We have talked many times before on here about Green Energy, the trend to investing in renewables and how that ties in with important changes in how investments are made and structured, such as the impact of ESG.

What we have always found is that there is a great deal of ‘spin’. What appears on the surface as being a great saviour for our planet may turn out to be not quite the panacea once you ‘dig under the surface’.

Examples of these can be “brown hydrogen”- which is hydrogen created, produced by fossil fuels – how can this possibly be a game changer?

Another would be the ‘natural gas’ lobby who say that gas is a clean fuel – well, it may be in some quarters and compared to oil and coal but it will always be a fossil fuel, or at least until it runs out.

Nevertheless, the Biden Administration in the US have recently unveiled a clean energy plan. This includes the pledge for 45% of all US electricity production by 2050 to come from solar power. This is a huge number and a highly ambitious statement of intent.

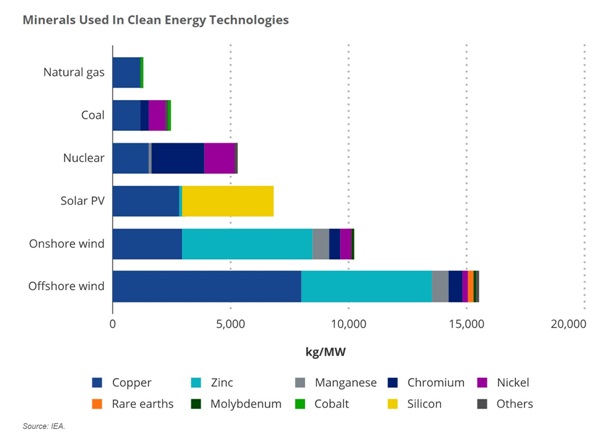

However, when one looks at the amount (both in number and in volume) of minerals required to create photovoltaic cells, then it is obvious that there is a necessity for large amounts of copper silicon.

That in itself is difficult to comprehend, but pales into the shadows when one looks at the amount of minerals for both offshore and onshore wind. In general, a wind powered generator requires 13x more minerals per Megawatt/hour of electrical production, than a gas powered plant. So maybe THAT’S what the gas lobby mean by a clean fuel. Its still going to run out in 50 years though.

Another pledge by the Biden team is that 50% of new car sales by 2030 shall be made up of “zero emission vehicles” – or electric vehicles, apart from the possibility of some commercial trucks POSSIBLY running on Hydrogen.

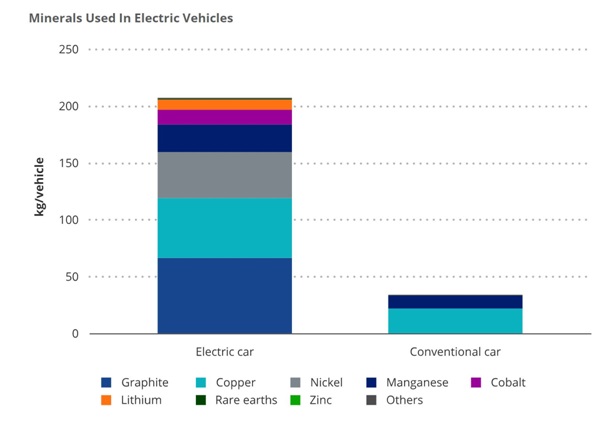

Again, all seems like a noble aim, but have you ever delved into the amount of minerals required to build a Tesla, a Leaf, aNio? One giveaway is the weight of an electric car is much much heavier than a conventional petrol driven car.

All told, the average EV requires around 6x-8x MORE minerals than your Ford Focus. Lets take copper again, for example. A standard combustion engine powered car requires around 15kg of copper, whilst the average EV needs between 60kg and 83kg to power those wheels forward. Eye-wateringly enough, but lets then consider that an EV Bus requires around 370kg of copper, JUST copper, to operate.

Where are all these minerals going to come from, surely is the question coming in to your head as you read this. Well, quite.

Lets try to put it in economic terms, as this would be appropriate on this site.

The DEMAND for these minerals is on an exponential journey and there is definitely ways to play this as an investment strategy. For instance, by mid century the demand for Cobalt will be 21 TIMES greater than it is today, for Graphite, it will be 25 TIMES and for Lithium (which we have touched on before) it will an incredible 42x the current levels of demand.

The issue is more about SUPPLY.

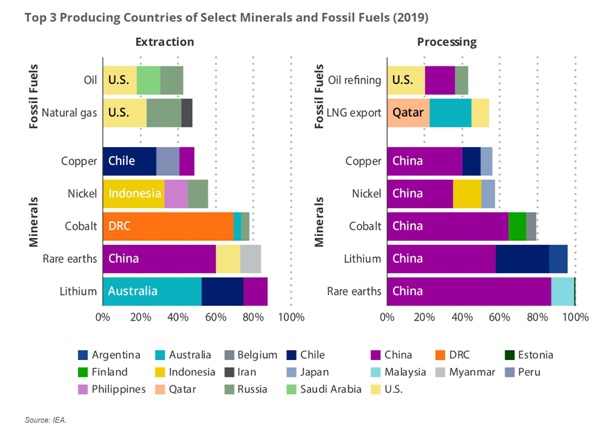

Whilst Biden has tried to encourage ‘responsible’ extraction of domestic supply of these minerals, for example in North Carolina, which has 3-6 % of global known reserves of Lithium, the more serious issues, for the USA, at least is that many minerals lie in unfriendly or downright enemy states.

China, Iran, certain countries of South America and Asia are where many valuable minerals are to be found – and this is notwithstanding that China is on a diplomatic and economic spending spree to bring many developing countries, especially in Africa, under their influence.

It would not be unreasonable to see a variation on the conflicts of the middle east in the 20th century replicate in the 21st century over rare earth metals and the like.