The S&P 500 closed positive for eight consecutive months in November. The index gained nearly 3% in November, and is now higher by more than 18% in price-only returns in the first 11-months of 2017. More significantly, S&P 500 has now increased 13 consecutive calendar months when including dividends. Since 1970, eight-month price-only winning streaks for the S&P 500 occurred five other times, and only one time did the streak make it to nine months.

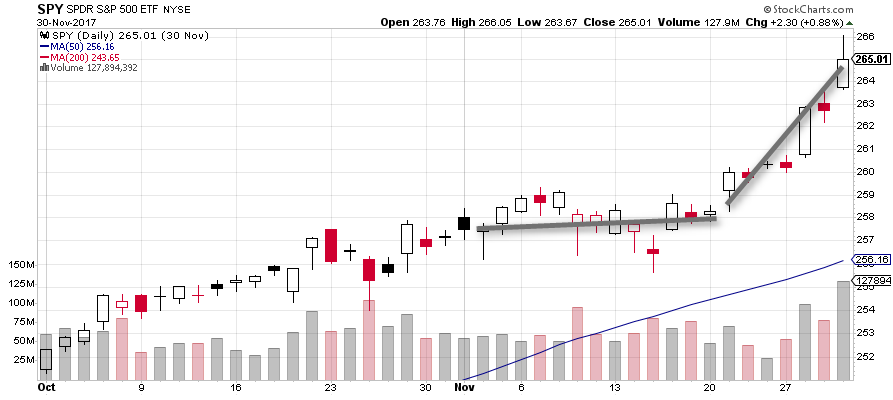

The S&P 500 ETF SPY traded sideways for the first half of the month, but then traded strongly higher. It is still extended far above its 50 and 200 day moving averages, which should act as support during a pullback in December.

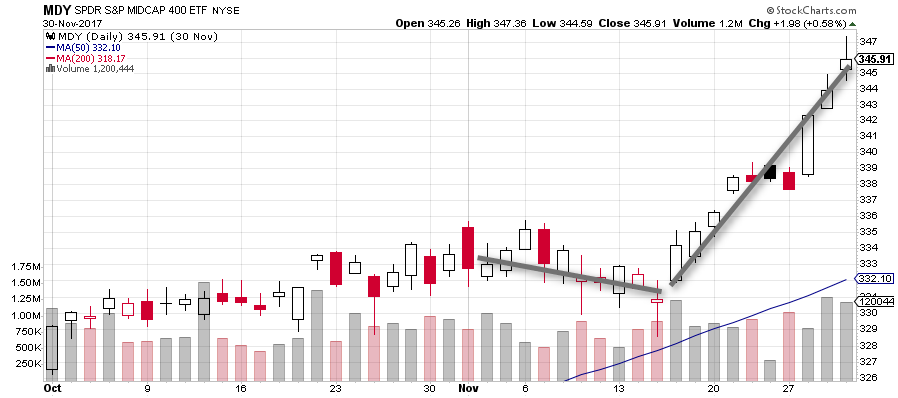

Medium sized companies followed SPY’s lead. The MDY also traded flat for the first half of the month, then rocketed higher around the Thanksgiving Holiday in the US.

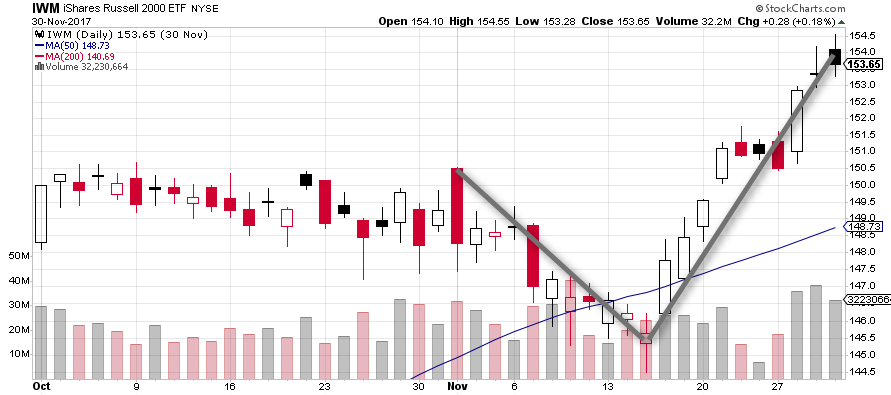

As witnessed in October, the smaller companies in the Russell 2000 index (shown below using the ETF IWM) were the weakest in the US markets. They actually traded below their 50 day moving average during mid-month. They also showed the strongest growth in the latter half of November.

