Ideas

Our observations, insights and news from the investment world

- 14.08.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: DJIA, SPX

As we discussed at the end of July, the August rally in US small cap stocks has taken hold. Can this continue as major indexes close in on all time record levels?

To access this post, you must purchase Subscription Plan – AVC Pro.

- 10.08.2020

- Categories: Investment ideas, Personal finance

- Tags: AAII, ARKK, bonds, EMQQ, MELI, russia, Tech

Again looking at the hot tech sector, the potential value to growth rotation, Russia as a value and dividend play, and some contrarian bullish indictaors for stocks while bonds are simply stretched very far. Mercado Libre (MELI) stock reports next week and BAML is out with a nice target price for the bulls.

- 3.08.2020

- Categories: Investment ideas, Personal finance

- Tags: $VNM, china, COVID, Gold, oil, Rubles, SLV, usd

- 29.07.2020

- Categories: Investment ideas, Personal finance

- Tags: COVID, inflation, interview

- 27.07.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: COVID, DJIA, dow jones, Elections, NASDAQ, Russell 1000, Russell 2000, S&P 500, Seasonality

The month of August is usually one of the worst months of the year for US stocks. In years of a US presidential election (like 2020), August holds a special spot in the calendar for certain stocks.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 25.07.2020

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

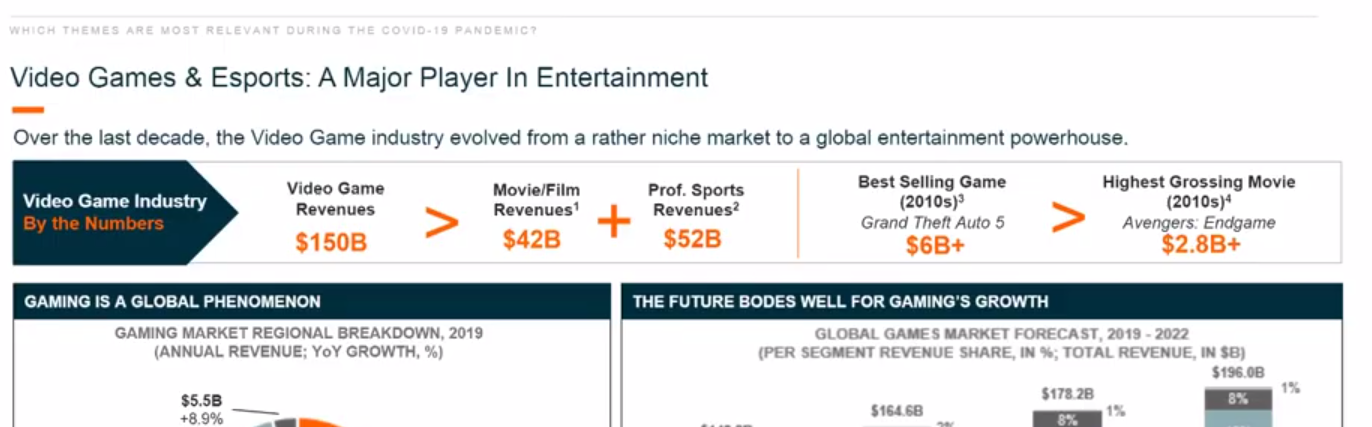

- Tags: ETFs, Gaming, Gazprom, GLD, Natural Gas, PSQ, QQQ, SLV, TAM, TTWO, UNG

- 22.07.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: RNG

RingCentral joined hands with Atos to market its products worldwide. The opportunity looks big according to 3 investment banks. The stock chart is set up for a break out.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 21.07.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: COVID, SBUX

We see an increase in short term call buying in Starbucks. Loyalty programs seem to be driving high customer demand.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 19.07.2020

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

- Tags: dividend, FAANG, Health Care, Seasonality, SPX, Tech

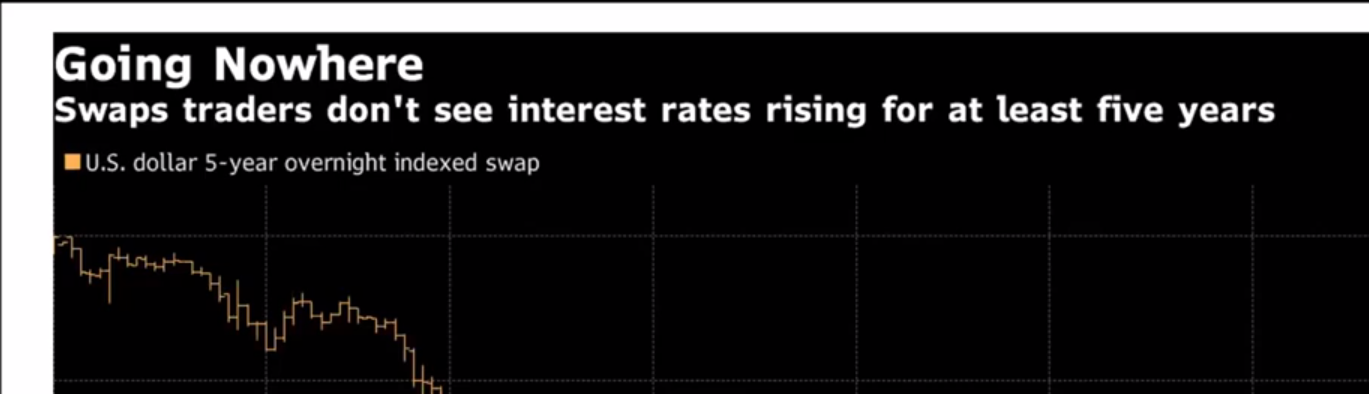

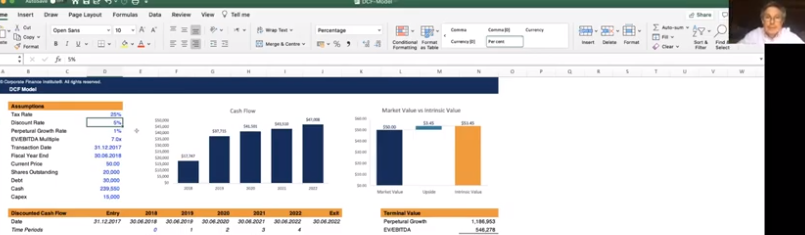

Are markets overbought? The narrow bull market in FAANG and some other technology stocks has led to concern among analysts that stocks are out of sync with the economy. We explore how interest rate assumptions affect analyst pricing in discounted cash flow models and lead to inflated asset prices. A discussion of the opposite case …

- 17.07.2020

- Categories: Analytics, AVC Pro Subscription, Investing basics, Investment ideas

- Tags: Coronavirus, DJIA, NASDAQ, NFLX, Russell 1000, Russell 2000, S&P 500

NASDAQ’s mid-year rally (described here in late June) came to an end on July 14. From mid-July, the second quarter is usually plagued with poor performance. Enthusiam and large amounts of cash on the sidelines could keep stock prices aflot. Hower, defensive positioning seems a more reasonable bet.

To access this post, you must purchase Subscription Plan – AVC Pro.