Humans are irrational—even predictably so. Knowing where clients go wrong, how to identify when they do, and what to do about it doesn’t just allows us to help them overcome their quirks and biases—it can help them boost their bottom line.

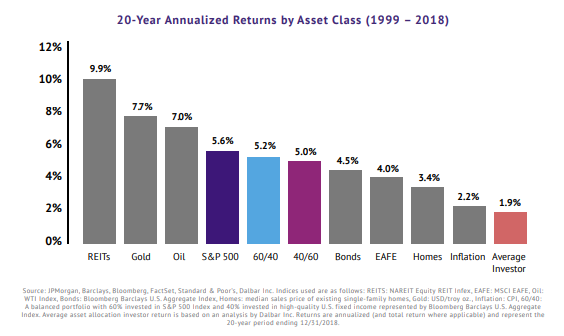

In an analysis done by Dalbar looking back over the past 20 years, the average investor underperformed in every single asset class. If one of those investors simply picked an asset class—any one— dropped their money in it and left it alone, they would have been better off than the rest of their peersin the study who were actively managing their investments.

We’re all swayed by biases and fallacious thinking from time to time. A significant part of the value our clients receive from working with us, and not on their own or with an online self-service resource, is our ability to help them overcome these missteps and use economics, not emotions, to drive their financial decisions and achieve greater success. Much of financial coaching is behavioral coaching—a perfect financial plan is of little value without the behaviors needed to execute it.