This week, we celebrate(!) our beloved offspring returning to school. This time of year reminds us how quickly time passes and how little time we have to enjoy our children. The event also turns our thoughts to the financial implications of education whether that be for primary, secondary, tertiary or all three.

A good education is invaluable for your children in building the skills required to flourish in the 21st Century – be that may through academic achievement, expanding the necessary knowledge to be a positive force in society, or simply to plug in to the type of network which allows your child to build an influential social cohort.

All or any of the above costs money. Usually lots of it! Establishing savings plans specifically for the purpose of funding your child’s education should be one of the cornerstones of every family’s financial foundations.

In lieu of that, I thought it might be interesting to compare two popular offshore regular savings plans available.

The results are quite shocking in comparative value, for no discernible differences. That is to say that both offshore regular savings accounts, which can be contributed to on a monthly, quarterly or annual basis. They are tax efficient – both in terms of money in and also, when applied correctly, money out.

The two plans I will look at are Compass from Providence Life Insurance based in Mauritius and Vantage from Hansard in the Bahamas.

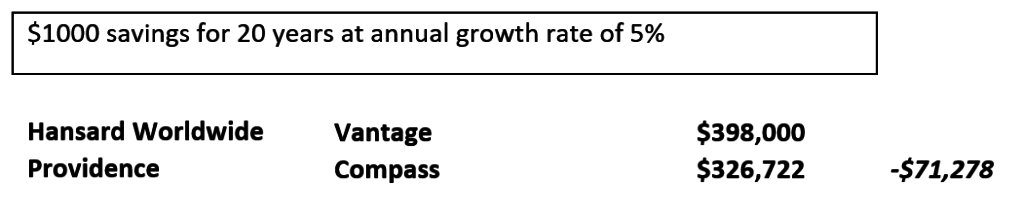

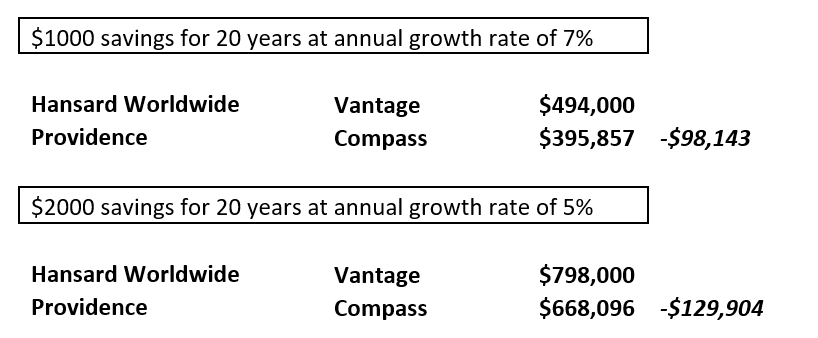

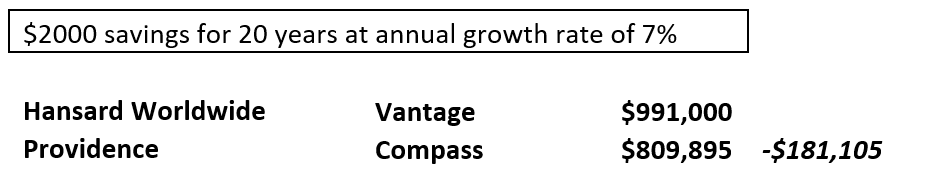

I ran four illustrations*: The first shows the savings of $1000 per month saved over 20 years with growth at 5% per annum. The second is the same as above with growth at 7%. The other two calculations are similar also, only using $2000 per month at 5% and 7%.

The Providence product, which according to International Advisor, is linked to DeVere Financial Advisors as a ‘supported provider’, is by far the most expensive product of the two.

At the basic level illustrated, the Providence Compass product lags woefully behind Hansard’s Vantage product, providing a $71,278 deficit in value at the end of the 20 year period. The story is repeated throughout all levels of illustrations with the $1000 a month savings at 7% growth and the $2000 a month savings at 5% growth showing the Providence Compass product much costlier to the client over the 20 years.

The difference is starkest, as you now might expect, at the $2000 month savings level at 7% growth level where the Providence Compass product is more expensive by more than an eye-watering $181,895, that’s almost 20% of the saved sum MORE in expenses.

AVC Advisory was established based on the belief that long term client relationships should be built on delivering value for money. These figures show that it is vital for your financial advisor to be able to choose from the best products on the market and not just ones which their company is affiliated with. The difference could literally cost your child’s future.

In my next blog entry, I will review how Investor’s Trust Evolution offshore savings plan compares to the DeVere’s tied Providence Compass. I already can guess how the results will turn out. I am sure our kids can figure it out, too!

*illustrations are available on request. Source: Lifebase.co.uk