It is almost inescapable to read any financial journal these days and not be confronted by the word “inflation” – sometimes, in capital letters, sometimes in Bold print, sometimes in red ink, always getting attention.

However there are two contending schools of thought. One is of the panic school, sell all shares and bonds and run for the hills, carrying as much gold as you can.

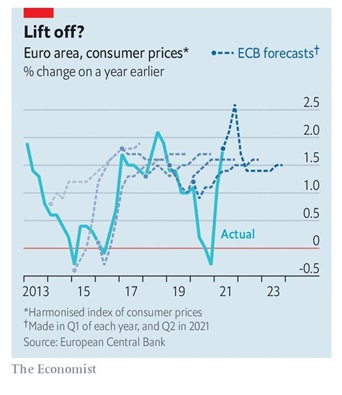

The other is a little more circumspect, and maintains that we should adopt a “wait and see” stance until the signals are stronger and more permanent that we really are in the early stages of a heightened, sustainable, inflationary cycle.

One piece of evidence was recently used to demonstrate that the former category are correct was the headline CPI figures in the US.

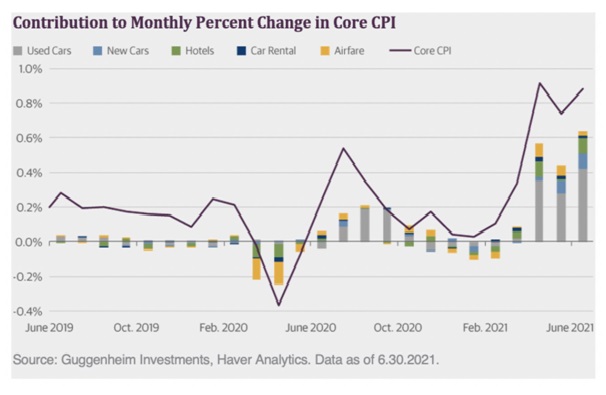

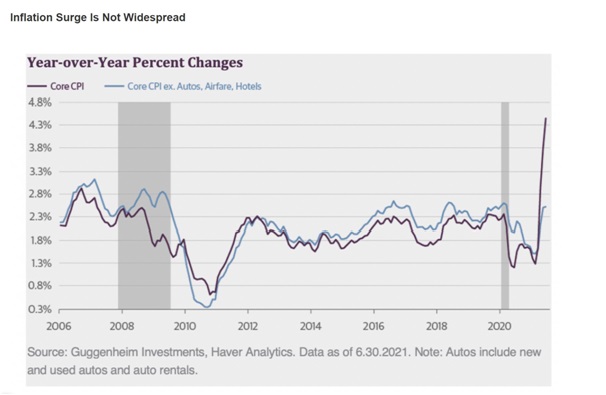

However, if we separate the underlying catalysts for this rise in CPI, we can determine that this is POSSIBLY a result of the economy reopening and nothing more sustained nor substantial.

In fact almost three quarters of the hike in inflation figures for June was due to Autos, Hotels, Car rentals and Airfare.

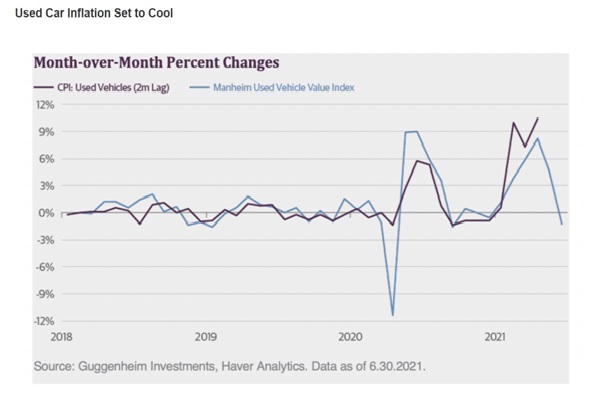

If we focus even more on the figures for Autos, we can see some other interesting data presented. Many people will be familiar with the shortage of semiconductors chips which are present in many of the electric gadgets we use daily. Autos are no different and due to these shortages of components, many manufacturers have had to cut back on the production of new cars. This has had an inflationary effect on the demand for both new and used cars.

Factor in the desire for many people, in our current pandemic world, to avoid public transport and take personal transport instead, we can see a rise in demand which has no doubt inflationary tones.

Our summary is that whilst we MIGHT be in the early days of an inflationary cycle, the evidence is not compelling just yet. It is too early to tell.