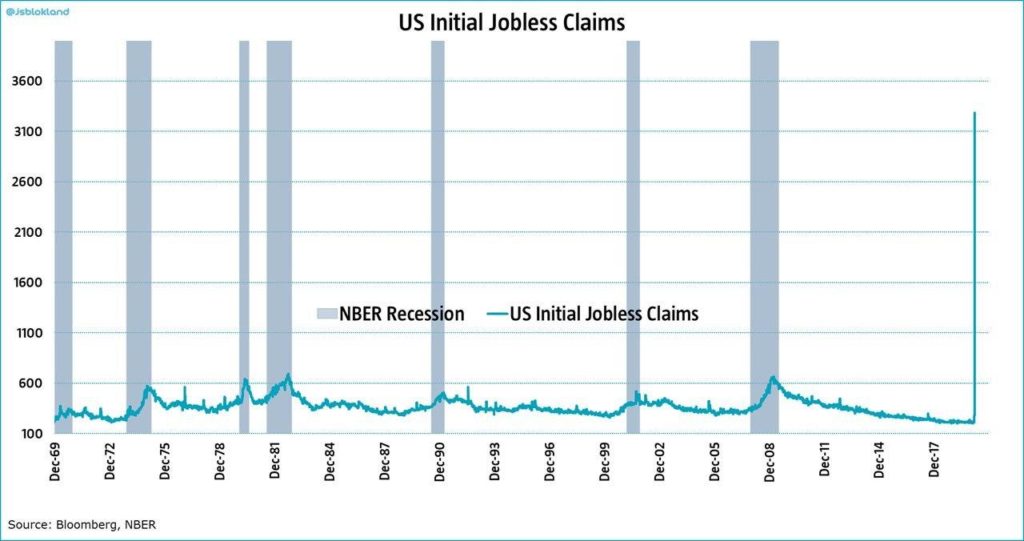

On Monday, SPX probed down to the 2175 area and rallied from there. By Monday, all of the gains since December 2016 had been wiped out by a one-month decline in stocks! Stocks are trying to establish a foothold for an oversold rally. The market had two positive days in a row for SPX, although there was heavy selling right on the close yesterday. Even with an amazingly bad employment report this morning, the market trades higher today.

Oversold rallies usually climb to – and go slightly above – the declining 20-day moving average. That has been the target that Veronika and I focused on at the end of our webinar on March 16th, and again Veronika highlighted in a quick video on March 24th. That SPX 20-day moving average is at 2690 and falling at the rate of 30 to 40 points per day. So, an oversold rally might be able to reach 2700 on an overshoot.

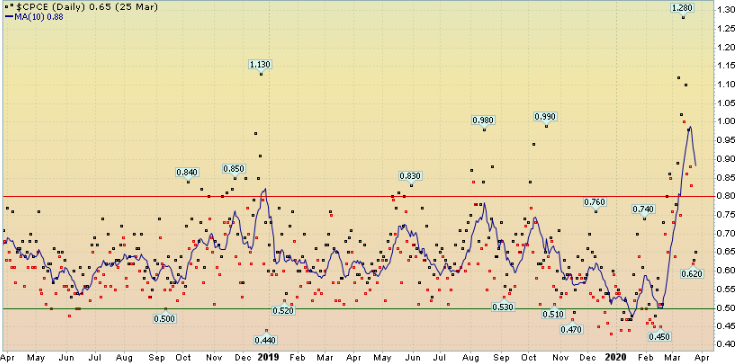

Other indicators are improving elsewhere, and perhaps a stronger rally could occur, but it is not certain at this time. Some very positive news has emerged from the put-call ratios. All of the ratios are on buy signals! This includes the standard and weighted equity-only ratios, the powerful total put-call ratio, and the CBOE equity-only put-call ratio. They have curled over in the last two day and have begun to decline. These are ratios are coming off multi-year highs, it is highly unlikely that they will move higher soon.

However, volatility (VIX) remains at very high levels. There is a VIX “spike peak” buy signal in place (it occurred on March 17th). But the trend of VIX is still higher, even though VIX has probably seen its highs. An elevated VIX in the 50’s or 60’s is still a danger sign for stocks, because swift volatile down moves in the SPX can occur at almost any time. Also, the construct of volatility derivatives is quite negative still. The front month, April, VIX futures are trading at about a 13 point discount to VIX, and the May VIX futures are trading at a 7-point discount to April. So, the $VIX futures are trading at huge discounts, and their term structure slopes downward.

In summary, things have improved as we are witnessing an oversold rally. However, the major trend is still down. Expect volatile movements in both directions. A first target would be 2700 on the SPX.