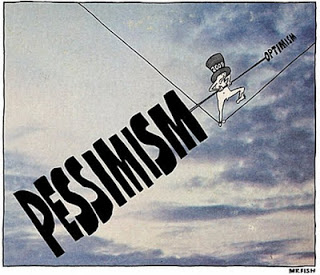

This overview came from a Global Macro Hedge Fund Manager. Its high on the pessimist side, however, it’s a wake-up call and gives everyone a chance to think about taking some level of uncorrelated assets into their portfolio. This manager is long gold.

The US trade deficit will remain an important indicator since any failure of the deficit to narrow alongside lacklustre non-resident purchases of US equities, agency and corporate debt will mean the US continues to underfund its US external deficit, which we expect will expose the US dollar to renewed weakness.

The vulnerability of the US dollar will reinvigorate the outlook for gold prices and may also encourage further central bank diversification into gold, which has recently included statements from the central bank of Kazakhstan that it aims to increase its gold to total reserve ratio from 12% to 15%.

According to a recent survey 55% of Germans want to return to the Deutsche Mark. This is an increase of 10% from last year’s poll.

Spain, the fourth largest economy in the EU is posing a bigger threat than Greece. The situation in Spain simultaneously poses a real threat to German growth. The Spanish banks are saddled with bad real estate loans and may be in need of more than EUR 40B. Spain is the fourth largest economy in the EU and there is the impression that growth over the years has been one of artificial nature . Spain may get the necessary help for their banks very soon. Late Thursday, Fitch downgraded the country’s credit rating to BBB from A, with negative outlook. BBB is just a notch higher than junk.

Spain has closed 30 of its state-run airports. In Castellon, east of the country, the airport inaugurated in March 2011 (estimated cost EUR 150 M to build this airport) has not had one single plane on its runway. There are 20 airports that handle less than 100,000 passengers a year.

The number of wealthy European property buyers in London has surged. Spaniards, Greeks and Italians (and even the French) wish to convert their euros into property. David Adams, managing director of Mayfair estate agents John Taylor said there are three main safe havens now — gold, the Swiss Franc and London property (the Guardian UK). From outside Europe, Middle Eastern and Asian, in particular Chinese, investors in central London are pushing property prices higher. That obviously brings up the question how the London nurse and secretary will manage to live in London. Property prices in prime Central London rose 0.7% over May 2012.

Germany and France are seriously considering to temporarily reintroduce border controls. Is that out of concern to stop an influx of migrants or is it about stopping people to flee with their money ? The political elite in Europe are watching the bank runs in Spain and Greece. The Swiss are considering to impose capital controls on foreign deposits if there is a Grexit. The franc would come under heavy demand from people looking for a safe haven. Thomas Jordan, Head of the Swiss Central Bank, said they were looking at ways of dealing with a flood of foreign money into Switzerland if Greece leaves the Euro.

In Berlin the two-year government bond yield fell below zero for the first time, with the bizarre result that jittery international investors are now paying – rather than being paid – for lending to Germany.

Manufacturing output falling in Britain and Europe, unemployment jumping in the eurozone and America, and fast-emerging economies such as Brazil and China showing signs of running out of steam. China cut interest rates for the first time since 2008, stepping up efforts to combat a deepening economic slowdown as Europe’s worsening debt crisis threatens global demand. Banks can also offer a 20 percent discount to the benchmark lending rate, the PBOC said, widening from a previous 10 percent.

Borrowing costs in Spain and Italy have soared back above 6 per cent towards the 7 per cent level that triggered bailouts in Greece, Ireland and Portugal. Spain’s yield on 10-year government bonds produced an average yield of 6.04% recently.

Investors piled into German, US and UK government debt. Not only did the German two-year bond yield fall below zero for the first time, but also the yield on ten-year UK gilts – the benchmark borrowing cost for the British Government – hit a record low of 1.44 per cent. The yield on the equivalent US treasuries fell to 1.46 per cent – the lowest in over 200 years of records.

Germany indicated it is prepared to provide greater support for the most indebted euro zone partners in exchange for more centralized control over government spending in Europe. This may well not find unanimous support. The weaker countries may sign however Britain may well oppose out of concern of what the effect will be on its banks. Chancellor of the Exchequer (finance minister) George Osborne told BBC radio : ‘There is no way that Britain is going to be part of any euro zone banking union’. Even more problematic are the positions of Italy and France. Neither wants to find itself in a position of answering to fiscal and bank authorities that will most inevitably be an extension of the German government. Moreover, how long would it take to change treaties? Most EU officials see the process of European integration taking 5 to 10 years at best…And in the meantime?

Germany is the real monetary power in Europe and Germany may only be willing to put up more money if it’s granted fiscal control of the EU, with gold bullion as collateral? After all, EU sovereign bonds are just paper? Germany however doesn’t seem to have the resources necessary for a euro-zone bailout.

On June 6th Moody’s downgraded the credit rating of six German banks and 3 Austrian banks. This follows 3 downgrades in Sweden on 24th May, 16 downgrades in Spain on 17th May and 26 downgrades in Italy on 14th May.

Portugal announced that it will fall short of its growth forecast. The country may need some further financial support in the summer.

French government sign decree lowering the retirement age for some workers. Despite this news that counters EU policies, France could sell 7.84 billion euros of bonds at record low yields.

The U.S. added just 69,000 jobs in May, the smallest net increase in nonfarm payrolls in a year, the government reported. Economists surveyed by MarketWatch expected a 165,000 increase.