Tag: SPX

- 24.05.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: EWJ, EWY, FXI, GLD, SPX, TLT

We have a just launched the first session of our new weekly "Friday Investment Talk" series. This week Alan, Mike, and I discuss the continuation of the bull market's posture. Mike speaks of how client's 'fear of missing out' leads to overly concentrated portfolios. Alan highlights how the recent Chinese sell off could be a buying opportunity, as other Asian markets look strong.

- 22.05.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance, Подписка AVC Про

- Tags: DJIA, IWM, NASDAQ, SPX

The month of June ranks near the bottom of all months for most of the US indexes. Expect volatility during the third week. After that it tends to only get worse.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.05.2020

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: AGG, BND, DJIA, IBB, IWM, QQQ, SPX, SPY, XLP, XLU

The best six months of the year for certain US stock indexes has ended. A defensive stance is warranted as the summer months arrive.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 15.05.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

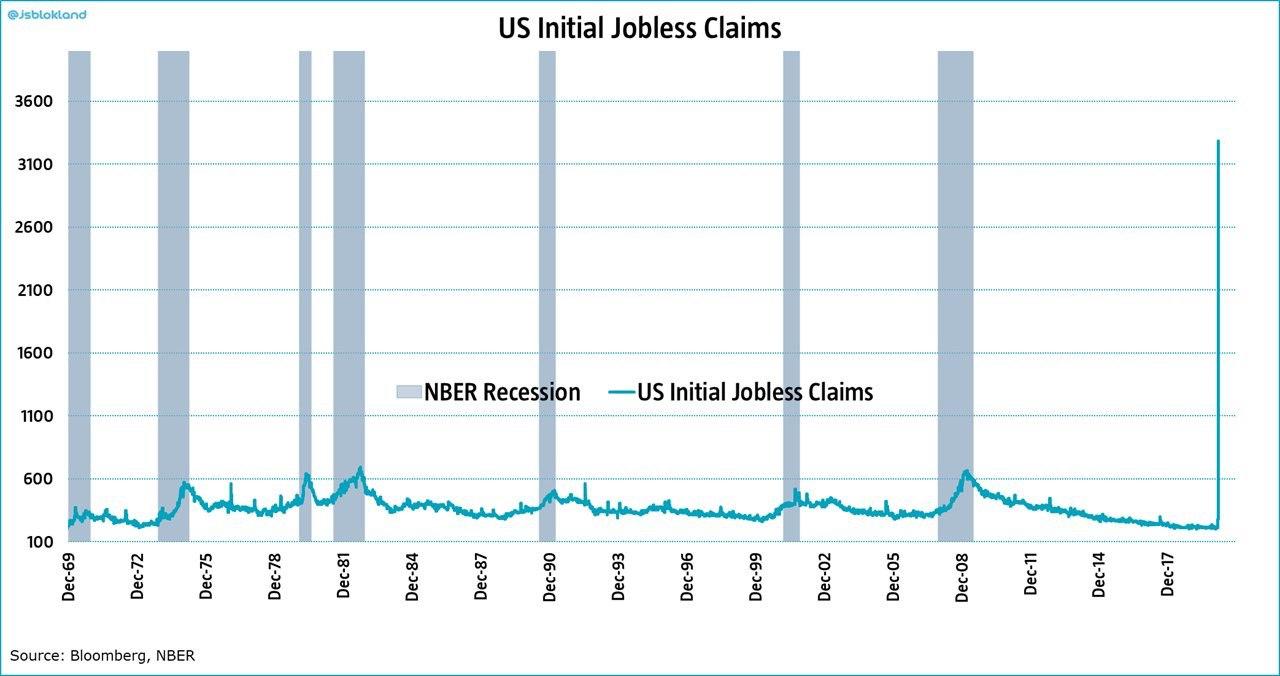

- Tags: SPX, Unemployment

Initial Weekly Jobless Claims in the past eight weeks totalled 36.5 million. The good news is the trend is lower. The peak in Initial Claims was two weeks ago, and an immediate precipitous retreat has taken place. Is this an effective indication of the end of the bear market in stocks?

To access this post, you must purchase Subscription Plan – AVC Pro.

- 26.04.2020

- Categories: Analytics, AVC Pro Subscription

- Tags: DJIA, NASDAQ, SPX

The US stock market in May used to perform buch better than it has in recent years. Still, there is generally a bullish bias in certain stock sectors.

May trading during US election years is generally weak. Caution is warranted, especially in the second half of the month.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 20.04.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance, Подписка AVC Про

- Tags: DJIA, Seasonal Strategy, SPX, TLT

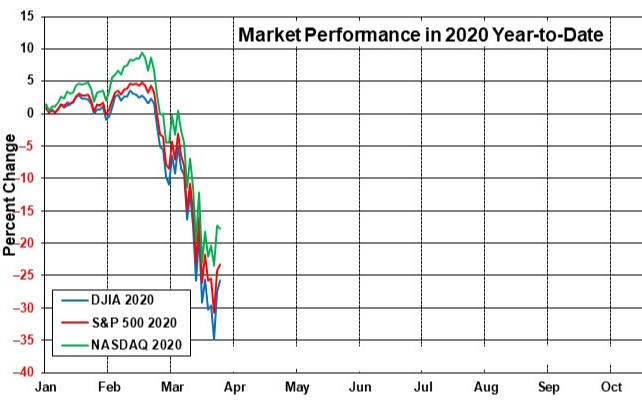

So far, April has regained some of this years losses - in fact the NASDAQ is again positive for 2020.

What should investors do now that markets are entering the weakest period of the year? How bad could this year be, actually?

To access this post, you must purchase Subscription Plan – AVC Pro.

- 6.04.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: AGG, BND, DJIA, GLD, IBB, Seasonal Strategy, SPX, Tech, XLP, XLU

Usually at this time of the year, early-April, stock markets would have had a nice seasonal rally. Well, there is nothing usual about the market or the economy this time.

As of today, the new bear market closing lows were on March 23. From their highs DJIA was down 37.1% and S&P 500 was down 33.9%.

Since then the market has rebounded to trim those losses.

Now we look to position for the worst months of the year ahead.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 30.03.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: April, CoronaVirus, DJIA, NASDAQ, Russell 2000, SPX, Tech

Everyone seems to be hoping for the stock market to find support here, already so much damage has been done.

A great deal of uncertainty remains for the world economy and health crisis. April looks like a good time for a bear market bounce.

Further out, investors should experience a rough ride in the market this year with quite a bit of choppy trading.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 26.03.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: P/C Ratio, SPX, vix

- 17.03.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: IWM, Russell 2000, SPX, SPY

After stocks suffer large declines, certain companies perform better during a rebound. Besides focusing on timing the bottom, investors need to know what is likely to perform best. We show some historical statistics to get investors ready.

To access this post, you must purchase Subscription Plan – AVC Pro.