I have just read the latest missive from our preferred metal trading advisors, and they have warned about some interesting developments in the sphere of base metal trading.

Essentially they believe that the demand from China for these types of commodities is not in a ‘slump’, as most of the other traders believe, but that the current demand is actually the most likely level going forward. In other words, those expecting a ‘bounce’ in demand from East Asia (and thus betting on both this and a corresponding increase in the commodity price) are going to be severely disappointed.

One of the reasons for this divergence in views is the relative opacity of current stocks held within China. one can say that the Chinese authorities like to play little games with the commodity traders. Actually all they are doing is behaving highly rationally – like one might expect the Taoists to act! That is, they tend to buy huge quantities of various commodities when they believe there is a relative value, and when they eat up supply, before new sources have hit the market to meet the increased demand, the price rises. At this point the Chinese stop or vastly reduce their quantity of purchasing, as they do not wish to continue to accumulate the commodity at this inflated price, hence a pullback in the value of that commodity.

And so to todays market situation, where our trading advisor believes that the volume of metal stored in Chinese warehouses is approaching a ceiling (literally and metaphorically), and that, coupled with the recent moderation in Chinese industrial metal consumption reflects a structural shift lower in demand growth.

“To dismiss softer growth as a short window of cyclical weakness ignores the changing realities of the Chinese economy”, they counter.

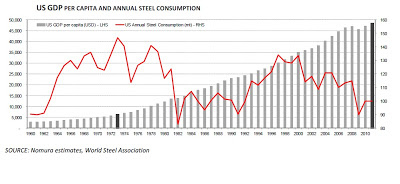

As you can see from the attached graph, the assumption that ongoing GDP growth be directly correlated with ongoing growth in annual raw material consumption, should be challenged. As you can see, steel consumption peaked in the US in 1973, yet GDP has risen sevenfold since then.

If our advisors are negative on Base metals however, they continue to see great opportunities to deploy risk within the precious metals complex.

“The ongoing fiscal instability across many sovereign nations, particularly in Europe, together with the potential for further monetary easing as global growth slows, creates a very positive backdrop for positioning in gold”, they believe.