Ideas

Our observations, insights and news from the investment world

- 4.06.2021

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AGG, BND, COPX, CPER, GLD, IBB, IYW, NASDAQ, QQQ, Seasonal Strategy, SLV, XLP, XLU, XLV, XLY

Waiting for the Seasonal sell signal in the NASDAQ, other sector trades come to and end in June. Gearing up for a sideways market is the plan now, until the strong months again come later this year.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 30.05.2021

- Categories: Investment ideas, News, Personal finance

- Tags: dividend, Fintech, MELI, PAGS, Semiconductors, SMH, SOX, T

- 25.05.2021

- Categories: AVC Pro Subscription, Investment ideas

- Tags: Stocks

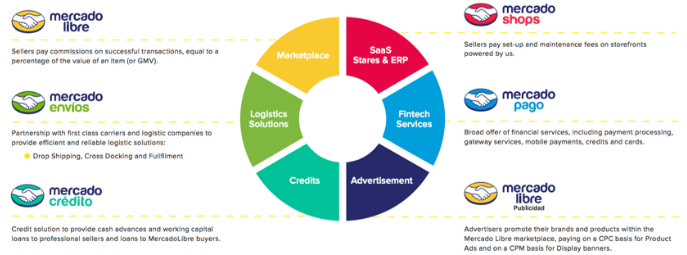

We see option activity picking up in our favorite Latin American payment service company. Morgan Stanley analysts expect stronger than expected growth. The chart looks interesting for the stock to run again.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 22.05.2021

- Categories: Analytics, Investment ideas, Personal finance

- Tags: EEM, emerging markets, ETFs, GLD, Seasonality, SLV, Valuations

- 21.05.2021

- Categories: AVC Pro Subscription, Investment ideas

- Tags: Autos, Stocks, TSLA

Tesla, the best innovator with first mover advantage in EV space, gets all the attention. It has a lofty multiple while other auto makers were shunned. Recently, new products signal a change.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 21.05.2021

- Categories: AVC Pro Subscription, Investment ideas

- Tags: Stocks

JPMorgan makes the case for an early stage growth opportunity within an established company: Urban Air Travel.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 21.05.2021

- Categories: AVC Pro Subscription, Investment ideas

- Tags: Stocks

Animal Health companies are showing strength recently. Four stocks are poised for new highs as demand for products remain elevated, according to Credit Suisse.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 21.05.2021

- Categories: AVC Pro Subscription, Investment ideas

- Tags: Stocks

A buying opportunity in a medtech company arises as a competitor product pulls out.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 21.05.2021

- Categories: AVC Pro Subscription, Personal finance

- Tags: Seasonality

Divergent markets pervade June. The NASDAQ ends its best 8 months and the Dow can really suffer, especially in post-election years.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.05.2021

The debate on the sustainability of inflation is alive! Markets react and traders battle out their Feds next move. Retail and consumer discretionary stocks look weak, while semiconductors and car resellers could bounce. Biotech sits on support.