Ideas

Our observations, insights and news from the investment world

ACTIONABLE STOCK: NRG Read More »

March Update: Is The Bull Run Done? Read More »

- 8.02.2019

- Categories: Analytics, News

- Tags: market review, market trends

Technically, all major indexes sit around their 200dMA – which means nothing really, other than everyone is watching it. Therefore, this level becomes a psychologically important level. A retracement from these levels is basically a self-fulfilling prophecy as everyone expects a fall of some sorts from here. Investors Business Daily counts only 2 distribution days …

Merrill Lynch’s CIO sees a positive US market environment underpinned by better valuations and loose monetary policy. Although political global uncertainty and potential volatility continue, a positive shift in the markets is underway. We would say that ML is looking in hindsight, and could miss the fact that February is usually the weakest of the …

- 15.01.2019

- Categories: Analytics, News, Personal finance

- Tags: bonds, market trends, usa

Today, Citigroup reported earnings in line with analysts expectations, but warned of weakness in its fixed income business. This resonates with our own concerns for the US debt market. Both government bonds and corporate bond yields have been under pressure for months as we have seen an inversion of the yield curve in some U.S. …

- 11.01.2019

- Categories: Personal finance

- Tags: пенсия, финансовое планирование, финансовый консультант

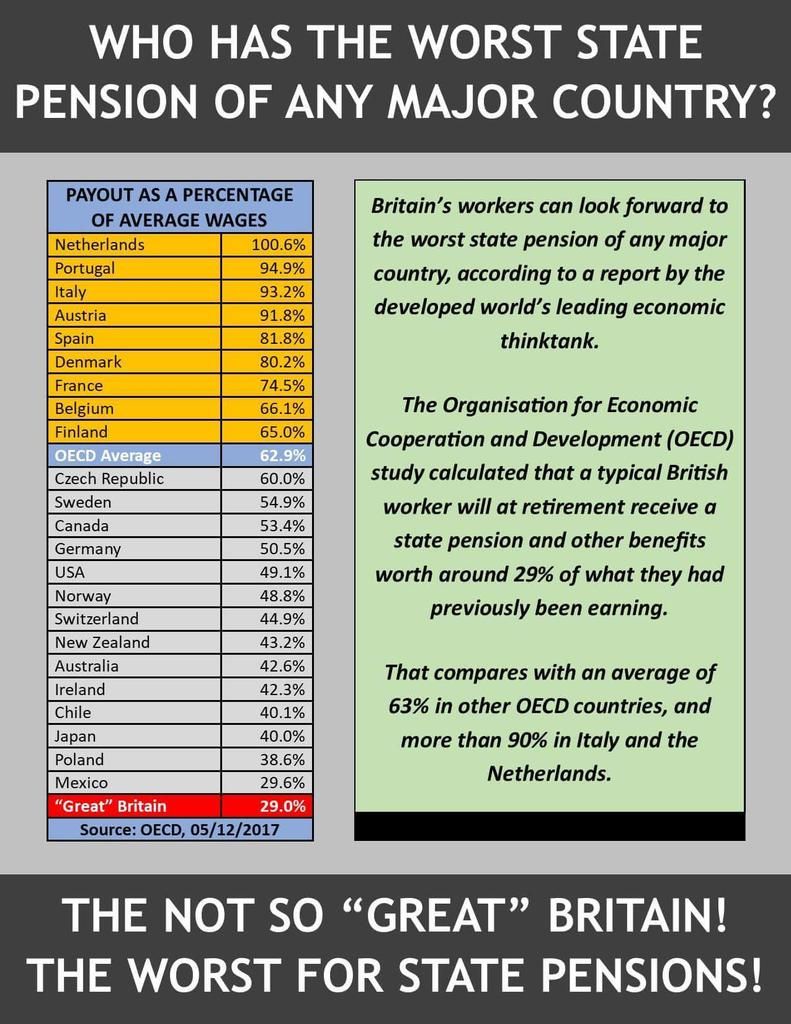

Retirement is increasingly seen as a long journey to look forward to, not, as it once was, a relatively short period of life that spelt the end of the road. Today’s retirees are more busy, independent and curious than ever and have more time to settle into a life filled with endless possibilities. But at …

Walls needed, walls built As the old adage goes, “markets climb a wall of worry”, so in good fashion BAML tapped into its inner Trump in its weekly market review to make certain sure that investors have a wall! While the US Federal Reserve tries to atleast stabilize its debt to GDP ratio – something …

- 2.10.2018

- Categories: Analytics, Investing basics, Investment ideas

- Tags: dividend

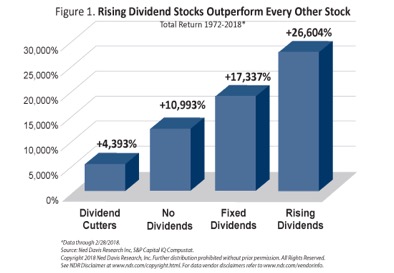

We all know that there is no such thing as the perfect investment, but I have one that comes pretty close. Working with the American Association of Individual Investors for many years, I have done research on dividend paying stocks. Investing in stocks that pay dividends offers a tantalizing triple play of 1) greater safety, …

DIVIDEND STOCKS: NEGATIVE MYTHS AND POSITIVE REALITY Read More »

- 5.03.2018

- Categories: Analytics

- Tags: market review, market trends

All the major equity markets saw massive selling in the beginning of February. Correlation between all asset classes rose sharply, as usual during market corrections, making it difficult to find shelter from the retreat. Combined with the unwinding of the short volatility trade which was so popular for the last few years, interest rate fears …