Ideas

Our observations, insights and news from the investment world

- 17.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: COVID, Earnings

Investors are usually pleasantly surprised by this critical supply chain player's ability to not only pre-announce better than expected earnings estimates, but also - within weeks - beat those estimates. With increased demand after the COVID pandemic, this trend is likely to continue.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 16.10.2021

- Categories: Analytics, Investment ideas, Personal finance

- Tags: Seasonality, Stocks

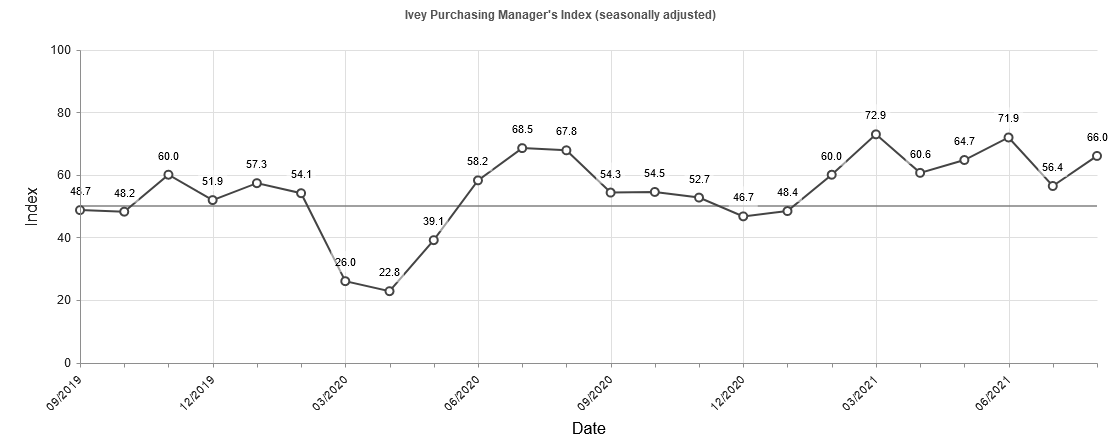

As seasonality turns bullish, we look at fundamental changes in economic indicators and technical market action. We see many opportunities in equities and highlight healthcare, natural resources, and technology companies.

