Category: News

- 7.12.2020

- Categories: Investment ideas, News, Personal finance

- Tags: EEM, EWZ, MJ, Stocks

This week we review Bitcoin's recent advance, USD weakness, Emerging Markets, November stock market strength, and a psilocybin company.

- 7.11.2020

- Categories: Analytics, AVC Pro Subscription, Investment ideas, News

- Tags: FAANG, Stocks

A leader in streaming media recently increased monthly subscription pricing. Will there be a spike in the churn rate in Q4? We present a bullish case for the stock with a clear price target.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 31.10.2020

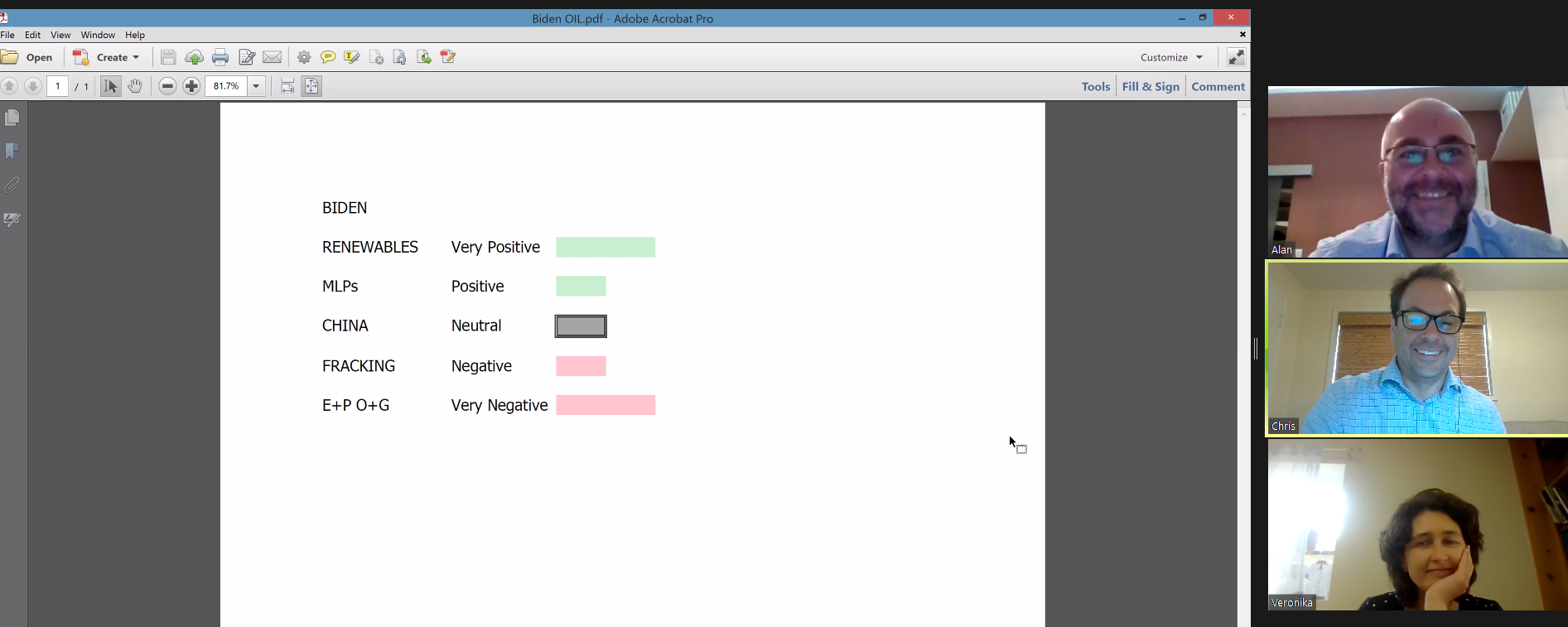

Reliance on coal for energy in the US continues to fall, even under the Trump administration. Solar power is on the rise. As the US market pulls back, US tech stocks underwhelming guidance is likely misleading.

