In a recent research note, HSBC’s Chief Economist, Stephen King suggested that some economies of the world are returning to a system of ‘financial repression’.

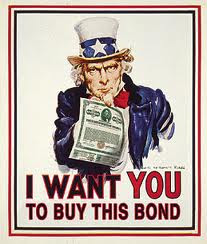

Financial repression was a name given to economic policies pursued at various times in the 20th century, and was used to funnel capital towards the public sector by encouraging investment in Government Bonds, for example, at the detriment of the private sector.

Its not difficult to guess why this strategy is being followed now, as there has only been 3 times previously when government debt has been as high as it is today, in terms of a percentage of national income.

Those occurred immediately after the First World War, during the 1930’s and the years following the Second World War. It was in the final of those three ages where financial repression was used — that is from the late 1940’s, through the 1950’s and into the 1960’s.

Those years were a period of great infrastructure building, particularly in terms of institutions: OECD, UN, NATO, the ECSC — precursor to the EU. A period then, where public rather than private capital drove the worlds’ economy forward.

Most retail investors (such that there were) invested in Government Bonds or Gilts, as stock markets were relatively illiquid- still suffering the stigma of the post-depression era, and rarely did investor capital move across borders.

Although the returns were not commensurate with the growth of the economies, investors were rewarded with fairly stable returns.

How does this translate to what we can see today?

What we are seeing is investors being discouraged by governments to placing capital in private institutions and thus securing more capital for Government Bonds.

This allows the state to keep interest rates low, meaning they can borrow more, at cheap rates whilst private sector lenders and borrowers have much higher costs (think the difference between base interest rates and your mortgage for products to enhance your income over bank rates whilst retaining high levels of security.)

We have seen governments bring in new regulations, such as those designed to force banks to lend more to the central bank, under the guise of ‘strengthening bank balance sheets’ and, finally, a willingness by governments to devalue the currency by the printing of huge amounts of capital.

As Mr. King states, repression «is not so much a mechanism designed to reduce government debt, but, rather, a way to live with it.»

You can see how strange this situation is, if you compare some corporate bonds — particularly in the Eurozone — where they are rated higher than some sovereign debt, and at the same time, have a lower yield.

This is a mirror image of what one would expect under normal conditions, where government debt is traditionally the most safe and hence pays less.

So are high levels of government debt here to stay? It certainly seems that this will be the situation for a long time to come, as governments try to induce growth in their economies, or for as long as the governments can control the market (i.e. the interest rates).

However it is very difficult to see how governments with huge deficits (alongside high debt to GDP ratios) can EVER kick start their economies, unless they can find new ways to grow, which at present remain unseen.