Non-US developed markets fared well in November, even after a rough second week. VEU tested its 50 day moving average and bounced dramatically higher.

Emerging markets faced some volatility in November, as VMO closed sharply lower mid-month only to rally higher. Currently, VMO needs to bounce off its 50 day moving average again to remain convincingly bullish.

Real Estate had a wonderful November. For most of the month it climbed higher. This marked a successful bounce of the 200-day moving average in late October.

Commodity producers had a wild ride in November as they sold off then bounced back with vigor. HAP traded below its 50-day moving average for several days before gaining to close at a new high by month’s end. This bodes well for December bulls.

Commodity prices traded choppy last month. USCI continues to bounce off its 50 day moving average as it climbs higher. Notably, USCI put in a lower high during its second bounce this month. Commodity prices could start trading in a more sideways range going forward as oil nears $60 a barrel.

US bonds traded sideways in November. AGG traded on both sides of its horizontal 50 day moving average.

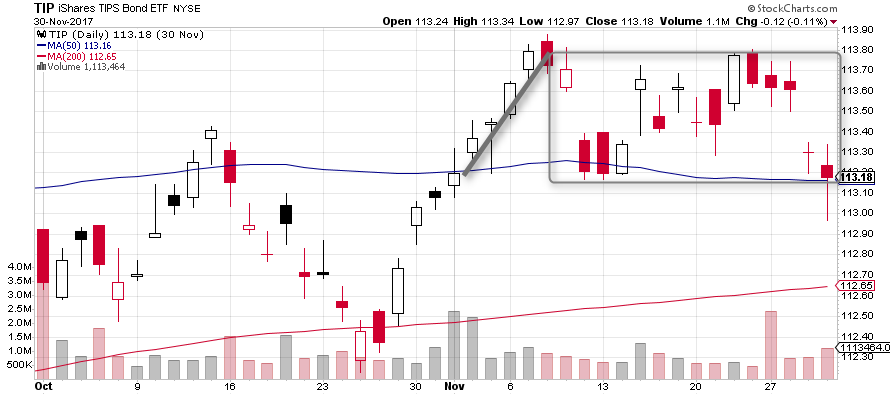

Inflation indexed US Treasuries (TIPs) continued their strength in the first week of November, but then traded sideways for the rest of the month. Until inflation appears TIP will struggle in more sideways action.

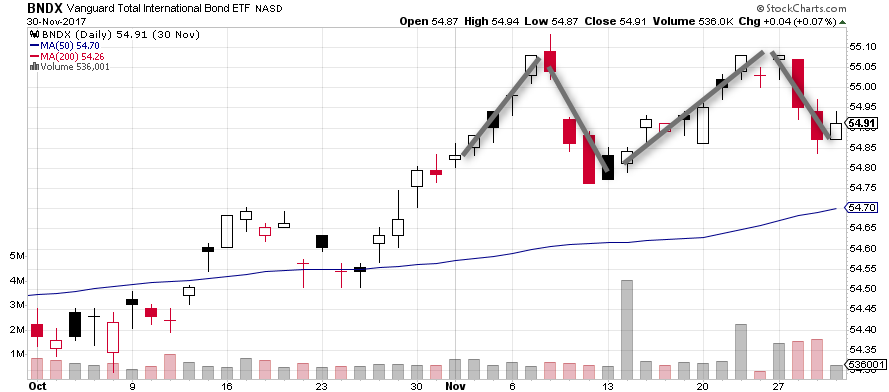

Non-US bonds could have formed a significant double top in November. If BNDX breaks below its rising 50 day moving average, a more significant pullback could be in store.

As US equities traded higher in November, the US Dollar weakened significantly. UUP traded around the lows of October during the last days of November. With an interest rate expected in mid-December, UUP should bounce from here.