Категория: Инвестиционные идеи

- 29.01.2012

- Категории: Аналитика, Инвестиционные идеи

- Метки: vix, инвестиционная стратегия, инвестиционный портфель, структурные продукты

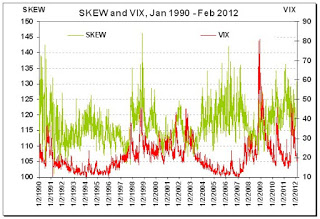

When traders and investors turn largely bullish, they decrease buying protection to hedge their bets against market declines. They become ‘complacent’ and market volatility falls. A visible account of this complacency and lack of volatility can be seen in the VIX — generally considered a ‘fear index’ on the US S&P 500 stocks. Reviewing the slightly downward sloping …

- 27.01.2012

- Категории: Аналитика, Инвестиционные идеи

- Метки: vix, золото, золотодобывающие компании, инвестиционные инструменты, структурные продукты

Almost daily we receive Structured Product offers in our emails from various brokers and banks, such as EFG, UBS, RBC, Commerzbank, Deutsche Bank, and Nomura. As we discussed on our Facebook page, we advise clients when the can achieve the best prices and the highest probabilities of a positive outcome on their investments into structured …

A Gold Opportunity in this Structures Product Читать далее »

I have been discussing the relative pricing of structured products lately with our clients and advisors. I thought it was timely to offer some data that pose a chance for much better pricing in the near future. First, the US market has been pretty bullish lately and is in short term overbought territory. Regarding options …

Structured Products Pricing and Market Posture Читать далее »

- 8.11.2011

- Категории: Аналитика, Инвестиционные идеи

- Метки: s&p500, vix

According to an article in Bloomberg recently, the put to call ratio on the CBOE Volatility Index (VIX) is the highest it has been since January 2009. Currently, there are around 101 puts to every 100 calls on the VIX as traders bet that volatility will fall and the recent rally in stocks will continue. …