Tag: Stocks

- 11.12.2023

- Categories: AVC Pro Subscription, AVC UL Subscription, Investment ideas

- Tags: Healthcare, Stocks

- 29.03.2022

- Categories: Analytics, Investing basics, Investment ideas

- Tags: bonds, interest rates, RPV, Stocks

Bonds are now worst performers than stocks since the beginning of the year. Such pessimism in bond prices has not been seen for decades. Meanwhile, interest rate hikes are usually bullish for equities during the first few months of increases. Value stocks broke out to new highs this week as market internals turn more bullish. …

Friday Investment Talk: Bonds Weakness and Equity Strength Read More »

- 8.01.2022

- Categories: Investment ideas, News, Personal finance

- Tags: bonds, BRK/B, inflation, PCAR, Stocks, TEX

Inflation has pushed interest rates higher and wrecked havoc in bond markets. Investors turn away from SAAS towards ‘reopening stocks’ in the Industrial sector. This rotation has crimped the markets so far this year and could spell trouble for most of 2022.

- 24.12.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: Stocks, Value

More Beat Up Blue Chips Read More »

- 12.12.2021

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- Tags: Stocks, Value

Beaten Down Blue Chips Read More »

- 7.11.2021

COP26 hits Glasgow ushering in a chance for governments to change corporate rules on environmental policies. Accounting standards are one area of focus. Main issues include reducing emissions (adoption of EVs and reduction of coal industries), deforestation, diet change, and new tech for emerging markets. Clean Energy Tech ETF (ICLN) looks interesting as US small …

Friday Investment Talk: Glasgow Goes Green, China’s Value and Small Caps Breakout Read More »

- 16.10.2021

- Categories: Analytics, Investment ideas, Personal finance

- Tags: Seasonality, Stocks

As seasonality turns bullish, we look at fundamental changes in economic indicators and technical market action. We see many opportunities in equities and highlight healthcare, natural resources, and technology companies.

- 26.09.2021

- Categories: Investing basics, Investment ideas, News, Personal finance

- Tags: Bitcoin, IWM, Stocks

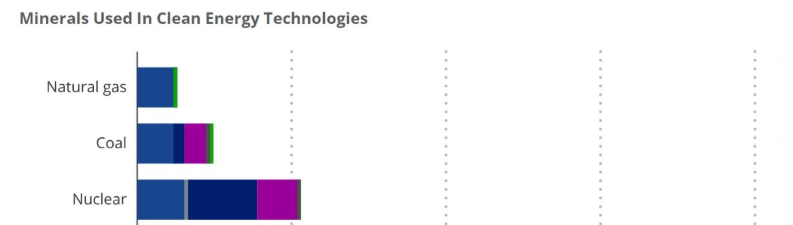

The US outlined extensive ‘Clean Energy’ priorities that will create a magnitude of change in demand for metals and rare earth minerals, such as cobalt, lithium, copper, zinc, molybdenum, etc. China is a main supplier of many of these elements key in electricity production from wind and solar power. Politics and transport issues can create …

Friday Investment Talk: Clean Energy Minerals, Cryptos, Market Pullback Read More »

- 25.06.2021

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

- Tags: QQQ, Seasonality, Stocks