Ideas

Our observations, insights and news from the investment world

- 4.10.2020

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: COVID, Elections, ETFs, GLD, market trends, Stocks

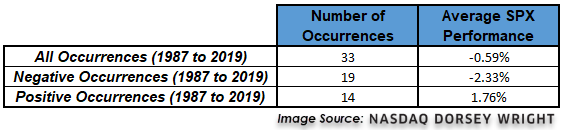

As US elections approach we take a look at how election results move markets. We go through 10 lessons for all investors who are nervous going into the elections. History shows that there is nothing to be afraid of except uncertainty. Markets look bullish for October based on the AAII Investors Sentiment Survey and several …

Friday Investment Talk: US Elections, Market Bullishness, and Fintech Read More »

- 2.10.2020

- Categories: AVC Pro Subscription, Investing basics, Investment ideas, Personal finance

- Tags: AGG, BND, DJIA, MASDAQ, Russell 1000, Russell 2000, SPX

- 1.10.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: COVID, Medtech

- 28.09.2020

- 26.09.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

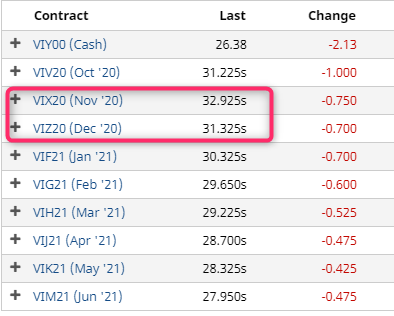

- Tags: Futures, Markets, SPX, vix

- 25.09.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: MDT, Medtech

- 21.09.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: eem, Elections, GLD, Seasonality, SLV, XLI

