Ideas

Our observations, insights and news from the investment world

- 7.11.2021

COP26 hits Glasgow ushering in a chance for governments to change corporate rules on environmental policies. Accounting standards are one area of focus. Main issues include reducing emissions (adoption of EVs and reduction of coal industries), deforestation, diet change, and new tech for emerging markets. Clean Energy Tech ETF (ICLN) looks interesting as US small …

Friday Investment Talk: Glasgow Goes Green, China’s Value and Small Caps Breakout Read More »

- 3.11.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

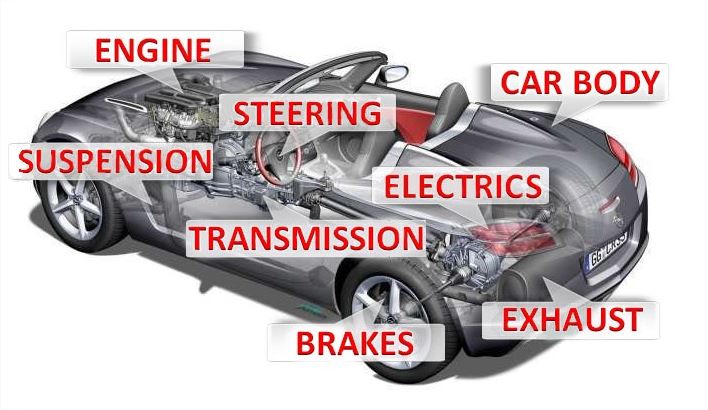

- Tags: Autos, Valuations

Bulls have been wrong on this beat up stock many times before. Things are changing for the better and now the bulls might be right. They put a great deal of money on a bet after earnings came out.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 1.11.2021

- 26.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: Biotech

A relatively new biotech company is likely to go back to new highs before its next earnings report. Stars are aligned for the long term growth of this company also.

To access this post, you must purchase Subscription Plan – AVC Pro.

Earnings out soon in a company that already preannounced deliveries. Investors will look to the future and buy this for a bounce.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 24.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: Medtech

An analyst has picked up on a beaten down medtech company in an underserved market that is technically set up to run if earnings come out with good news.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 22.10.2021

- Categories: AVC Pro Subscription, Personal finance

- Tags: DJIA, NASDAQ, Russell 2000, S&P 500, Seasonality

November leads into the best months of the year. Trading around Thanksgiving is a bit tricky.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 20.10.2021

- Categories: AVC Pro Subscription, Investment ideas

- Tags: Seasonality, Semiconductors

Semiconductor stocks are entering a seasonally bullish period. With more upside ahead, we review stocks that are likely to post positive gains.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 18.10.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: Medtech

We review a name we had good luck with last year. As medtech has gone nowhere with the Delta variant keeping elective procedures to a minimum, company management feels things are changing for the better.

To access this post, you must purchase Subscription Plan – AVC Pro.