We have often focussed our investment insights on North America and, to a lesser extent, Asia. There are a number of valid reasons for this. USA is by far the most actively traded, most liquid stock market and where many non-American companies go to become listed.

Similarly, Asia has some of the most traded markets and as China, in particular, is growing rapidly it makes sense to focus on this region also.

In addition to the above, these two regions have the most important thing in common – performance! Both the NYSE and Nasdaq have performed admirably over the last few years, as has many Asian bourses, especially when compared to the UK and Continental Europe.

However, is this dynamic now shifting?

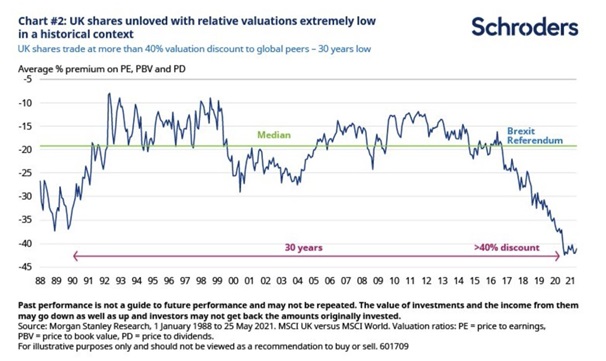

Well, as you can see below, UK equities are trading at a discount to global peers of more than 40%. This has no equivalence within recent living memory. The UK is bouncing back from the twin hits of the Pandemic and Brexit, and with vaccination figures leading the way globally, it seems ripe for the UK economy to re-open and break out.

Not to be outdone, the usually anemic Eurozone has seen a raft of positive figures after positive figures.

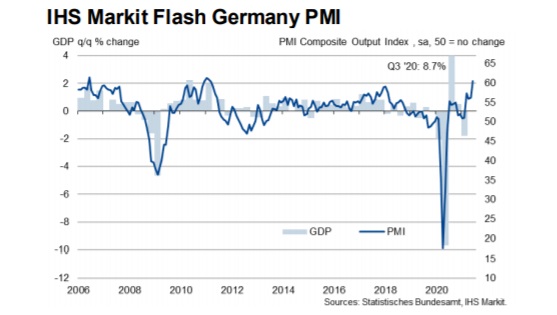

According to IHS Markit, the latest flash data on Germany pointed to the strongest rise in business activity for 10 years. The Purchasing Managers Index (PMI) was up from 56.7 in May to 60.2 in June.

“Output growth at both services and manufacturing gained momentum while optimism was historically elevated.”

Likewise in France, the PMI index rose marginally from 57.0 in May to 57.1 in June.

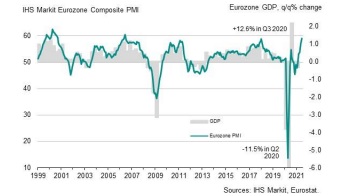

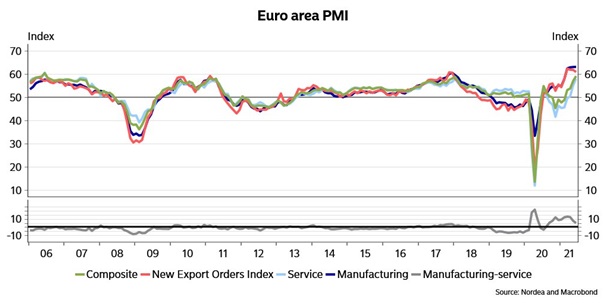

In fact, all across the Eurozone, prices charged higher and confidence returned in a big wave. Business activity grew at the fastest rate for 15 years in June, as the flash PMI rose from 57.1 in May to a post-financial crisis high of 59.2 in June.

These figures in Europe prompted the Group Chief Economist of Nordea Bank, Helge Pedersen to Tweet: “Boom! A super strong recovery is under way in Europe.”

Now, these figures are great but it IS worth remembering that they are coming from a relatively low base, with pent up demand on a continental and global economy reopening.

However, one of the reasons for such enthusiasm over and above these numbers was the results of a recent survey by the Confederation of Swedish Industry, which quizzed its members about the recovery and whether their business practices had altered post-Covid.

They found two conclusions, firstly that manufacturers are looking around at implementing a multiple number of suppliers whether that is local or global, in order to minimise future supply chain disruption. However, this is certainly NOT the death of globalisation, as we know it. The second conclusion is that there is an element of stockpiling going on.

Therefore Swedish companies and, by extension, likely European companies, have become increasingly pragmatic about suppliers, that they have diversified their risk by seeking alternatives to previous supply chains. Finally, and most importantly, they have re-affirmed the global trade and value supply chains, which have boosted world trade over the previous decades.