- 4.10.2020

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: COVID, Elections, ETFs, GLD, market trends, Stocks

As US elections approach we take a look at how election results move markets. We go through 10 lessons for all investors who are nervous going into the elections. History shows that there is nothing to be afraid of except uncertainty. Markets look bullish for October based on the AAII Investors Sentiment Survey and several …

Friday Investment Talk: US Elections, Market Bullishness, and Fintech Read More »

- 28.09.2020

- 18.09.2020

- Categories: Analytics, AVC Pro Subscription, Investing basics, Investment ideas, News

- Tags: CTLT, ETSY, SPX, TER

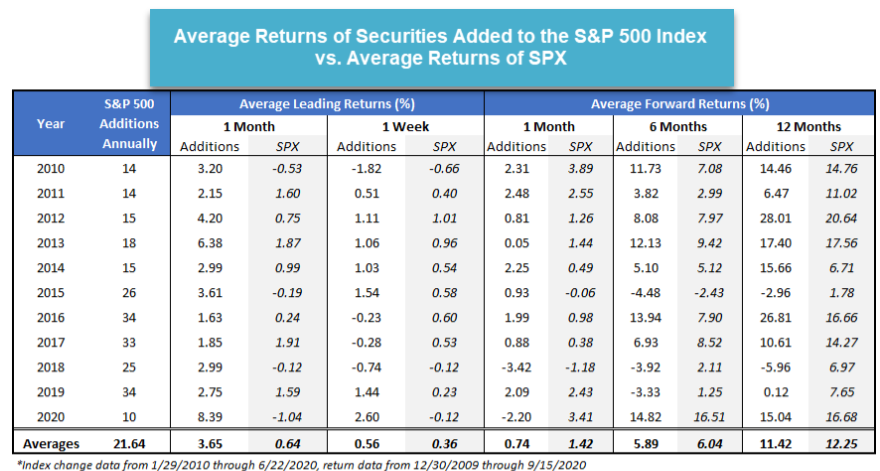

We examine whether there is a performance advantage for stocks being added to the S&P 500.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 6.09.2020

- Categories: Analytics, Investment ideas, News

- Tags: Abenomics, Japan, NDX, Property, Real Estate, SPX, Tech

- 23.08.2020

- Categories: Analytics, Investment ideas, News

- Tags: emerging markets, GLD, IWM, Rubles, SPX, TUR, Turkey

- 11.07.2020

- Categories: Analytics, Investment ideas, News, Personal finance

- Tags: Gold, RCL, russia

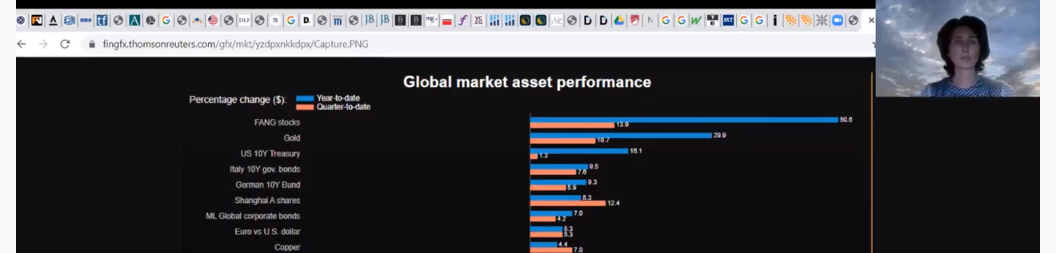

July remains bullish as low interest rates fuel stock returns and gold gains. Russia can be viewed as a high dividend value opportunity if oil prices can remain elevated, and natural gas prices stabilize. A note from Merrill Lynch outlines the demand for hydrogen fuel cells that support natural gas (UNG) prices. China continues to …

- 4.07.2020

As Europe reopens, UK's BOE announces the economic recovery will be 'V-shaped'. Tourist travel seems to be picking up and markets (especially tech stocks) reacted well - as is usual in this seasonal bullish period. Q2 earnings reports are on the horizon, with stocks priced for perfection.

Fiscal stimilus is ending in the US as government transfer reciepts and other forms of unemployment support expire. As elections come to the forefront and COVID cases increase further aid is likely. The effects on inflation will be muted until employment levels come back and wages increase.