Current Gas Price shock in Europe

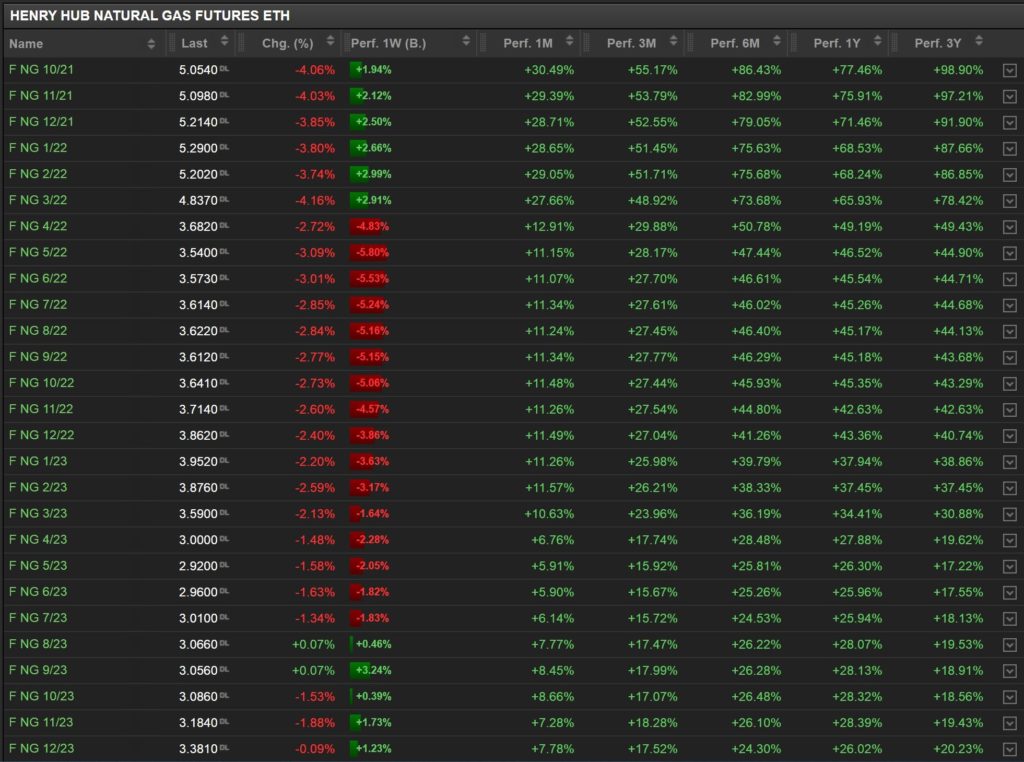

Gas Futures hit record prices – €79 Mw/h on 15th Sep on October price – that’s up 250% since January – and expectations are that it “may hit three figures”, as one can see from the page of green figures below.

The rays of summer are still present for many of us but prices, usually with winter seasonality, have been rising over the past few weeks/months. The general explanation offered for these rises are a some part demand-led (return to work, offices opening again, and general move to decarbonisation particularly reducing reliance on Oil) and some part supply-led (bitter winter of 20-21 left European storage sites depleted, inventories are at lowest level for a decade, Asia buying up available LNG supplies and “Russia limiting flows”).

Some energy intensive industries are already curbing production, for example in steel and fertiliser, due to gas supplies. This will have a knock-on effect with inflation, but that’s for another day.

Furthermore, the most impact will be felt perhaps not in Industry but in the domestic markets. Retail rates already rising by more than 20% in 2021 – and likely to stay high or go higher as we progress through the winter.