- 15.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: AMZN, GOOG

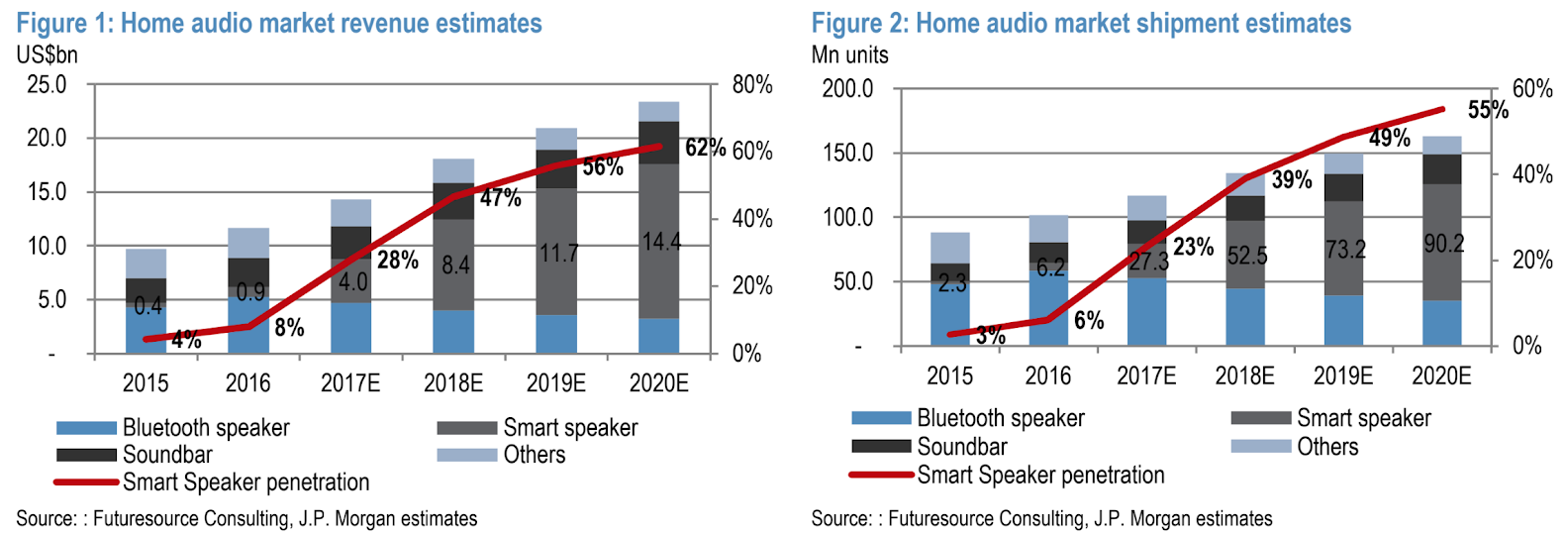

The US home audio market continues to grow. A small, but highly relevant player has multiple lawsuits out against bigger players. Judges rulings have been positive initially, and a main date is coming in Q4 for a final decision.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

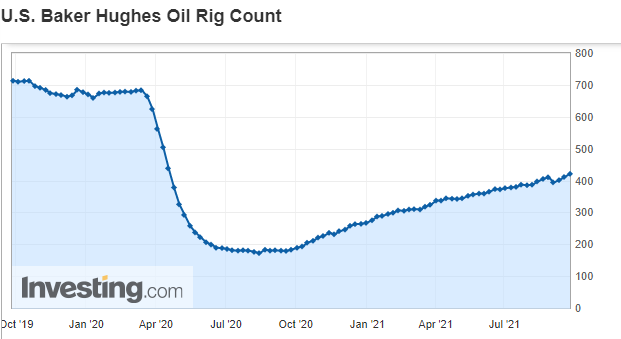

- Tags: ESG, oil

We highlighted this US oil producer as a short term trade recently, but now provide a more long-term, in-depth outlook on its bullish prospects.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

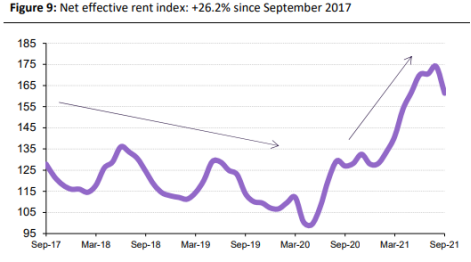

- Tags: COVID, REITs

This REIT has made some interesting acquisitions and is likely to grow robustly as self-storage trends continue as rent rates increase. Currently, the stock has pulled back to an interesting point.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

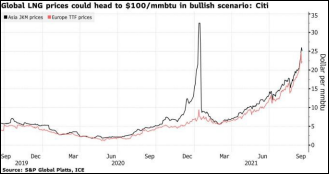

- Tags: Natural Gas, oil, REITs

One of the world’s largest and most diversified alternative asset managers with significant revenue streams from utilities, REITs, oil and gas provides a good entry point.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: Mining, oil

Assuming the world economy is entering a period of global stagflation and/or accelerating inflation, investments in economies that are closest to the earliest stages of supply chains - ones that have direct exposure to oil and commodities - look most attractive.

To access this post, you must purchase Subscription Plan – AVC Pro.

An investment bank has moderated its generally bullish view on Q3 earnings expectations for a Wall Street sweetheart.

To access this post, you must purchase Subscription Plan – AVC Pro.

Buy signals in the major US equity markets have emerged on time according to typical seasonal patterns. Sales of bond funds are now appropriate as a move from defensive positioning to a more offensive risk stance is warranted.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 6.10.2021

- Categories: Analytics, Investing basics, Investment ideas, News

- Tags: Copper, Energy, ESG, EV, US