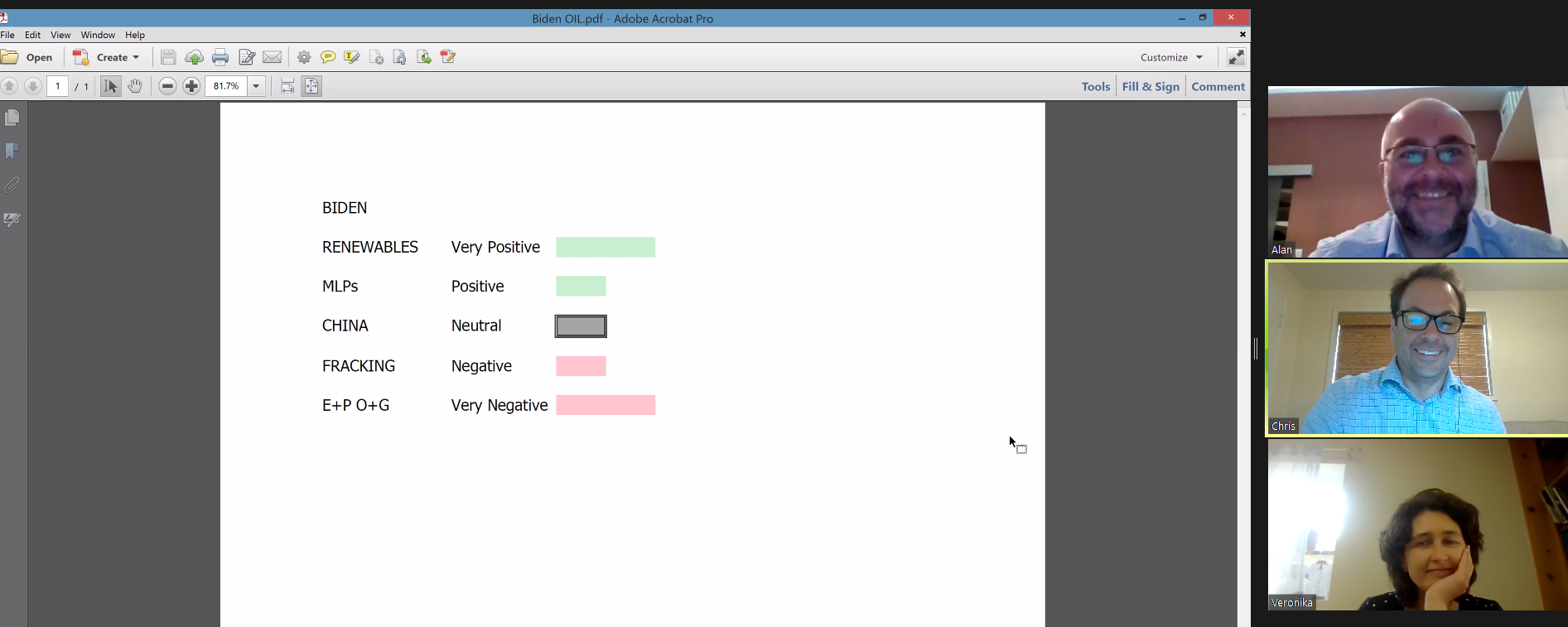

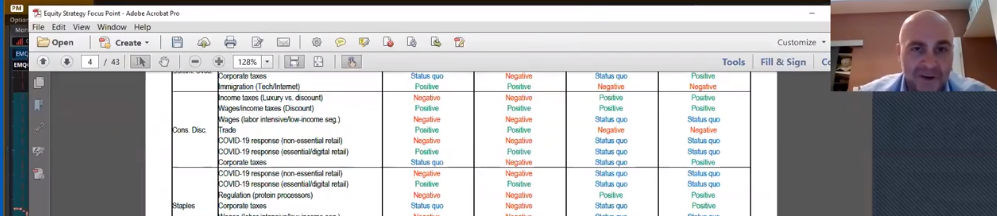

We take a first glance at Bank of America research on which sectors will benefit under the four possible election results in the US. Meanwhile, US sector rotation is visible. Investors are moving from technology to industrials. Emerging markets are holding up, also. Gold and Silver are flat. Barron’s highlights the possibility of Japan and …

Friday Investment Talk: US Elections, Seasonality, Europe, Japan and Emerging Markets Read More »

- 21.09.2020

- Categories: Analytics, Investing basics, Personal finance

- Tags: Seasonal Strategy, Seasonality, SPX

- 19.09.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: Investing, Stocks

- 18.09.2020

- Categories: Analytics, AVC Pro Subscription, Investing basics, Investment ideas, News

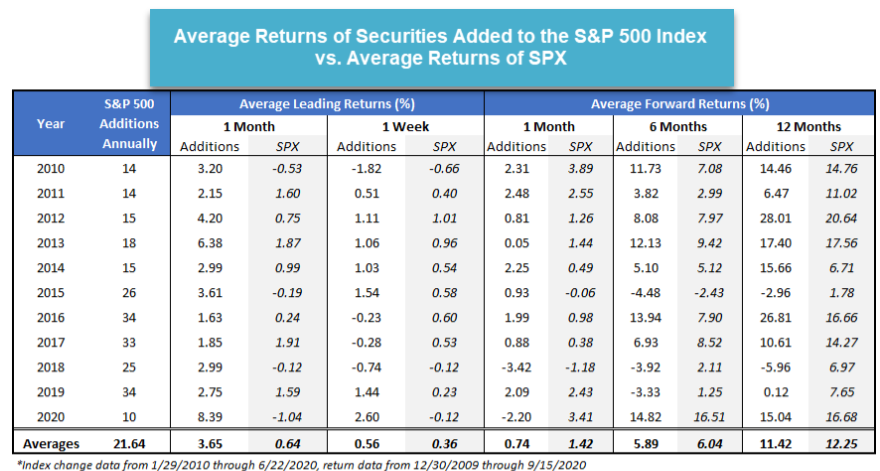

- Tags: CTLT, ETSY, SPX, TER