In the early 1990s, Russia emerged from decades of socialism into the world economy as an undercapitalized new target for investors. Those investors who were willing to accept the risks Russia presented during its decade of transition were able to earn large returns on their investments. Today, Russia is no longer such a “frontier market” and is now seen by most economists as one of the world’s premier emerging markets.

A similar story may be told about all developed countries today. The United States was a country of marginal economic relevance to the rest of the world before its development began in earnest.

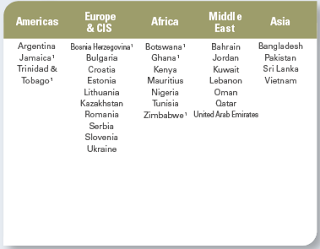

Common Frontier Markets (MSCI FM Index Countries)

Across the globe, there are dozens of countries poised to begin the process of major development and emergence into the global economy. Categorically, these frontier markets (or “pre-emerging” markets in some analyses) are countries with an investible stock market and relatively low market capitalization. Common features of these countries include underdeveloped financial infrastructure, poor quality regulation, and inadequate reporting requirements.

Despite these risky features of frontier markets, an upsurge in manufacturing in these countries has caught the attention of investors. The workforce in these countries is generally young, relatively well educated, and cheaper to employ than its emerging or developed market counterparts. Several multinational corporations are beginning to recognize this and are relocating their manufacturing operations to these emerging markets.

Risk remains an ever present concern however for investors in frontier markets. In addition to the risk factors already mention, foreign companies face the risk of nationalization especially as these countries undergo political transition parallel to economic emergence. The most prominent risk in frontier markets is illiquidity. Because of undercapitalization and low trading volume, investors can find themselves stuck with a souring investment in some circumstances. The return offered by emerging markets can offset this risk if investors are willing to bear this risk.

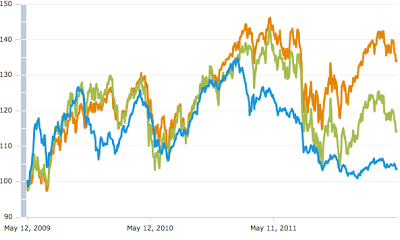

Frontier markets can also serve to further diversify a portfolio. Generally, frontier markets are uncorrelated with developed or even emerging markets. Given this characteristic, it should be no surprise that hedge funds are among the largest investors in frontier markets.

Blue=Frontier Market MSCI Index

Orange=World minus US Index

Green=G7 MSCI Index

*Note the lack of correlation between the FM index and developed world indices

There is of course no guarantee that these new markets will develop like Russia or any one of the BRIC nations. Within the MSCI frontier market index there are 23 heterogeneous countries. These countries all have different economic histories, laws, politics, and geography. Investors must as always carefully select investments based on fundamentals and personal goals within the context of reasonable expectations.

Whether or not frontier markets will offer windfall returns to brave investors remains to be seen. Investors interested in more information about frontier market should consult with their financial advisor to find a specific investment that is right for them.