Tax Treatment of a Qualifying ULIP

With many ‘nomads’ and ‘golden visa’ recipients relocating to Portugal, it is a good time to highlight the tax efficient investment opportunities Unit Linked Insurance Policy’s (ULIPs) provide Portugal residents. This article will discuss how these unique products are treated for tax purposes.

As is in many European countries, there are essentially four taxes which are applied to personal assets held in a life insurance policy on surrender, drawdown or death. These four are income tax on a withdrawal amount, capital gains, estate taxes and Stamp Duty. Let us address the latter three in short order as there is very good news here.

Tax Exemption

In Portugal, there is no stamp duty applied on ULIPs as they are considered insurance products. Further, as the product is a bona fide life insurance policy, ULIPs are very useful for estate and inhertance planning, as there is an exemption on estate taxes (i.e. inheritance tax) upon the death of the life assured. Finally, any accrual of profits which occur inside the life insurance structure is free of tax.

Income Tax on Withdrawals

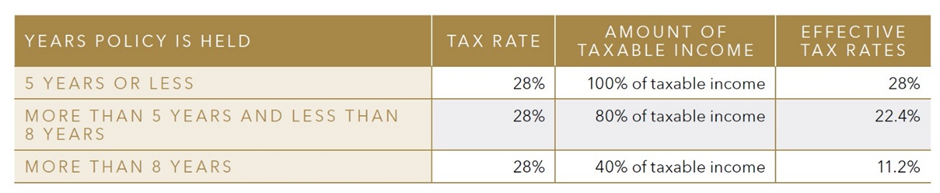

The only tax an investor need worry about is the income tax on withdrawals made from the policy. The Portuguese tax authorities treats these policy drawdowns as an income, which is combined in whole or in part with the policyholder’s other income. Depending on how long the policy was held, or when the money was invested, a tax rate is determined, as shown in the table below. The income tax rate on this part of the policyholder’s total income tax rate ranges from 28% to 11.2%.

On the surface, Portugal has an off-putting 28% tax on insurance policy withdrawals. However, in reality, Portugal has very competitive, low tax rates for retirees. If at least 8 years have passed then the effective tax rate on any drawdown, assuming this is the clients only income, is only 11.2%.

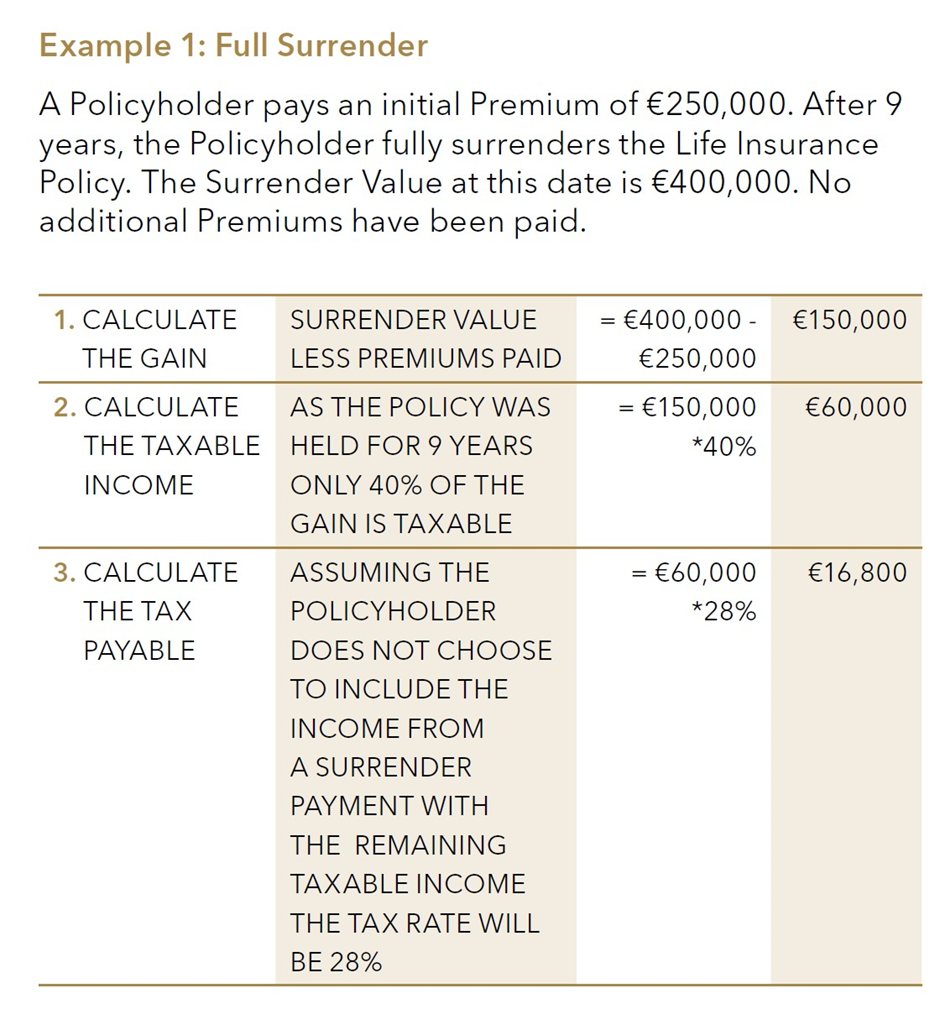

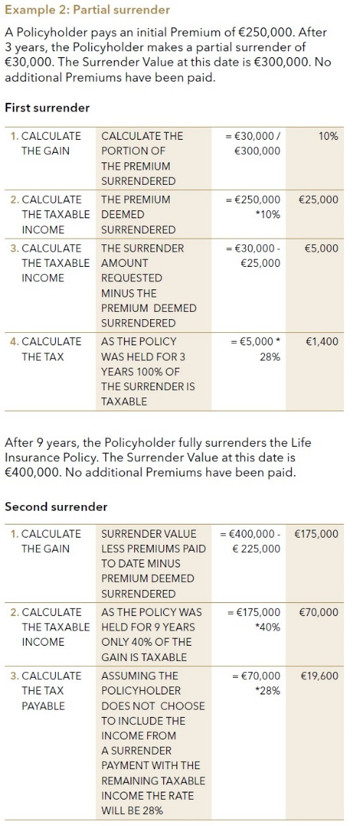

Illustrative Examples

Let us illustrate this by using some recent case studies.