Ideas

Our observations, insights and news from the investment world

- 17.03.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: IWM, Russell 2000, SPX, SPY

After stocks suffer large declines, certain companies perform better during a rebound. Besides focusing on timing the bottom, investors need to know what is likely to perform best. We show some historical statistics to get investors ready.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 17.03.2020

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: SPX, Stocks

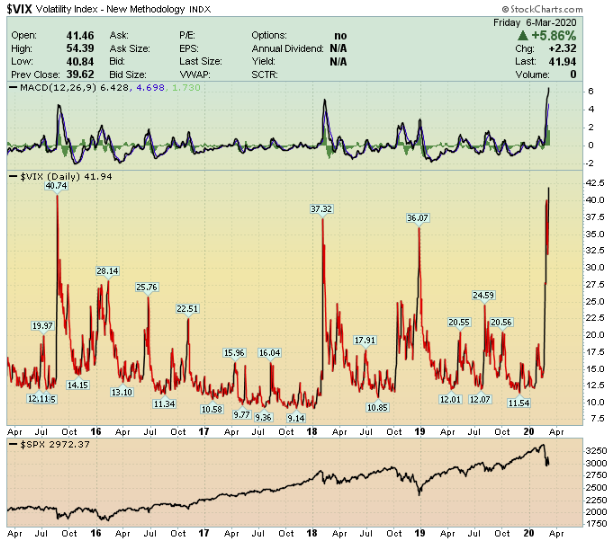

Volaitlity is spiking to levels not seen since 2008. Should long-term minded investors run for shelter?

With no light at the end of the tunnel these bleak times seem desperate. But what happens usually after VIX spikes like the one we are currently experiencing? We look at the months and years after intense volaitility to find solace in the future of the economy.

- 16.03.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: NASDAQ, Russell 2000, s&p500, SPX

After the close on Thursday, the main US markets entered a bear market for the first time in 11 years. A simple virus killed the bull.

How long do bear markets last, and are they always accompanied by a recession? We take a look at history to find answers.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 8.03.2020

- Categories: Analytics, Investing basics, Personal finance

- Tags: CPCE, NYMO, NYSI, P/C Ratio, SKEW, SPX, vix, volatility

Volatility in the US has exploded, throwing the markets into disarray. The intermediate-term trend is bearish, with extreme oversold conditions likely to produce sharp, but short-lived, rallies. We will look at some important indicators to see how oversold the markets are and what usually happens at times when markets sell off quickly.

- 7.03.2020

Large daily moves in both directions of 2-5% and huge intraday swings have taken a toll on markets and psyches. But the February 28 low has held through this week’s wild swings.

According to sector seasonality, there are two sectors that begin their seasonally favorable periods in March: High-Tech and Utilities.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 23.02.2020

- Categories: Analytics, AVC Pro Subscription, Investing basics, Personal finance

- Tags: DJIA, NASDAQ, Russell 2000, Seasonal Strategy, SPX

Unlike weather and the biblical tales, stock markets in March usually start with stability and turn wild with volatility towards the end.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.02.2020

- Categories: AVC Pro Subscription, Investing basics, Personal finance

- Tags: DJIA, NASDAQ, s&p500, SPX, SPY, Stocks

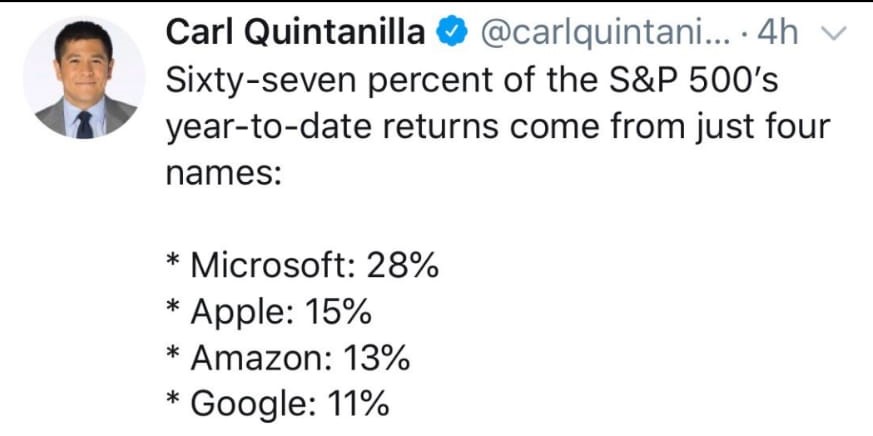

Large Cap stocks make up most of the gains this year, far outpacing smaller stocks. A reversal of this trend could come soon, in March even.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 13.02.2020

- Categories: News, Personal finance

- Tags: Non-Resident, pension, TAX, UK

If you approaching pension age and are resident in a low tax jurisdiction (Russia, for example), you could take advantage of the UK's flexible drawdown regime from age 55. If you are non-resident for tax purposes, although you might in future return to the UK to live, or indeed to another country, you may be able to receive the full value of your fund liability to UK tax and so without deduction of tax at source. By investing the proceeds properly, you could obtain tax free growth whilst you are outside the UK and then benefit from withdrawals of 5% per annum tax free when you are back in the UK.

- 13.02.2020

- Categories: News, Personal finance

- Tags: Non-Resident, Property, TAX, UK

- 12.02.2020

- Categories: Personal finance

- Tags: Life Policies, Non-Resident, TAX, UK

There are three main tax benefits of using offshore life assurance policies when you are considered a UK tax resident, but do not maintain 'domiciled status' in the UK. These include tax free investments, no Capital Gains Tax, and Tax Deferred Withdrawl Allowances.

There are specific ways that HMRC calculates taxable benefits on proceeds of insurance bonds during retirement. These include Top Slicing and Time Apportioned Relief.

Using trusts can also be a benefit to transferring wealth with reduced tax implications.