Ideas

Our observations, insights and news from the investment world

- 18.05.2020

- Categories: Investment ideas, Personal finance, Личные финансы

- Tags: Gold, interest rates, Rubles, russia, Tech

Having one’s cake and not eating it. When I came to Russia, my first summer was hot and sunny and I took to cycling, exploring the city’s cycle paths, one of my favourites being the one that runs along Bolshaya Nikitskaya up to the Garden Ring. For those unfamiliar, the Garden Ring is a ring …

COVID Emergency Funds, the Price of Gold, and the Stock Market Read More »

- 15.05.2020

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AGG, BND, DJIA, IBB, IWM, QQQ, SPX, SPY, XLP, XLU

The best six months of the year for certain US stock indexes has ended. A defensive stance is warranted as the summer months arrive.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.05.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: SPX, Unemployment

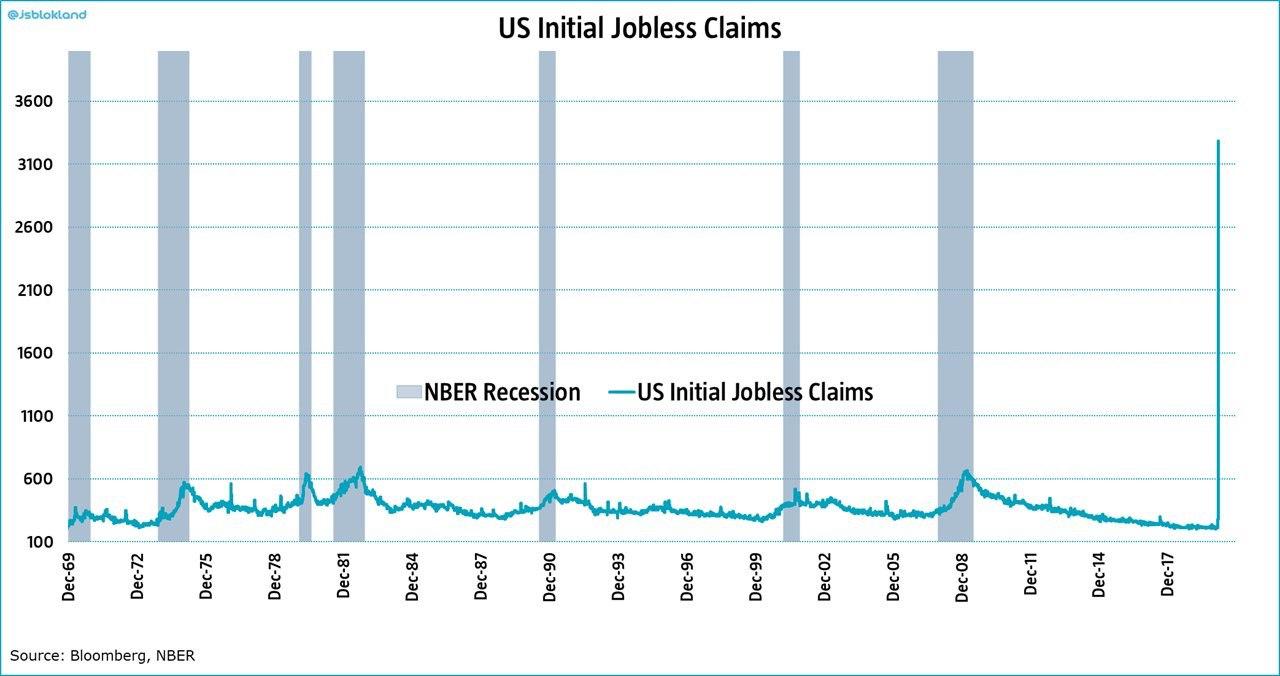

Initial Weekly Jobless Claims in the past eight weeks totalled 36.5 million. The good news is the trend is lower. The peak in Initial Claims was two weeks ago, and an immediate precipitous retreat has taken place. Is this an effective indication of the end of the bear market in stocks?

To access this post, you must purchase Subscription Plan – AVC Pro.

- 26.04.2020

- Categories: Analytics, AVC Pro Subscription

- Tags: DJIA, NASDAQ, SPX

The US stock market in May used to perform buch better than it has in recent years. Still, there is generally a bullish bias in certain stock sectors.

May trading during US election years is generally weak. Caution is warranted, especially in the second half of the month.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 20.04.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance, Подписка AVC Про

- Tags: DJIA, Seasonal Strategy, SPX, TLT

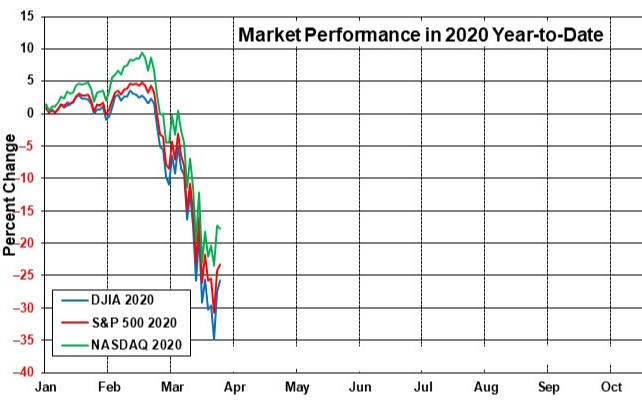

So far, April has regained some of this years losses - in fact the NASDAQ is again positive for 2020.

What should investors do now that markets are entering the weakest period of the year? How bad could this year be, actually?

To access this post, you must purchase Subscription Plan – AVC Pro.

- 6.04.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: AGG, BND, DJIA, GLD, IBB, Seasonal Strategy, SPX, Tech, XLP, XLU

Usually at this time of the year, early-April, stock markets would have had a nice seasonal rally. Well, there is nothing usual about the market or the economy this time.

As of today, the new bear market closing lows were on March 23. From their highs DJIA was down 37.1% and S&P 500 was down 33.9%.

Since then the market has rebounded to trim those losses.

Now we look to position for the worst months of the year ahead.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 30.03.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: April, CoronaVirus, DJIA, NASDAQ, Russell 2000, SPX, Tech

Everyone seems to be hoping for the stock market to find support here, already so much damage has been done.

A great deal of uncertainty remains for the world economy and health crisis. April looks like a good time for a bear market bounce.

Further out, investors should experience a rough ride in the market this year with quite a bit of choppy trading.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 26.03.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: P/C Ratio, SPX, vix

Today, US stocks were finally able to stage a rally that lasted from opening bell to the close. That has not been the case for a very long time.

Remember, a one day move does not make a trend. We need to see if the bulls can even hold this rally for more than a day. Our feeling is they likely will be able to.

- 23.03.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: DJIA, Gold, NASDAQ, QQQ, s&p500

One of the fastest and most furious declines in stock market history has taken place . While similar declines have occured, they did not come as rapidlynor straight off a new all-time high. we cannot know if we have hit bottom yet - bottoms are only visible with a bit more hindsight. So speculating on the timing of a rebound, rally and recovery needs some leadership response.

To access this post, you must purchase Subscription Plan – AVC Pro.