Multi-strategy funds are designed to meet the needs of smaller investors who are interested in diversification through a single cost effective vehicle. Multi-strategy funds are often referred to as multi-strategy hedge funds, as fund managers utilize similar investment strategies across a variety of asset classes. These funds, however, are generally classified differently than hedge funds because of an emphasis upon employing a multitude of hedge fund strategies to mitigate risk and decrease volatility as well as individual management.

The appeal of multi-strategy funds to smaller investors and family offices is rooted in single management and relatively low fees. An alternative principally to large hedge funds, multi-strategy funds allow smaller investors to maintain a relationship with the fund manager, providing an important layer of due diligence and reducing agency risk. Smaller investors who have investments in hedge funds are unlikely to garner the attention of the funds’ multiple managers for either fee concessions or personal financial concerns.

When investors represent a larger portion of a fund’s total investment, access to management becomes less systematic and more personal. This individual touch, combined with the rather unimpressive performance of hedge funds relative to return-eroding fee structures, has led to the increasing popularity of individually managed multi-strategy funds among investors, in particular wealth managers and family offices.

Recent cases of misconduct among hedge fund managers has also added to investor demand for the increased scrutiny granted to them by multi-strategy funds. This increased scrutiny does not come at the expense of the benefits generally attributed to hedge funds. Multi-strategy funds enable smaller investors to hold managers accountable and keep fees low while still accessing the non-traditional asset classes and strategies characteristic of hedge funds.

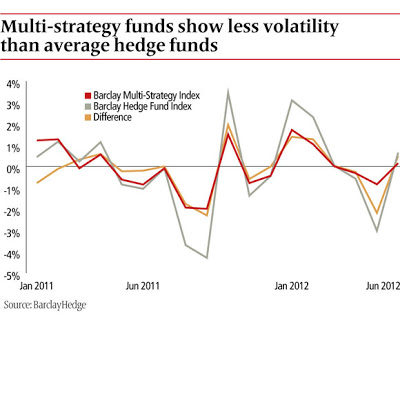

Multi-strategy funds do tend to underperform broad indices of hedge funds. This is in large part due to the high degree of specialization that is sacrificed when a firm is individually managed. The margin between what is lost in return between typical hedge funds and multi-strategy, however, can very well be less than what would otherwise be lost due to fees especially for smaller investors. Moreover, the added benefit of lower risk of exposure to the structural drawbacks of large hedge funds for smaller investors makes multi-strategy funds a potentially lucrative alternative.

For investors interested in entering or staying in hedge fund investment but wish to lessen the drawbacks that come from being a small investor in a large fund should talk with their financial advisor. AVC Advisory’s financial experts can discuss these funds with interested investors and break down the details of multi-strategy fund investment in order to determine whether such an investment fits with a client’s personal financial goals.