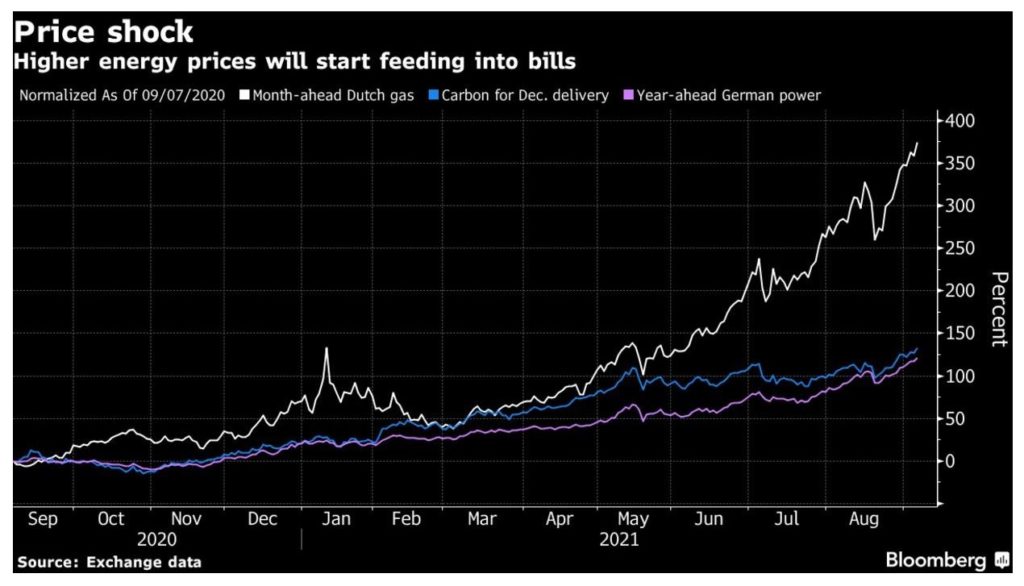

Especially if there is another tough winter (like last year in Europe), then the prediction for winter is that European supply will be “very tight”, as one can see from the chart below, year ahead futures hit record levels in Germany last week.

This has impacted other energy sources as coal prices are up 70% year to date and unusually so, natural gas is trading at a rare premium to Crude Oil.

Of course, old enemy Russia is in the firing line, as the Financial Times alleged that they had enacted a “quiet supply squeeze”.

NordStream2, the controversial pipeline project is completed but has not yet been approved in Germany, and so is yet unused.

According to analysts, it can take up to 4 months for this to be processed and this MAY be a way of Russia pushing the process to an earlier conclusion. Other analysts argue however, that this will not have a huge material effect on prices.

In a recent interview, Gazprom supremo Alexei Miller maintains that the company has met all long term contracts, not turned any taps off.

Instead Mr Miller pointed the EU to issues of their own making, such as pushing for a move away from Long Term contracts (which traditionally favoured Russia) to a more ‘market – spot price’ oriented deal. He also noted that the extraction of natural gas from Western Europe has declined sharply, for example UK North Sea produced 110bcm in 2001 compared to 35bcm in 2020. A rising demand from Asia for Russian extracted gas, via the Power of Siberia pipeline has exacerbated these supply issues.

The Europeans responded by complaining that Gazprom refused to supply top up spot prices over the summer to help increase reserves.

Interestingly, according to the analysts we spoke to, many of the storage facilities not at capacity in Europe are actually run by Gazprom – which has the effect that they are not buying from themselves – and may have the outcome where Europeans find alternative suppliers (from the United States for example) and switch further away from Russian dependency.

Well, its all a bit of a mystery and not a small dose of geopolitics but more importantly how can investors play this scenario?

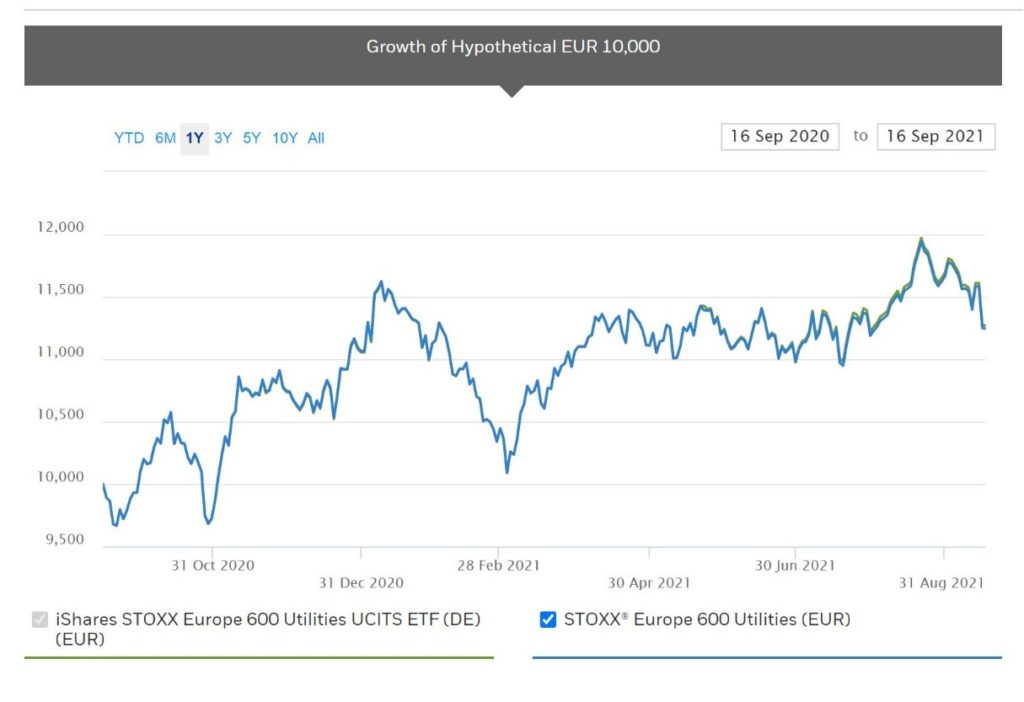

One can simply trade the ETFs of the relevant energy source, so gas prices, crude oil and coal all have some tracker somewhere. Another idea is to trade the European Utility companies via the Eurostoxx 600 ETF with ticker EXH9.