Many investors around the world have all eyes (and ears) on the Federal Reserve as next week the Federal Open Market Committee (FOMC), which directs U.S. monetary policy, will conclude its July meeting.

The Federal Reserve has three key objectives related to monetary policy – maintaining maximum sustainable employment, maintaining stable prices, and moderating long-term interest rates. The first two objectives are often referred to as the Fed’s “dual mandate”. One of the Fed’s primary tools for achieving this mandate is influencing short-term interest rates via setting a target for the federal funds rate, which is the rate that banks that charge each other for the overnight lending of funds. If the Fed believes that inflation and/or the economy are growing too fast, it will often try to counteract this by increasing the fed funds target rate; on the othr hand, the Fed can try to combat economic weakness or high unemployment by reducing the target rate, with the hope of reducing the cost of borrowing and thereby spurring economic activity.

At next week’s FOMC meeting, it is widely expected that the committee will vote to reduce the federal funds target rate for the first time in more than a decade. Currently, the fed funds futures market is pricing in a 78.6% probability of a 25 basis point reduction and a 21.4% chance of a 50 basis point reduction, meaning that the futures market places the probability of a reduction of at least 25 basis points at 100% (Source: CME Group). At the end of June, the futures market had been pricing in a significantly higher chance of a 50 basis point cut; however, these expectations were tempered by the better-than-expected June US jobs report released in early July, which suggested that the US economy may be stronger than previously thought.

While they are not an explicit component of its mandate, US securities markets can react strongly to a Fed’s monetary policy changes. Rate decisions are often discussed as they relate to fixed income markets, as rate movements have a direct and inverse relationship to bond prices. However, as we saw earlier this year when dovish comments from Chair Powell led to an equity rally, fed rate policy can have also have important implications for the US stocks. So, what’s in store for the US equity market should the Fed cut rates next week as anticipated?

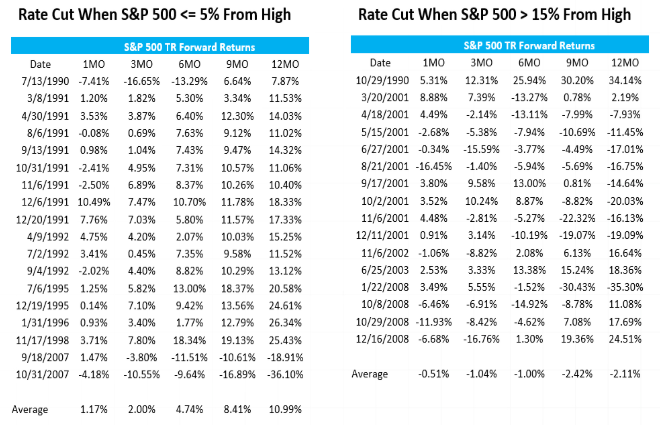

The expected rate reduction from the Fed comes against the backdrop of a US equity market that has seen each of the major large cap benchmarks hit new all-time highs within the last week. Since 1990, when the Fed has initiated a rate cut when the S&P 500 SPX was within 5% of its high, on average, the index has posted positive returns over the next one-, three-, six-, nine-, and 12-month period; with an average 12-month gain of almost 11% (Source: Nasdaq). In fact, the only two occasions when we saw negative 12-month returns following a rate cut when SPX was within 5% of its high were the two successive cuts in September and October 2007, which preceded the global financial crisis. On the other hand, when a rate cut has been initiated when the S&P 500 is more than 15% below its high, on average, the index has posted negative returns over the next one-, three-, six-, nine-, and 12-month period.

Of course, a historical trend is just that – a trend, not a guarantee. However, to the degree that history can offer insight about what the future holds, one would expect a rate cut next week to be a positive sign for the US equity market as SPX (and each of the other major US indices) currently sit well within 5% of their all-time highs. This historical data is also in-keeping with what other indicators are telling us – US equities remains the number-one-ranked asset class worldwide, a breakout has ocurred on the SPX recently, and thepercent of bullish stocks on the NYSE is currently at 52%, indicating an offensive posture towards US equities exposure.