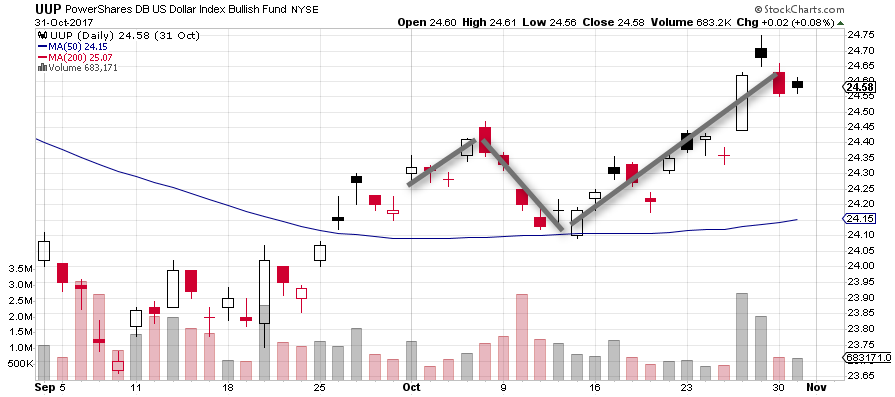

UUP, an ETF tracking the USD versus a basket of currencies, continued to strengthen off its September lows. Its medium term moving average is now starting to slope upwards and turn bullish. UUP is still below its 200-day moving average (not shown on the chart, but currently around $25) bbut will likely test that soon as the US Federal Reserve is set to raise interest rates in December.