Category: Investment ideas

- 25.06.2019

- 24.06.2019

- Categories: Analytics, AVC Pro Subscription, Investment ideas

- 24.06.2019

- Categories: Analytics, AVC Pro Subscription, Investment ideas, Personal finance

- Tags: Consumer Staples, Health Care, Seasonal Strategy, Utilities

- 22.06.2019

ACTIONABLE STOCK: NRG Read More »

- 2.10.2018

- Categories: Analytics, Investing basics, Investment ideas

- Tags: dividend

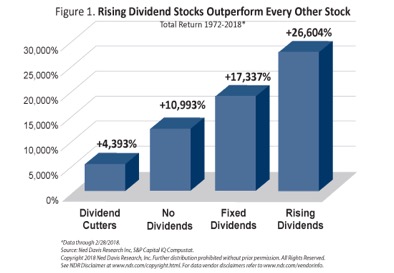

We all know that there is no such thing as the perfect investment, but I have one that comes pretty close. Working with the American Association of Individual Investors for many years, I have done research on dividend paying stocks. Investing in stocks that pay dividends offers a tantalizing triple play of 1) greater safety, …

DIVIDEND STOCKS: NEGATIVE MYTHS AND POSITIVE REALITY Read More »

We are way overbought. We are recommending our active trading clients to go to at least 50% cash or preferably higher. We are not saying this because we fear a significant downturn in the market. There is not much risk to see in strong economic data and geopolitical risks are rather muted at this point. …

- 8.07.2015

- Categories: Analytics, Investing basics, Investment ideas

It is not a secret. As the S&P 500 and other US stock market indexes have seen big gains in the last five years, active managers have struggled to outperform. Bloomberg reported (using Morningstar data) earlier this year that just 20 percent of actively managed funds investing in U.S. stocks beat their main benchmarks in …

- 23.06.2015

- Categories: Analytics, Investment ideas

- Tags: market review, market trends, usa

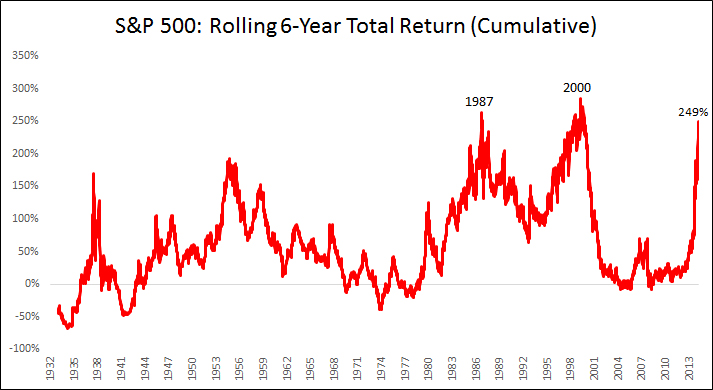

As the US bull market goes into its seventh year, we admire how far we have come. From the dark clutches of fear in March 2009, the S&P 500 has had one of the greatest six year bull market runs in history, more than tripling. Only 1981-1987 and 1994-2000 saw larger gains over a similar …

Last week the US market showed some signs of cracking its bullish momentum. The SP500 and NASDAQ fell out of their positive bullish consolidations (pennant patterns everyone is talking about) and broke back down into the August and October trading range. More bullishly, meanwhile, the DJ30 was actually holding above that trading range and continuing …