Category: Investing basics

- 17.07.2019

- Categories: Investing basics, Personal finance

- Tags: Advice, Annualized returns, Dalbar

Humans are irrational—even predictably so. Knowing where clients go wrong, how to identify when they do, and what to do about it doesn’t just allows us to help them overcome their quirks and biases—it can help them boost their bottom line. In an analysis done by Dalbar looking back over the past 20 years, the …

- 11.07.2019

- 3.07.2019

- 26.06.2019

- Categories: Analytics, AVC Pro Subscription, Investing basics

- Tags: DVY, RDVY, SDY, SPHD, VIG

ETF Spotlight: Equity Income ETF Ideas Read More »

After 6 weeks of down markets, today, the US indexes bounced back with a broad based rally. There are a few things we are watching for to see if the market is actually ready to rebound higher. “The first potential major buy signal could present itself in the form of put-call ratio data. The Total …

- 2.10.2018

- Categories: Analytics, Investing basics, Investment ideas

- Tags: dividend

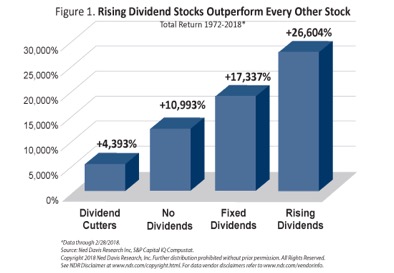

We all know that there is no such thing as the perfect investment, but I have one that comes pretty close. Working with the American Association of Individual Investors for many years, I have done research on dividend paying stocks. Investing in stocks that pay dividends offers a tantalizing triple play of 1) greater safety, …

DIVIDEND STOCKS: NEGATIVE MYTHS AND POSITIVE REALITY Read More »

- 8.07.2015

- Categories: Analytics, Investing basics, Investment ideas

It is not a secret. As the S&P 500 and other US stock market indexes have seen big gains in the last five years, active managers have struggled to outperform. Bloomberg reported (using Morningstar data) earlier this year that just 20 percent of actively managed funds investing in U.S. stocks beat their main benchmarks in …

- 18.03.2012

- Categories: Investing basics

- Tags: financial planning

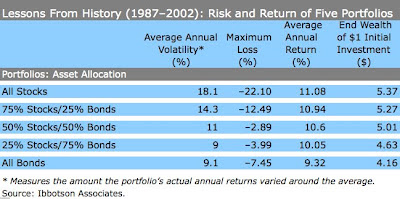

Lets face it, asset allocation models are the heart of financial planning and investment advising. I have highlighted five major lessons we can learn from investment errors and market history in order to get allocations correct! Mistakes can be made in all kinds of environments. The market’s behavior over the 16-year period from 1987 to …