I have been discussing the relative pricing of structured products lately with our clients and advisors. I thought it was timely to offer some data that pose a chance for much better pricing in the near future.

First, the US market has been pretty bullish lately and is in short term overbought territory. Regarding options pricing and market sentiment the Option Strategist’s latest weekly review and the linked graphs are worth a read with the graphs on the page this links to: http://www.optionstrategist.com/blog/2012/01/weekly-commentary-1202012

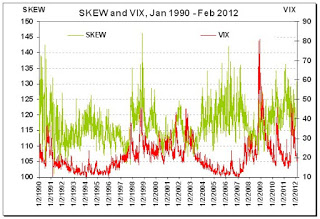

Second, option pricing is very skewed currently on the CBOE. There is a massive implied volatility skew in the front month options that makes call buying extremely expensive relative to puts — an interesting anomaly! More about SKEW can be found here: http://www.cboe.com/micro/skew/introduction.aspx

A return to normalcy is needed before better pricing can be had on many structured products that are geared to income generation through positive market performance. Within even one or two weeks the SKEW and VIX will likely reverse to a more optimal pricing situation. This will come with a pullback in the stock market.