Tag: Seasonality

- 29.12.2020

- Categories: AVC Pro Subscription, Personal finance

- Tags: Santa Claus Rally, Seasonality

- 22.12.2020

- Categories: AVC Pro Subscription, Investment ideas

- Tags: Seasonality, Stocks

- 14.12.2020

- Categories: AVC Pro Subscription, Investment ideas, Personal finance

- Tags: Copper, COPX, Seasonality

- 4.12.2020

- Categories: AVC Pro Subscription, Investing basics, Personal finance

- Tags: Seasonal Strategy, Seasonality

- 23.10.2020

- Categories: Analytics, AVC Pro Subscription, Personal finance

- Tags: DJIA, NASDAQ, Russell 1000, Russell 2000, Seasonality, SPX

- 21.09.2020

- Categories: Analytics, Investment ideas, Personal finance

- Tags: eem, Elections, GLD, Seasonality, SLV, XLI

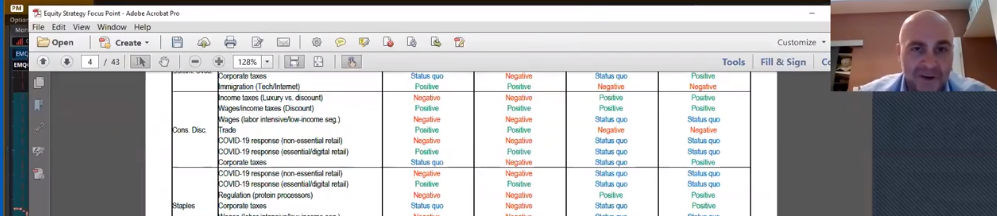

We take a first glance at Bank of America research on which sectors will benefit under the four possible election results in the US. Meanwhile, US sector rotation is visible. Investors are moving from technology to industrials. Emerging markets are holding up, also. Gold and Silver are flat. Barron’s highlights the possibility of Japan and …

Friday Investment Talk: US Elections, Seasonality, Europe, Japan and Emerging Markets Read More »

- 21.09.2020

- Categories: Analytics, Investing basics, Personal finance

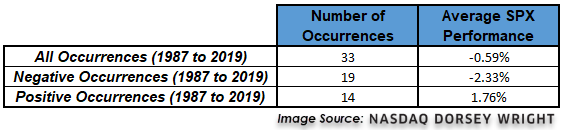

- Tags: Seasonal Strategy, Seasonality, SPX

- 18.09.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: DJIA, Elections, NASDAQ, Russell 1000, Russell 2000, S&P 500, Seasonal Strategy, Seasonality, SPX

- 27.07.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: COVID, DJIA, dow jones, Elections, NASDAQ, Russell 1000, Russell 2000, S&P 500, Seasonality

- 19.07.2020

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

- Tags: dividend, FAANG, Health Care, Seasonality, SPX, Tech

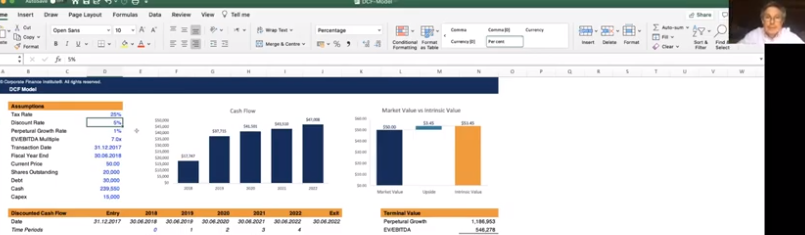

Are markets overbought? The narrow bull market in FAANG and some other technology stocks has led to concern among analysts that stocks are out of sync with the economy. We explore how interest rate assumptions affect analyst pricing in discounted cash flow models and lead to inflated asset prices. A discussion of the opposite case …